Pristine Market Analysis & Watchlist 10/10

PPI Incoming!

Team,

Imagine…just as market participants threw in the towel and accepted the inflation forever narrative…the PPI decelerated?

-Andrew

News/Economic Data

PPI is coming tomorrow morning Team!

FX Market

The Dollar index broke below the bottom of the bullish trend channel which is BULLISH for risk assets.

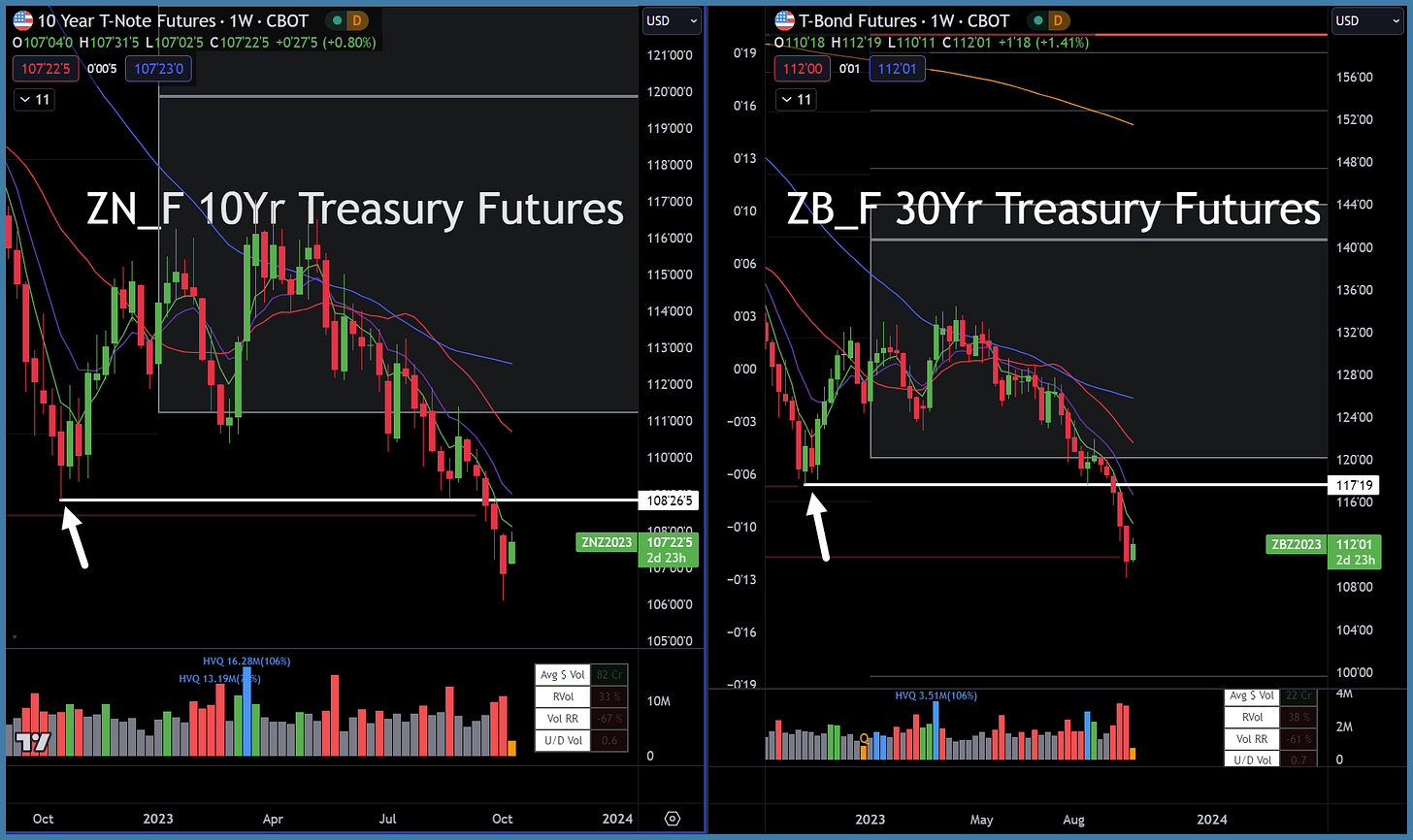

Long-Term Treasuries

Treasuries have been moving on every monthly inflation datapoint. Soon after the August inflation reports were released (hot), long-term treasuries cascaded below their Fall ‘22 lows. A deceleration in inflation could result in a retest of these breakdowns!

Energy

Despite renewed geopolitical tensions, crude oil is still trading well off the summer highs, which is positive for the forward-looking inflation outlook.

Equity Dashboard

The market finished with 80.7% advancers💪

I was surprised at the level of risk appetite we saw today ahead of inflation reports.

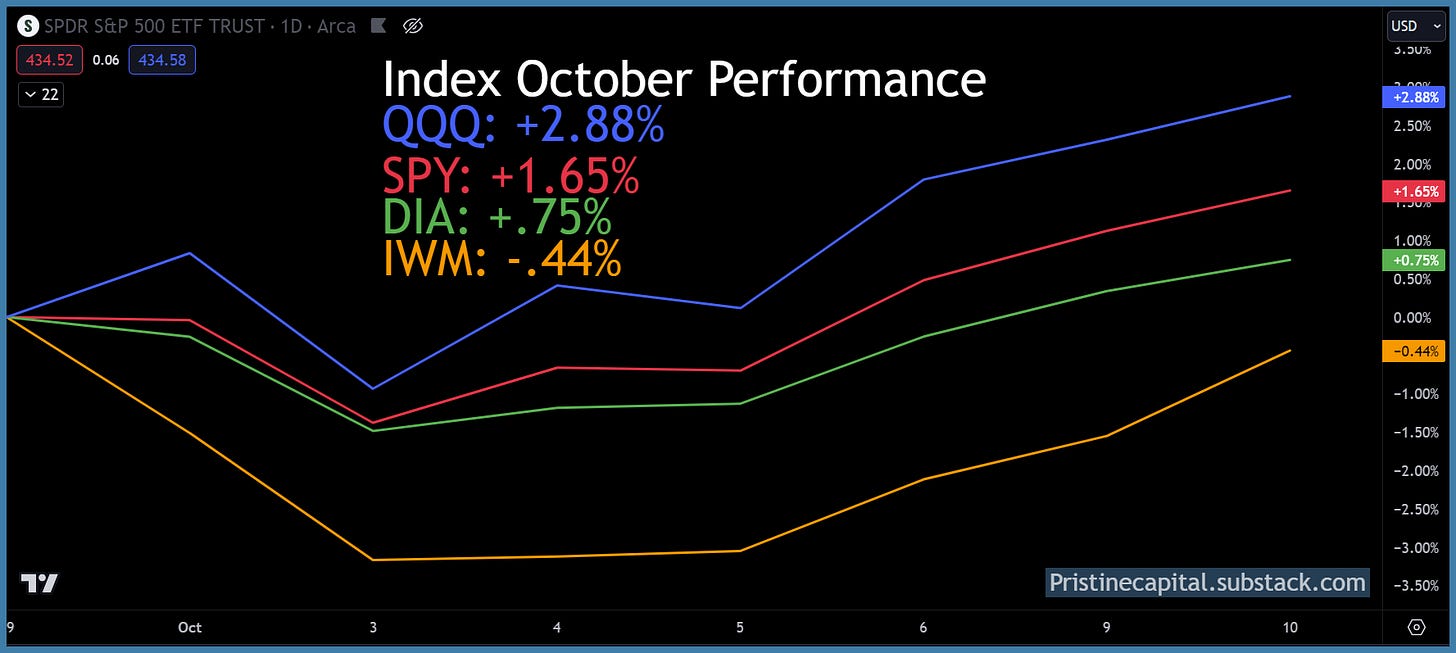

Equity Index October Performance

Indices are mixed for the month of October!

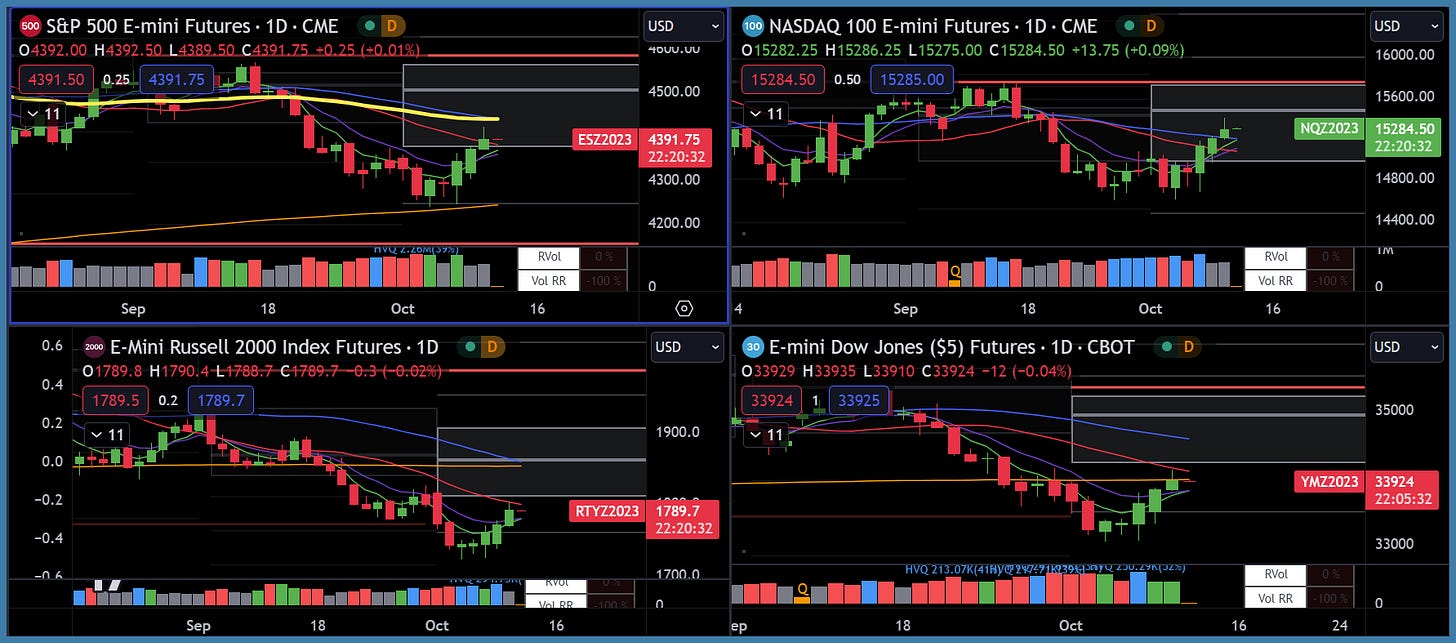

Index Price Cycle Monitor

ES S&P 500 - ABOVE 20-day SMA & inside monthly value area

NQ Nasdaq - ABOVE 20-day SMA & inside monthly value area

RTY Russell 2000 - Testing 20-day SMA & inside monthly value area

YM Dow Jones - Testing 20-day SMA and inside monthly value area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities