Pristine Market Analysis & Watchlist

📉It's Time To Move On From the Magnificent 7

NVDA beats lofty earnings expectations, but fails to rally

Team,

We outlined the potential for an NVDA disappointment in last night’s note, and that is exactly what we got! Let’s take a look under the hood of the market. HAGE🍻

-Andrew

News/Economic Data

FOMC minutes came and went. The fed clearly communicated that they are on pause until further notice👇

Long-Term Treasuries

Our baseline assumption is that the TLT takes out the upside VPOC at $93.81 by year-end. Continuing to ride the short term EMA’s higher for now👇

FX Market

The dollar index is attempting to find support at the 200-day SMA. The weakening dollar trend loosens financial conditions, which is bullish for risk assets. ✅

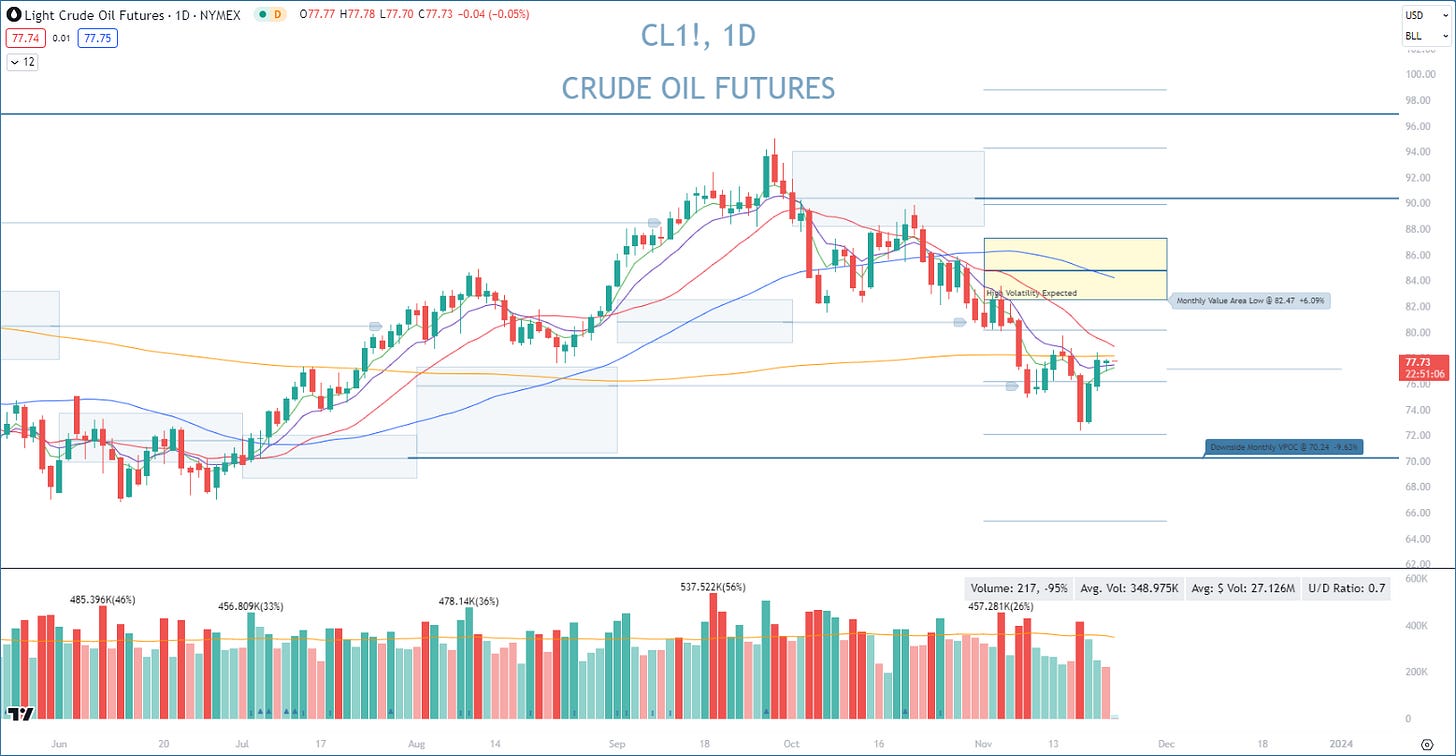

Energy

Crude oil remains in the $70’s and in a downtrend. Does crude have to keep falling every single day to support risk assets? No. We just don’t want to see crude oil in a raging uptrend like it was in the summer and early fall 👇

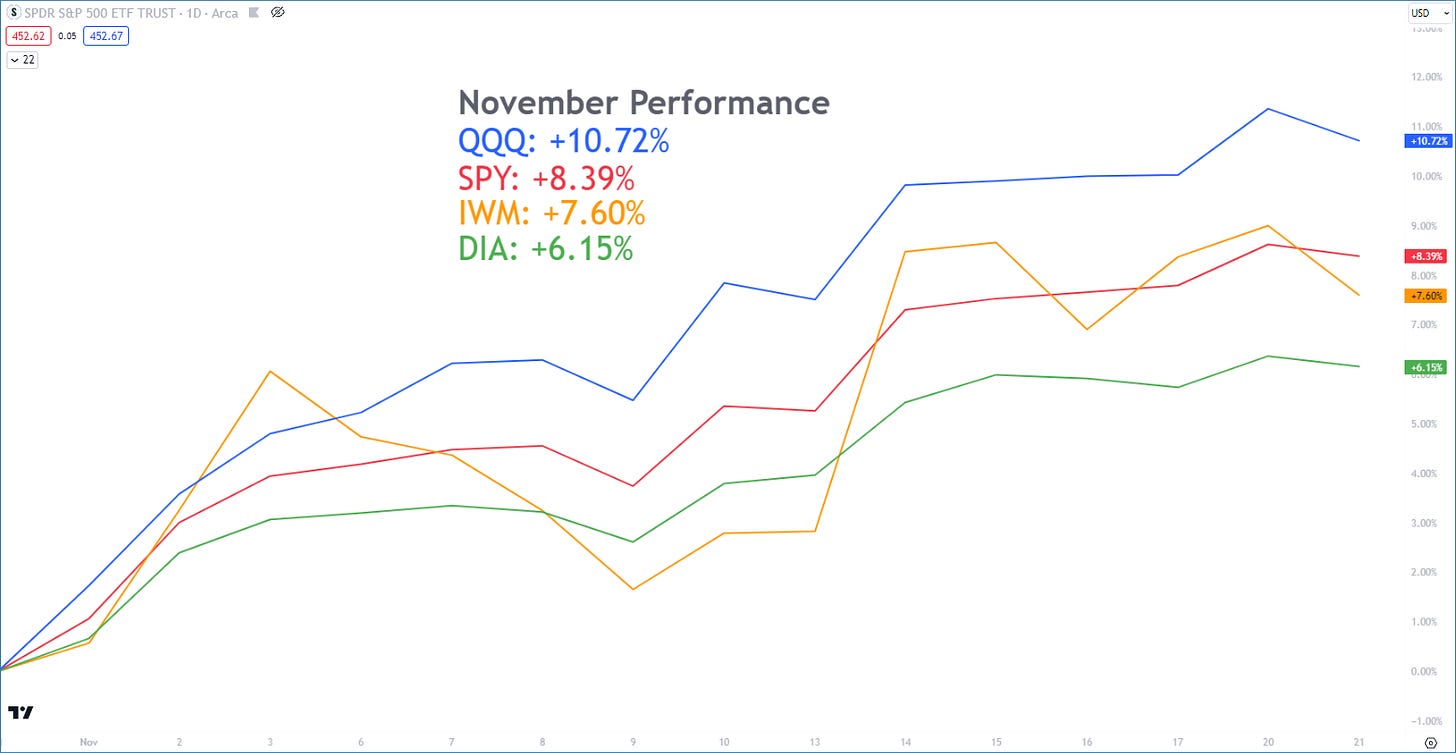

Equity Dashboard

A much needed pullback in the indices after a sharp run the past few weeks👇

Index Price Cycle Monitor

Market pullbacks are a completely normal thing. We tend to forget that after a crazy run in the market, but so far this looks benign👇

Index Performance Monthly

When in doubt, ZOOM OUT!

The indices have put in a full year’s worth of returns in just a few weeks 👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities