Pristine Market Analysis & Watchlist 3/7

Pricing in a Recession

Team,

We are trading through unprecedented times! There is no textbook to navigate the 2023 market, because the current setup is unlike any other. Continue to be mentally flexible, control downside risk, and you’ll make it through!

-Andrew

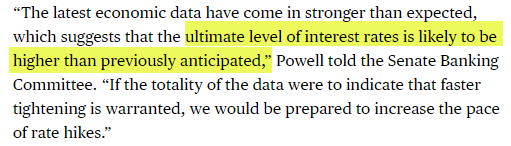

Powell’s Testimony - Day 1

Today’s session kicked off with the following from Powell:

We must remember that at the last Fed meeting, Powell had all but declared victory over inflation. Now after receiving the hot January inflation prints, he shocked the market with discussion of re-accelerating interest rate hikes!

It appears that the market is now pricing in a more hawkish fed that will hike interest rates to higher levels, and is also pricing in that those hikes are likely to lead us into a recession.

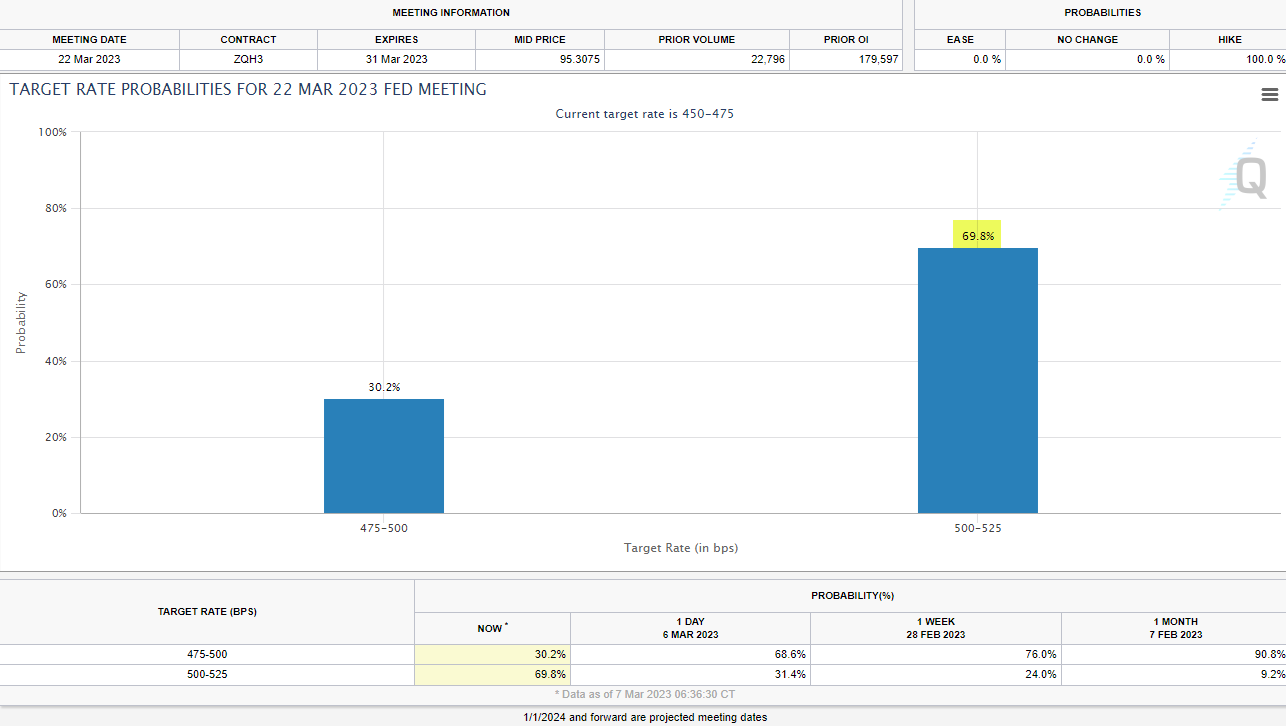

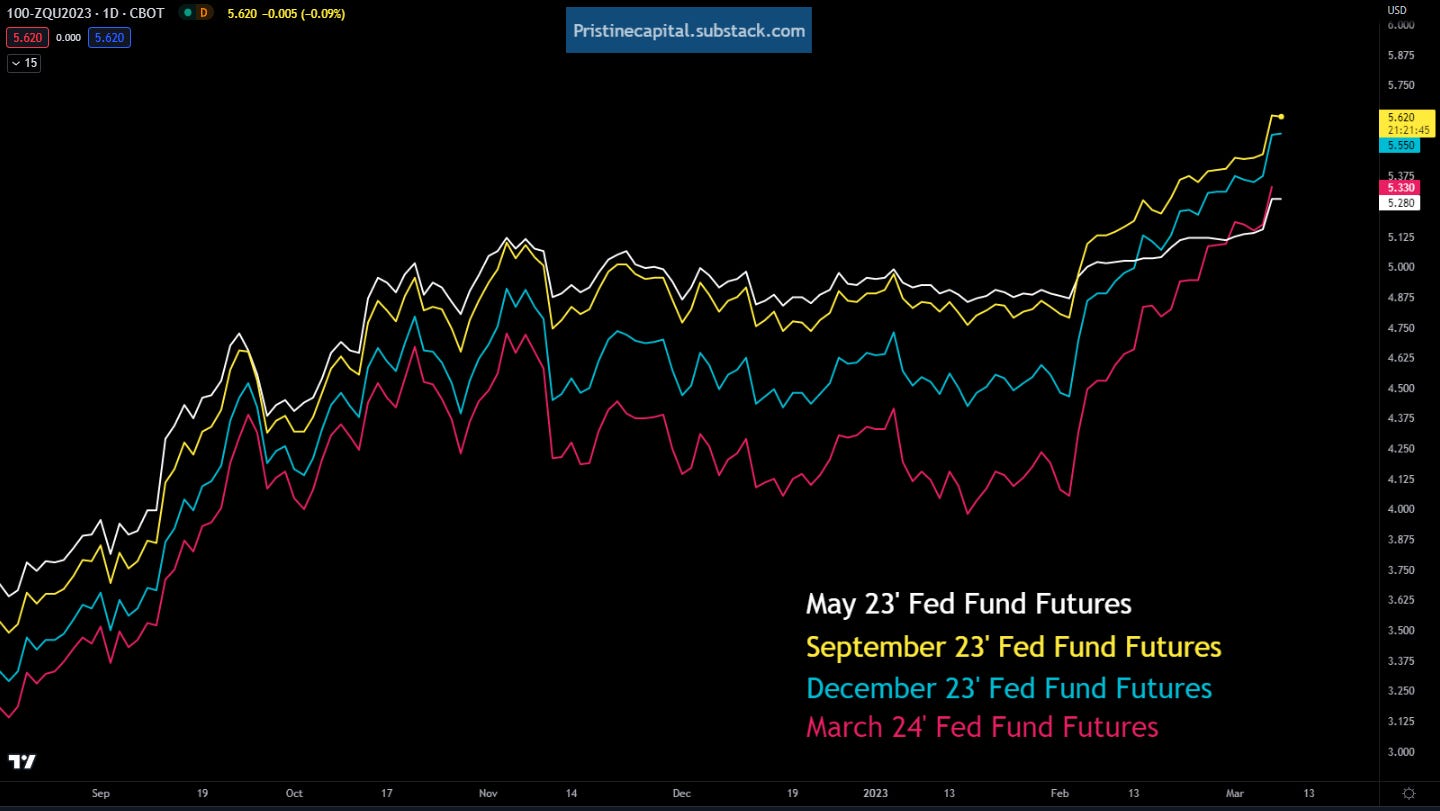

Fed Fund Futures

Interest rate markets are now pricing in a 69.8% probability of a 50 basis point rate hike at the March 22nd meeting:

And are now implying a 5.62% federal funds rate by the September fed meeting. Imagine getting paid 5.62% to keep your money in a money market? Wild. I’m also beginning to see market strategists calling for a 6% terminal rate. Don’t be surprised if you begin to see that narrative gain traction.

MOVE Index On the Move

The MOVE index, which measures treasury volatility, exploded to the upside and retested levels not seen since December.

DXY Dollar Index Rally

The dollar index put in a +1.76 ATR move, and pushed up out of a 7-candle consolidation area. Further evidence that the market is pricing a hawkish fed.

Long-Term Treasuries Bottoming?

But here is the kicker…30yr bond yields actually declined against the backdrop of a more hawkish fed! Why would this be the case? Perhaps bond market participants believe that as a result of more aggressive rate hikes, the economy will slow, and the recession everyone has been talking about since Q4 22’ will either be pulled forward in time, or more severe when it finally arrives.

CL_F Crude Oil Also Pricing Recession?

Crude oil put in a bearish engulfing candle, which also fits the narrative of a recession pull-forward.

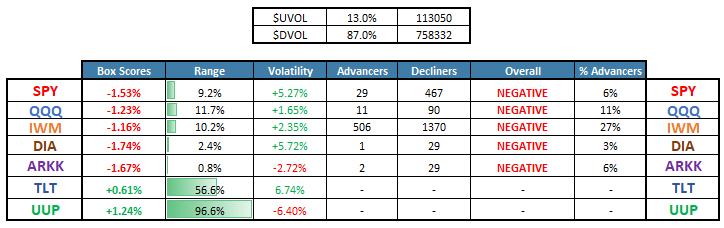

Equity Dashboard

Equities washed out to the downside at a point when almost every market bear had capitulated…including the biggest bear on Wall street…Mike Wilson of Morgan Stanley!

ES_F S&P 500 Price Action Analysis

ES rejected at the 20-day SMA, the monthly value area low ~4,058, and finished the session below the 50-day SMA. Wowza. That’s a lot of technical damage for just one session.

So where does this leave us?

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities