Pristine Market Analysis & Watchlist 12.12

📈FOMC Incoming!

CPI +.1% vs +.1% estimate

Will Powell push back on rate cuts?

Team,

In tonight’s note, we’ll assess the market reaction to the CPI, and the setup into tomorrow’s FOMC! HAGE🍻

-Andrew

News/Economic Data

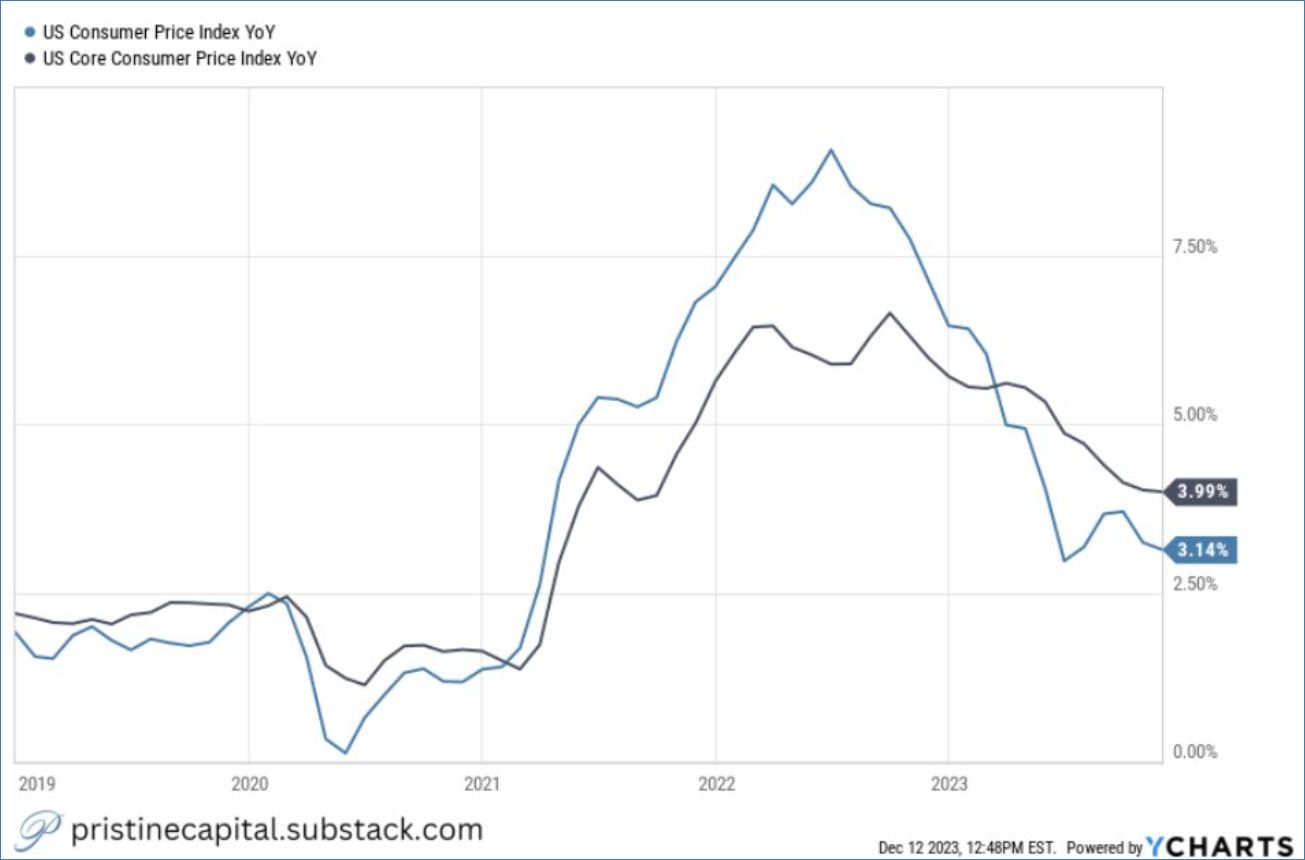

The CPI came out largely in-line with estimates, and continued it’s glide lower 👇

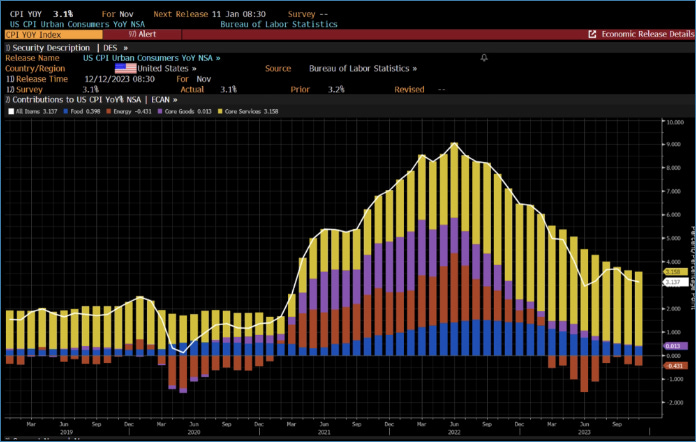

Without going too galaxy-brain on you, below is a decomposition of the CPI. The optimistic take by econ watchers is that core services is now the primary driver of CPI, with the lagging rents component creating most of the inflationary pressure. If we adjust for the rent lag, the US inflation problem is completely gone!

It’s not our job to determine if that theory is correct or incorrect, but it is our job to interpret the price action! Let’s take a look 👇

Treasuries

The TLT long-term treasury ETF finished the day in positive territory and continues to respect the 10-day EMA. This would not have been the case if today’s CPI had changed investor’s views on the long-term inflation outlook for the worse✅

FX Market

The dollar index finished DOWN and put in a red candle ✅

Energy

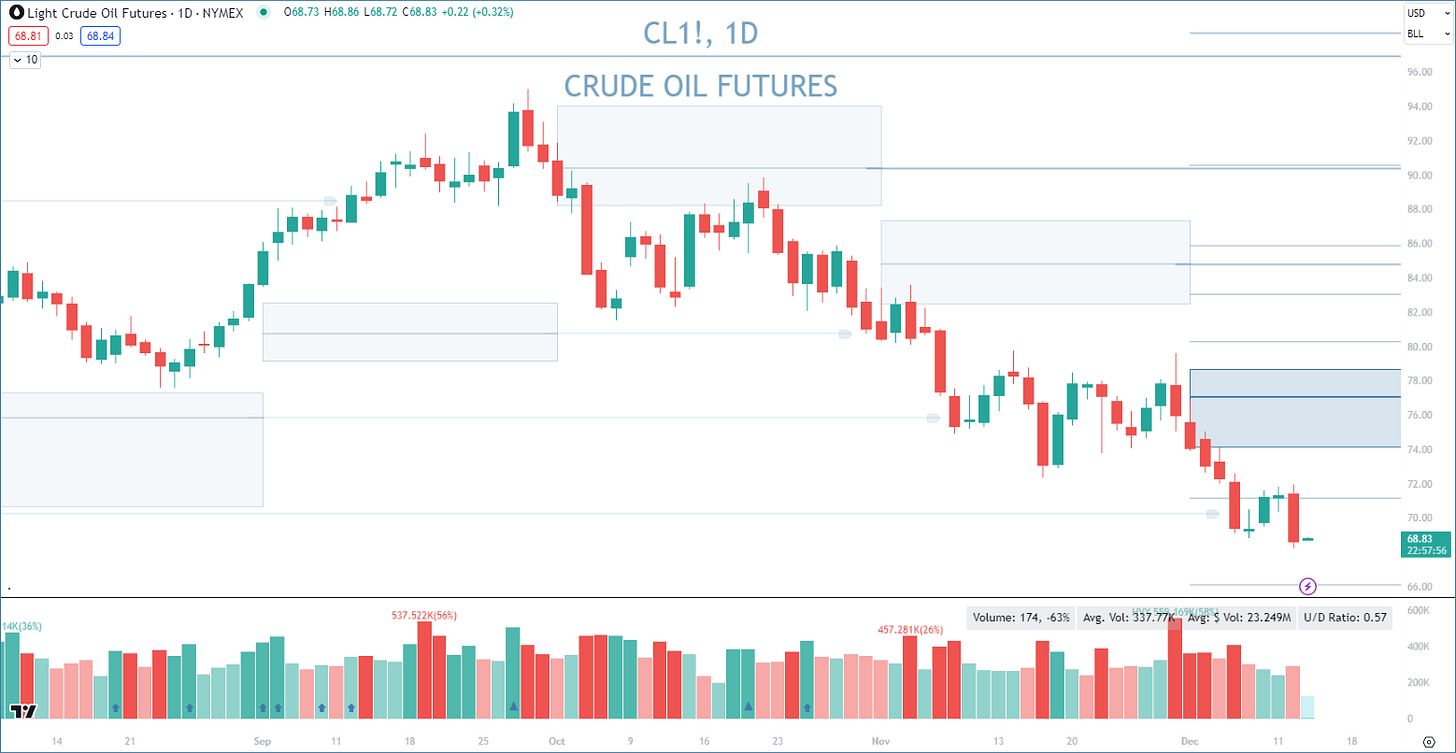

Probably not a direct reaction to CPI, but crude oil nuked lower into the $60’s✅

Equity Dashboard

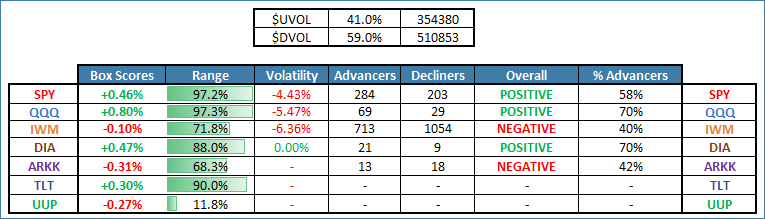

The indices opened up in negative territory and melted up higher throughout the session. Relative weakness in small caps. Volatility crushed once again👇

Index Price Cycle Monitor

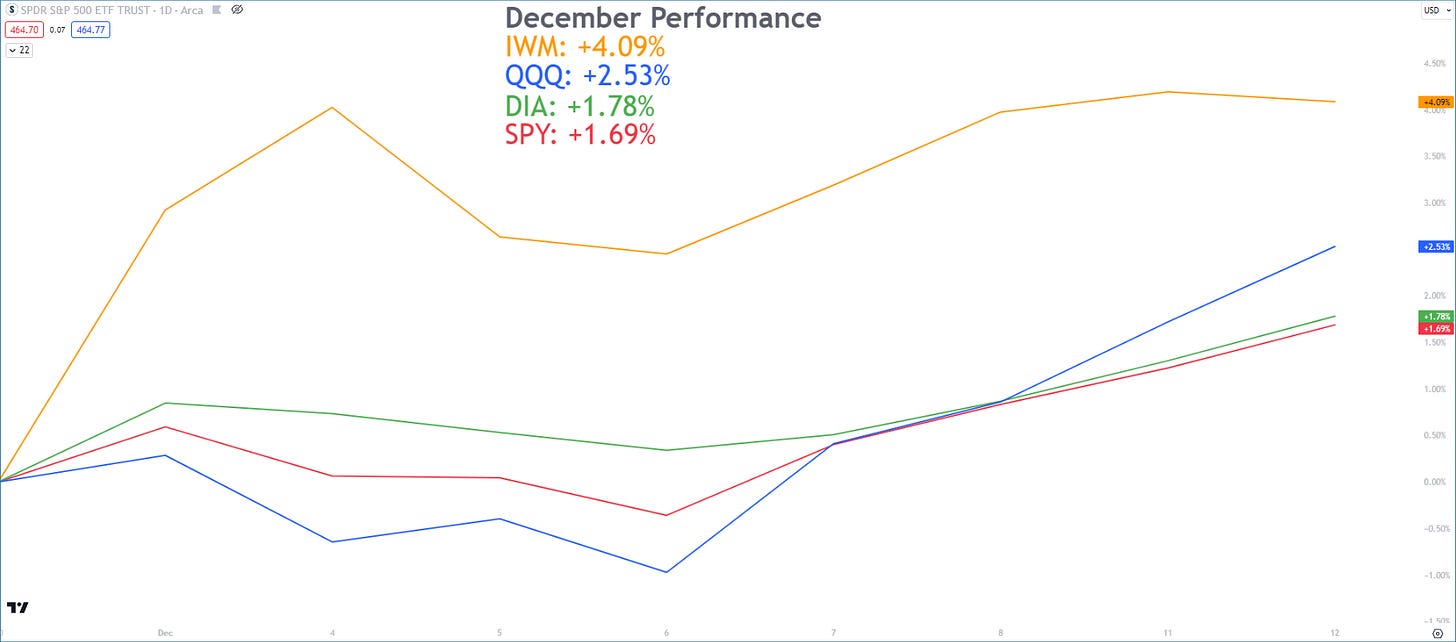

Index Performance Monthly

All tracked indices remain in positive territory for the month👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - Our trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities