Pristine Market Analysis & Watchlist 5/22

Feeling FOMO

Team,

I’ve been getting some questions related to FOMO today. If you are seeing stocks fly high and think you have missed your opportunity, think again! If this is the start of a bull market, there will be plenty of opportunities to ride the bull!

-Andrew

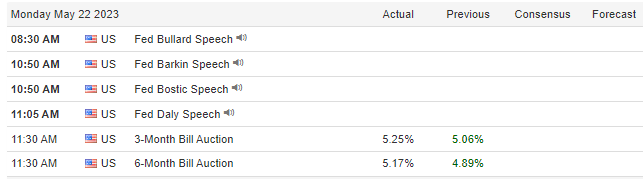

Economic Data

Today’s session kicked off with a group of fed speakers. The main gist of what they have been saying is that they reserve the right to continue to raise rates. I agree with most other market pundits in that they are not likely to raise rates again. The inflation problem is getting much better until proven otherwise.

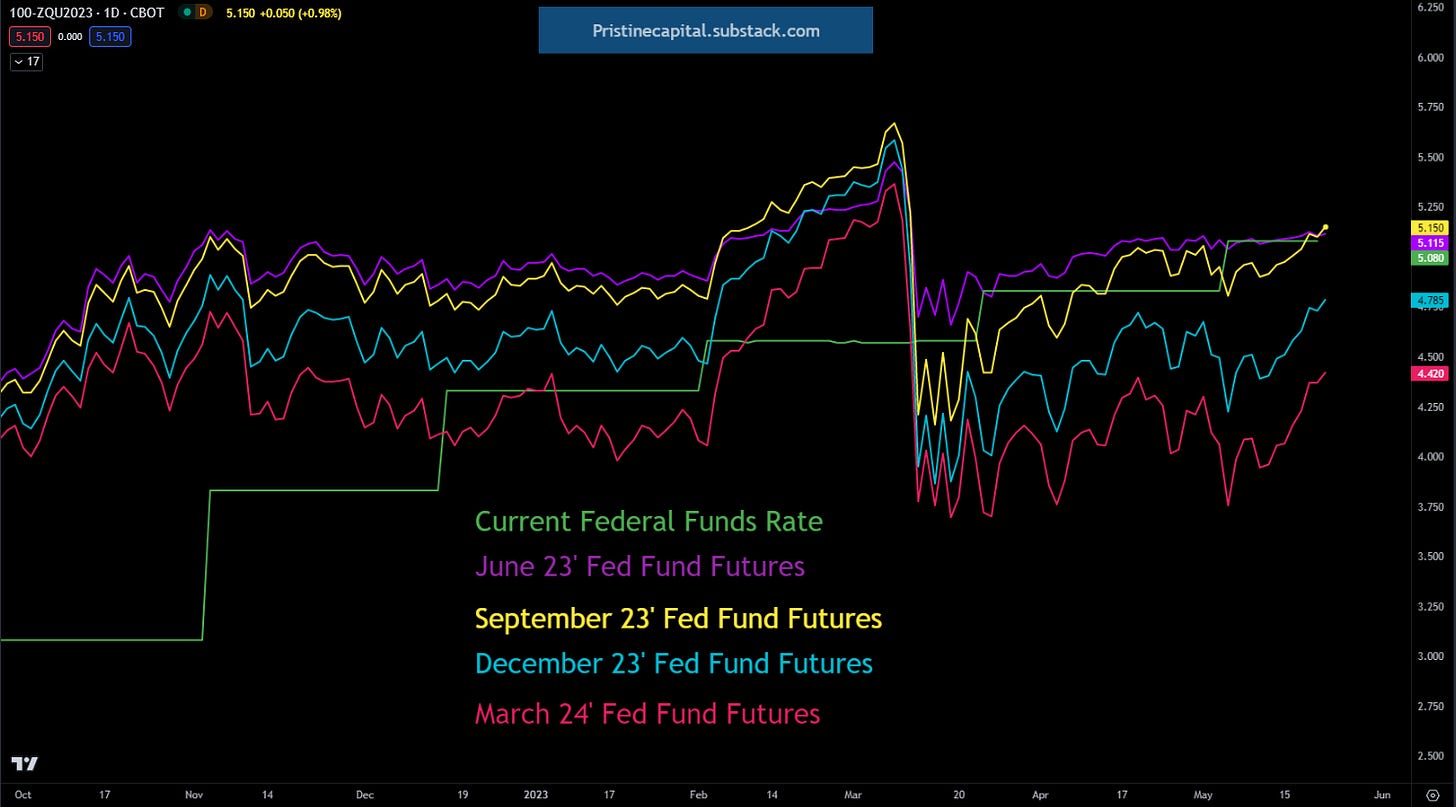

Fed Fund Futures

The real question is not whether the fed is going to keep raising interest rates, but rather when they are going to cut interest rates! The market is currently pricing in one rate cut into the end of ‘23, and an additional rate cut in Q1 ‘24. This re-rating is a large driver behind the recent bond market weakness as a whole.

10Yr Treasury

ZN_F 10yr treasury futures finished in negative territory again! Bonds haven’t been able to catch a bid all month.

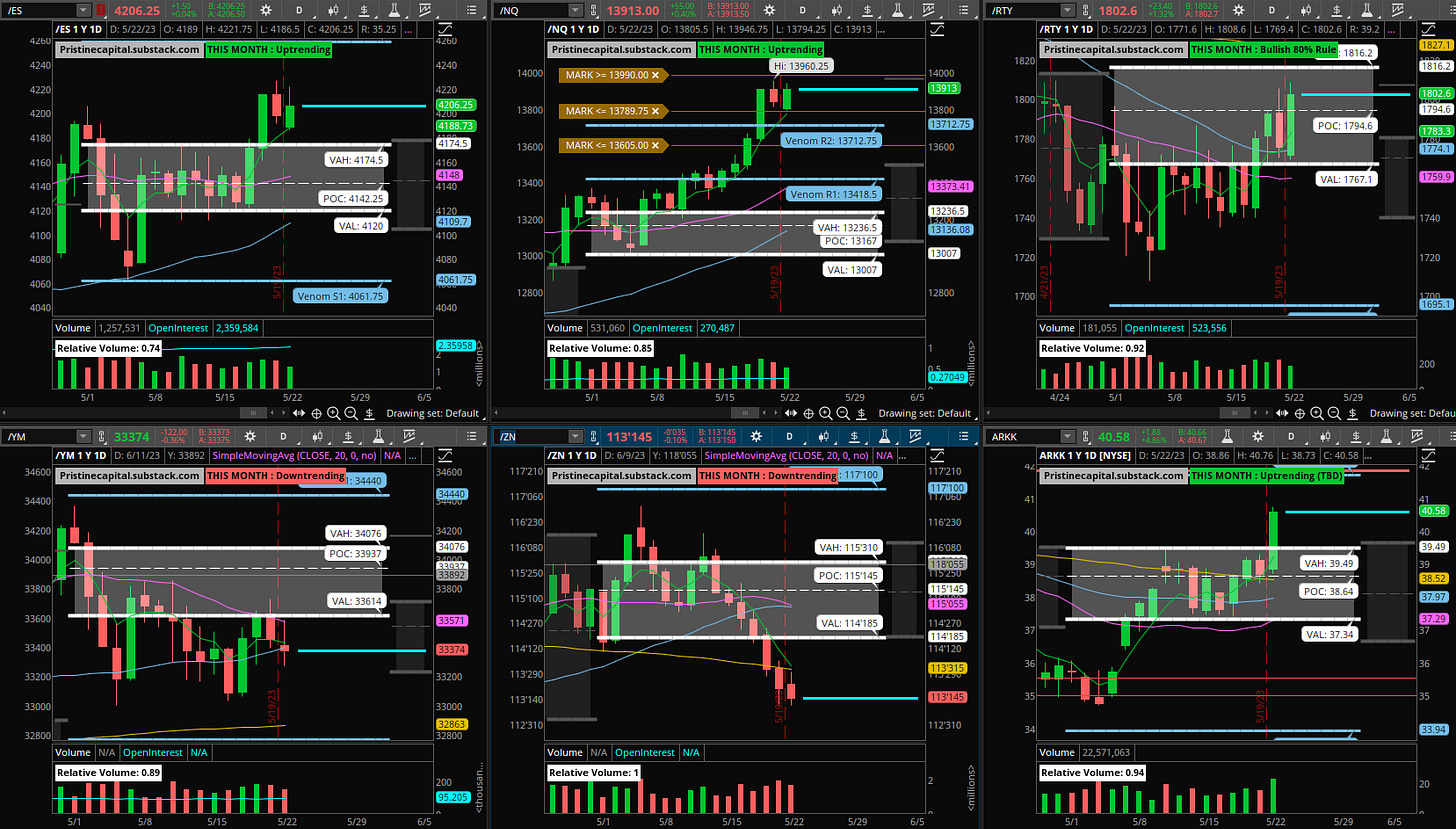

Equity Dashboard

Notice anything strange about the dashboard below? Equity volatility is rising in tandem with spot prices! ARKK innovation stocks and IWM small caps led today’s action as investors rotated from defensive assets to risk-on assets.

PFE and TSLA were today’s top megacap movers:

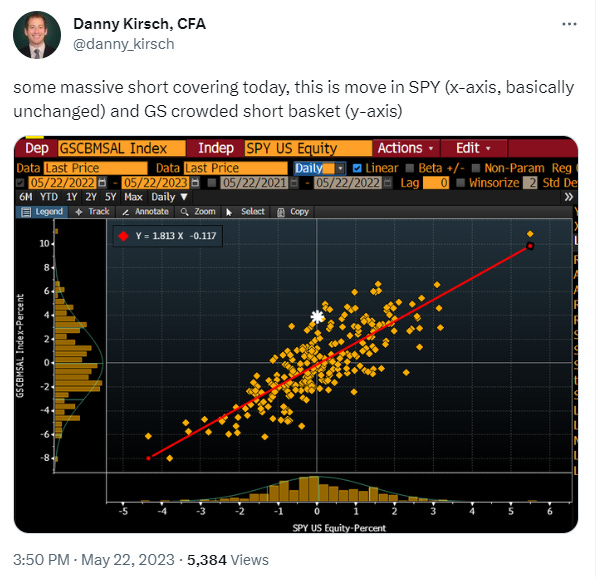

Most Shorted Stocks Relative Strength

The Goldman Sachs crowded short basket had a day of rare outperformance vs the S&P 500:

May Index Performance

The S&P 500 joined the Nasdaq and Russell 2000 and entered positive territory today.

Index Price Action

ES S&P 500 - Above monthly value area

NQ Nasdaq - Overbot

RTY Russell 2000 - Inside monthly value area/ Above monthly POC

YM Dow Jones - Below monthly value area

ARKK - Fresh breakout above monthly value area

ZN 10yr Treasury - Below monthly value area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities