Pristine Market Analysis & Watchlist - 1/25

Long up to our eyeballs

Good evening everyone,

Three more trading sessions in January, and four more till the Feb 1st Fed meeting. Let’s finish strong!

-Andrew

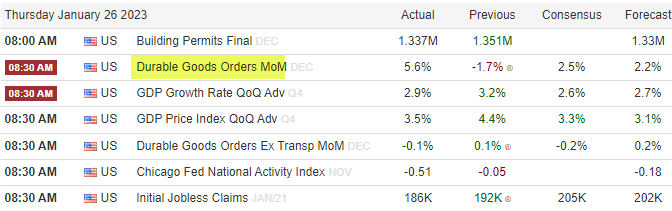

Durable Goods Orders

Our story begins with a durable goods orders report that came in way better than expected!

The consensus estimate was for a 2.5% MoM increase, and it came in at a whopping 5.6%:

Economic data this strong vs consensus is a double edged sword. With the upcoming Fed meeting less than a week away, it will be tough for the fed to be max dovish if employment is strong and economic data points are coming in red hot!

ZN_F 10yr Treasury Futures

Stronger data also puts upward pressure on treasury yields. The ZN_F 10yr treasury futures contract fell back inside of it’s monthly value area while also putting in it’s first lower high of the new year! Remember, treasuries lead equities, not the other way around.

Equity Dashboard

But equities were undeterred by the treasury weakness, and the Nasdaq led the market with a +1.95% advance on increasing volatility.

Red flag #1 - Treasuries and the Nasdaq diverging

Red flag #2 - Nasdaq price diverging with Nasdaq volatility

Finviz Heatmap

Are we really about to blow off into next week’s fed meeting? We are seeing climactic moves in risk-on assets, and both megacap tech and energy are rallying together!

Energy and tech leading together is not a sustainable dynamic. Tic said it best:

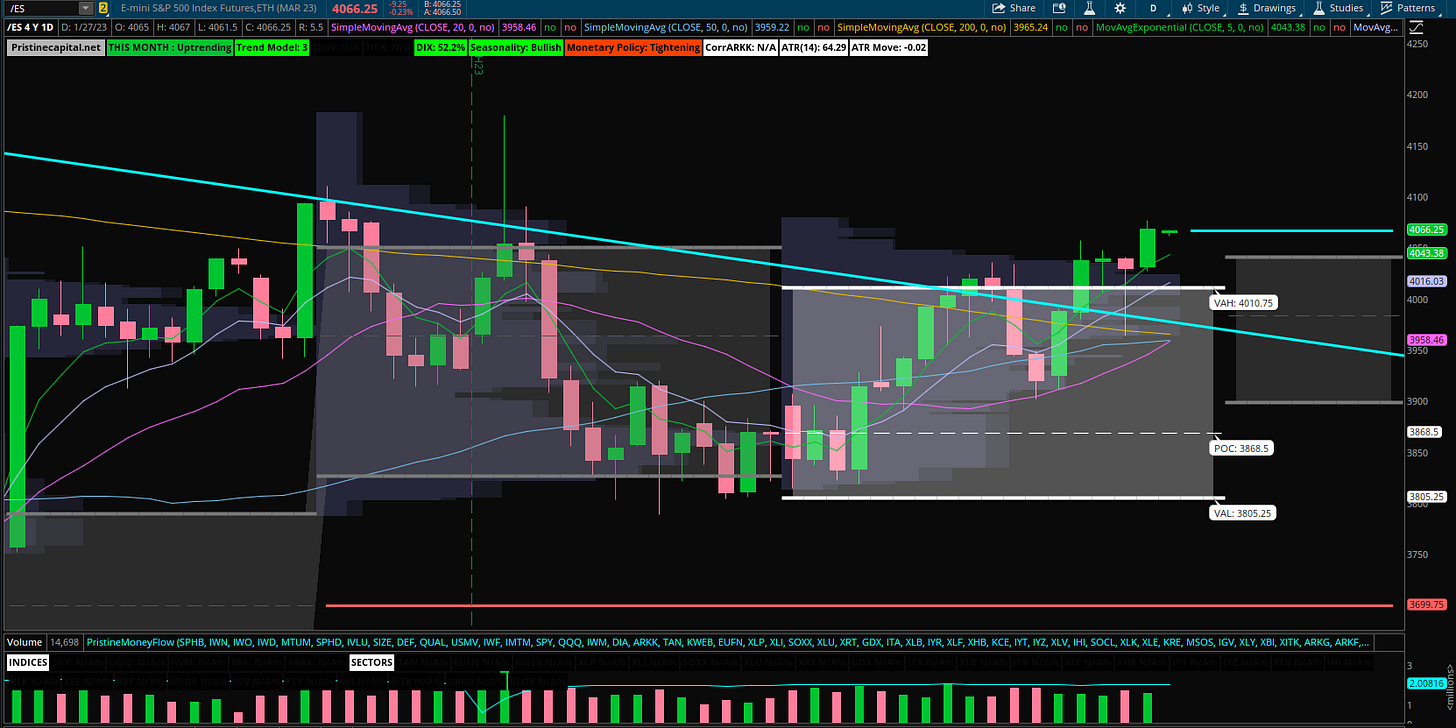

S&P 500 ES_F Price Analysis

We discussed the potential for a move up to 4100 in last night’s note, and the market made significant progress toward that level today. At the current price of 4066.25, we have 34.75 points of upside to 4100, vs 23 points of downside to the 5-day EMA at 4043. We are playing for scraps ahead of the fed meeting!

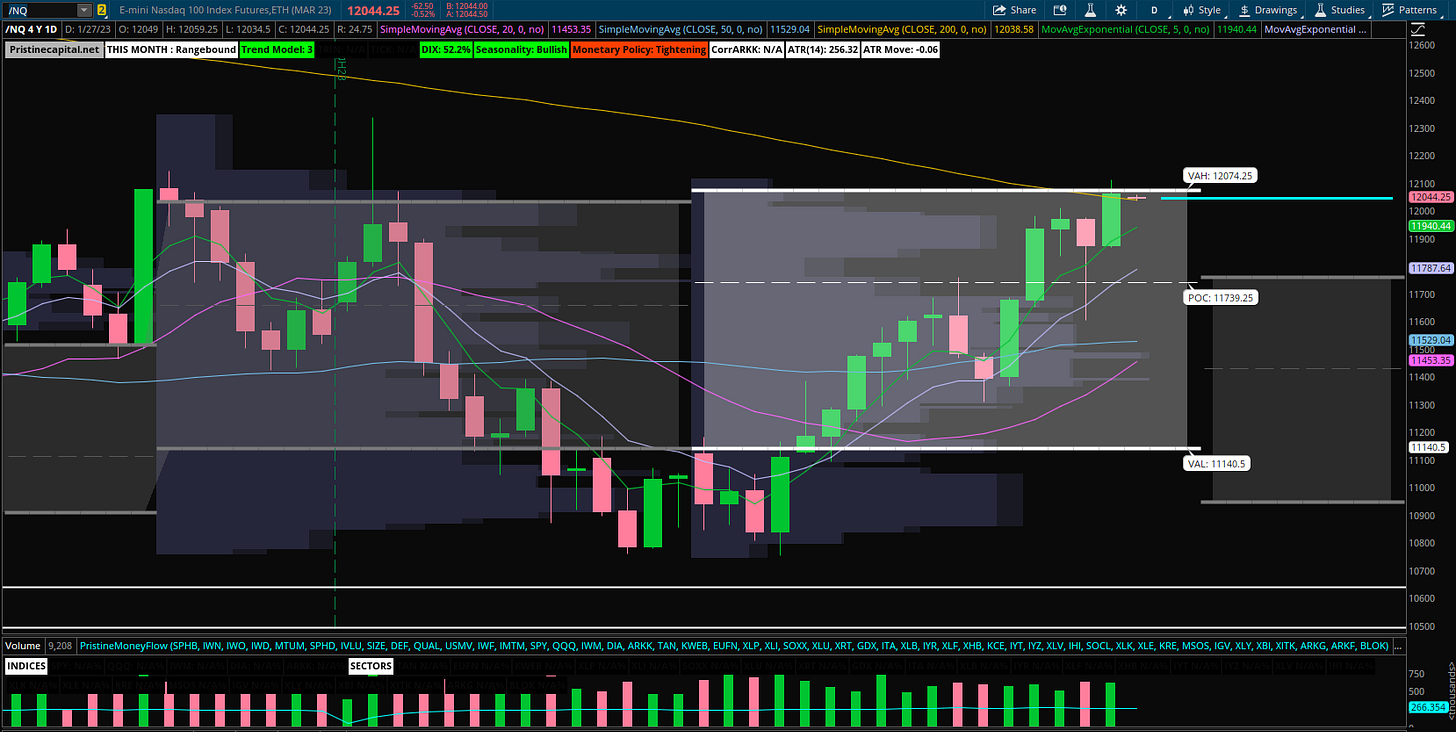

Nasdaq NQ_F Price Action Analysis

Nasdaq tagged the 200-day SMA! This is another playing for scraps situation ahead of the Fed.

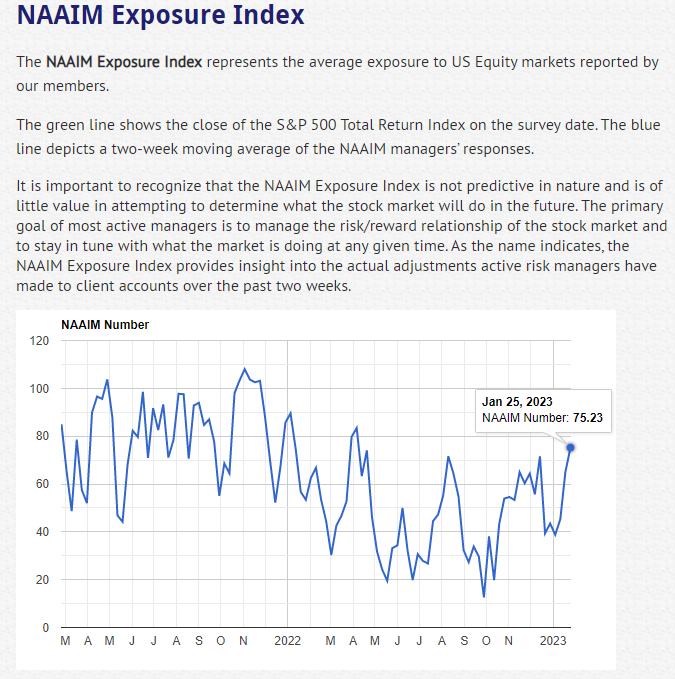

Long Up To Our Eyeballs into the Fed Meeting

The fear of underperformance makes investors do crazy things. Active equity fund managers are going ‘all-in’ on the market into the Fed meeting. The more exposure they have, the higher the bar is for Powell to deliver the goods!

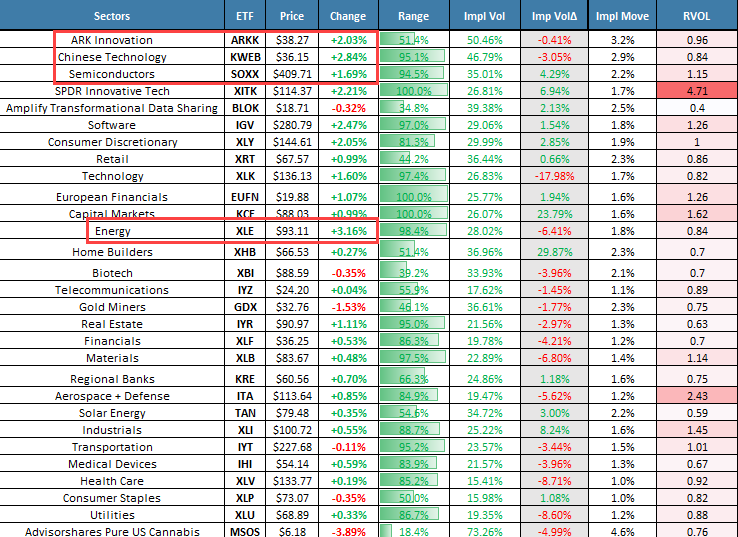

Sectors - Ranked by Momentum

ARKK KWEB SOXX momentum leaders

XLE energy was today’s top performer

Earnings on Tap

I am covering all of these reports and reactions in Discord

Key Takeaways

The economy is showing signs of strength into the Fed meeting

Stocks are climaxing as investors chase anything and everything

Tech and Energy will likely diverge in the near future - Only one can lead

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities