Pristine Market Analysis & Watchlist 7/18

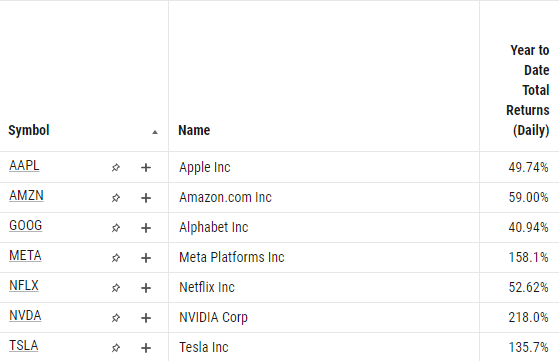

Magnificent 7 Euphoric Run into Earnings

Team,

NFLX and TSLA report earnings tomorrow, and both the Nasdaq special rebalance and Fed meeting are going down next week. Get ready for an eventful period in markets!

-Andrew

Economic Data

Retail sales and industrial production came out lighter than expected.

But the real market-moving news was as follows:

MSFT reported that it would be monetizing its AI offering, and it sent megacap tech flying. I’d imagine that investors who were finally positioning for a selloff for the Nasdaq special rebalance got squeezed…once again! MSFT traded well outside of it’s 3 standard deviation bollinger band! I scrolled back through the chart and was not able to find a similar instance of short-term overbot conditions in this name.

NFLX closed up at the 3 standard deviation bollinger band and put in a +1.9 ATR move. Keep in mind that this name reports earnings…tomorrow! Are investors now playing for a move up to the 4 standard deviation band? The 5?

NVDA also trading close to the three standard deviation bollinger band into earnings

TSLA not quite at the three standard deviation bollinger band, but multiple consecutive ants setups into tomorrow’s earnings report! To say that this stock is being accumulated into the earnings print would be an understatement.

I can only remember one similar instance where a group of stocks rallied this hard into earnings on anticipation of fantastic results. It was during the 2020 bull run when software stocks were putting up a banner year and seemed like ‘sure thing’. Many of those stocks put up euphoric runs into earnings, and topped out soon after their reports. The magnificent 7 stocks are having a similar euphoric run INTO their earnings reports, and I believe the same exact thing will happen with this group. Trust me when I say that these companies are not going to ‘shock the world’ with their fantastic results. Investors have been positioning in these stocks all year, and they are now panicking in, chasing prior YTD performance.

History never repeats, but it often rhymes. Stay tuned!

Equity Dashboard

Strong market breadth

We share the following table of market-maker implied moves with premium subscribers as part of our weekend market analysis.

As you can see below, SPY, QQQ, IWM, and ARKK are already trading above the implied weekly move. This does not mean that they can’t go higher, but it does mean that they have already moved farther than market makers thought they would on the close Friday 7/14. I could see this being the case if it was Thursday 7/20, and both NFLX and TSLA reported beat-and-raise quarters…but it is Tuesday 7/18, and NFLX/TSLA haven’t even reported earnings yet!

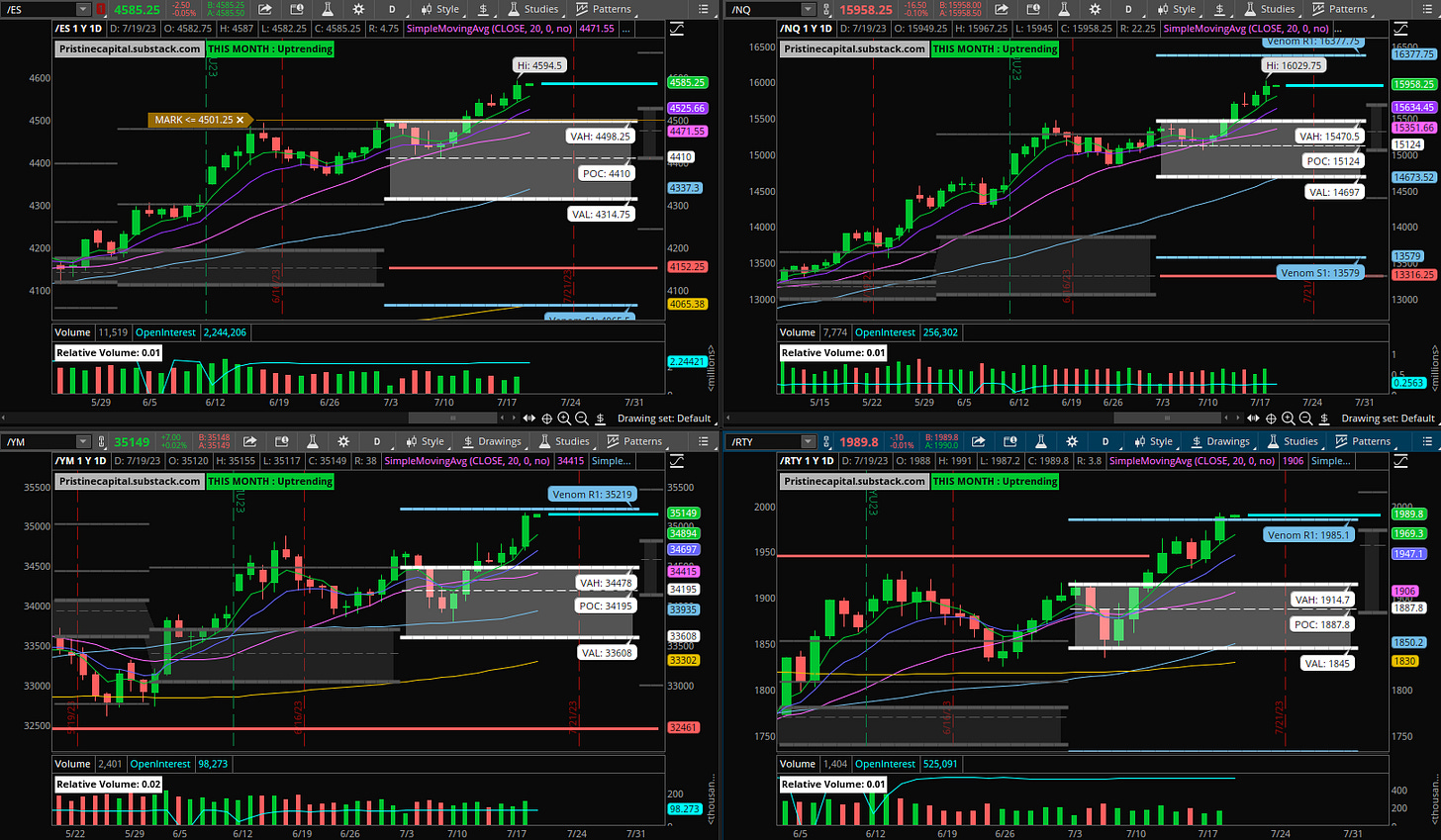

Index MTD July Performance

July index performances are stellar so far.

Index After Hours Price Action

The indices stuck the landing and finished above their respective monthly value areas.

ES S&P 500 -.05% - Above monthly value area

NQ Nasdaq -.10% - Above monthly value area

YM Dow Jones +.02% - Above monthly value area

RTY Russell 2000 +.01% - Above monthly value area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities