Pristine Market Analysis & Watchlist 8/31

The recession trade continues

Team,

The market is going all in on a light NFP print tomorrow. Let’s discuss 😎

-Andrew

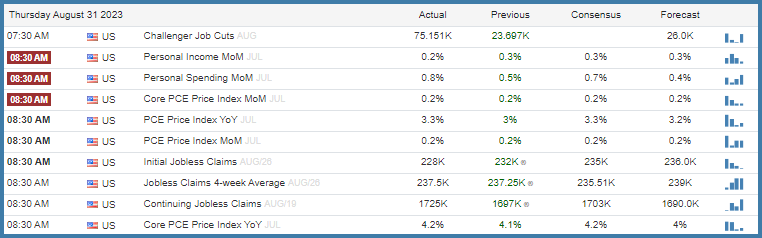

Overnight/Economic Data

Today’s session kicked off with a flurry of economic data. Jobless claims, and the largely backward looking July PCE data came out in-line with expectations.

10Y and 30Y treasuries remained in bounce mode!

While the DXY dollar index diverged and put in a green candle.

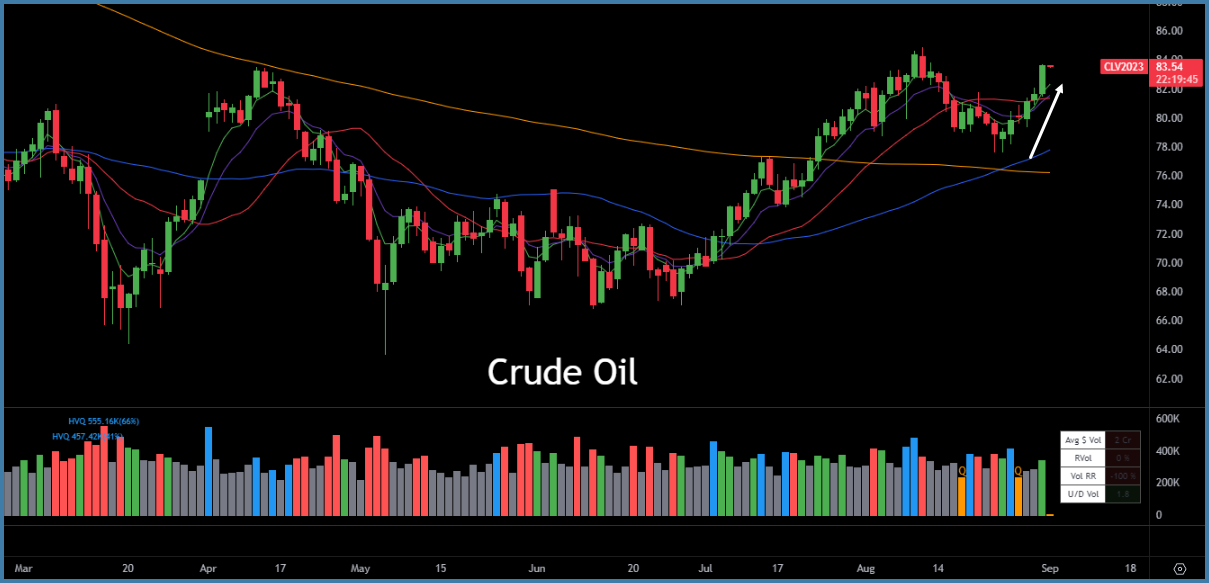

Crude oil finished the month of August with a bang and closed at $83.54/barrel. This move in energy price and commodities more broadly is at odds with the recent bounce in treasuries and tech stocks. Which force will win out?

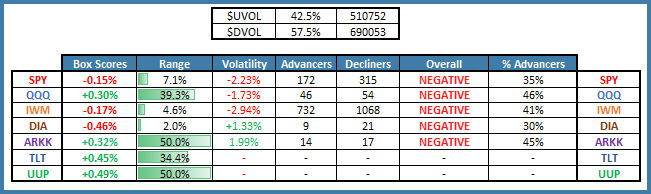

Equity Dashboard

Today’s equity action was not as vibrant as what we’ve seen since the bounce off the equity lows began. The session finished with 42.5% advancers, and the indexes were mixed. Megacap tech and software stocks did most of the heavy lifting.

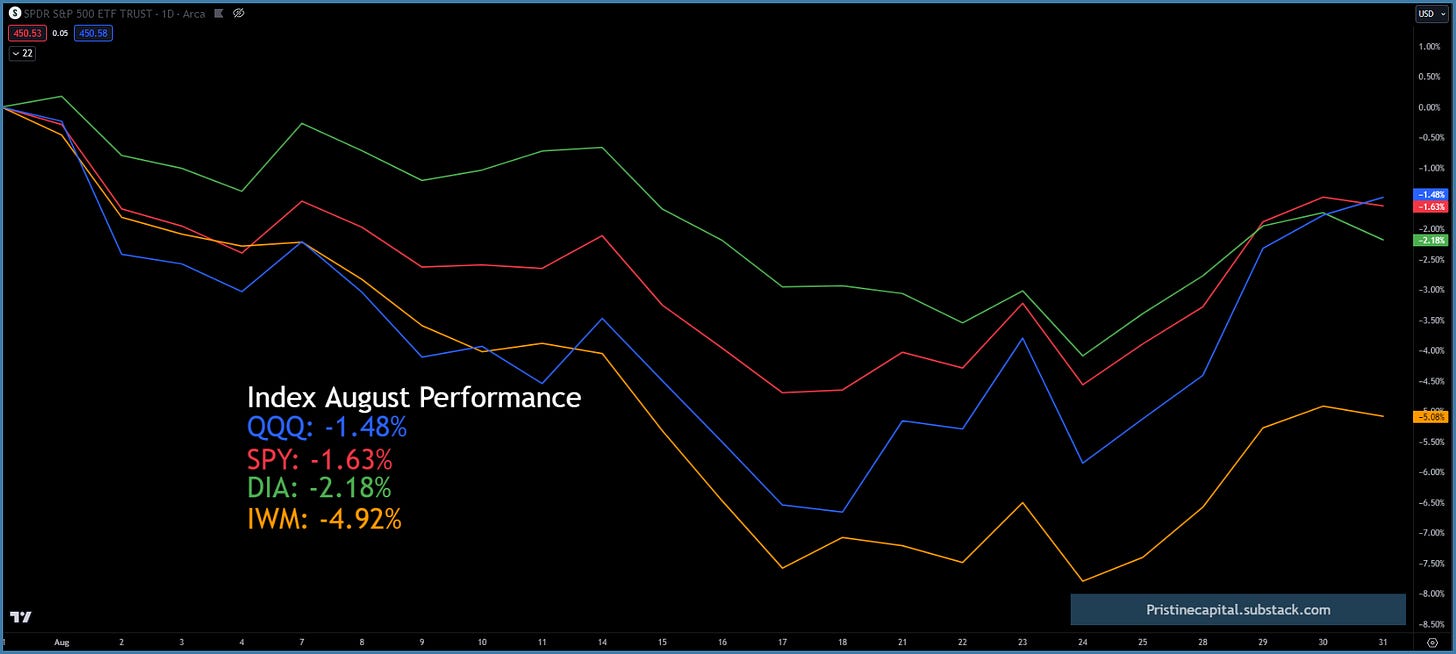

Equity Index MTD August Performance

The Nasdaq QQQ came from behind and finished the month of August as the top index performer! This is more evidence that investors have been flocking into the safety of megacap tech and being more cautious of other areas of the market.

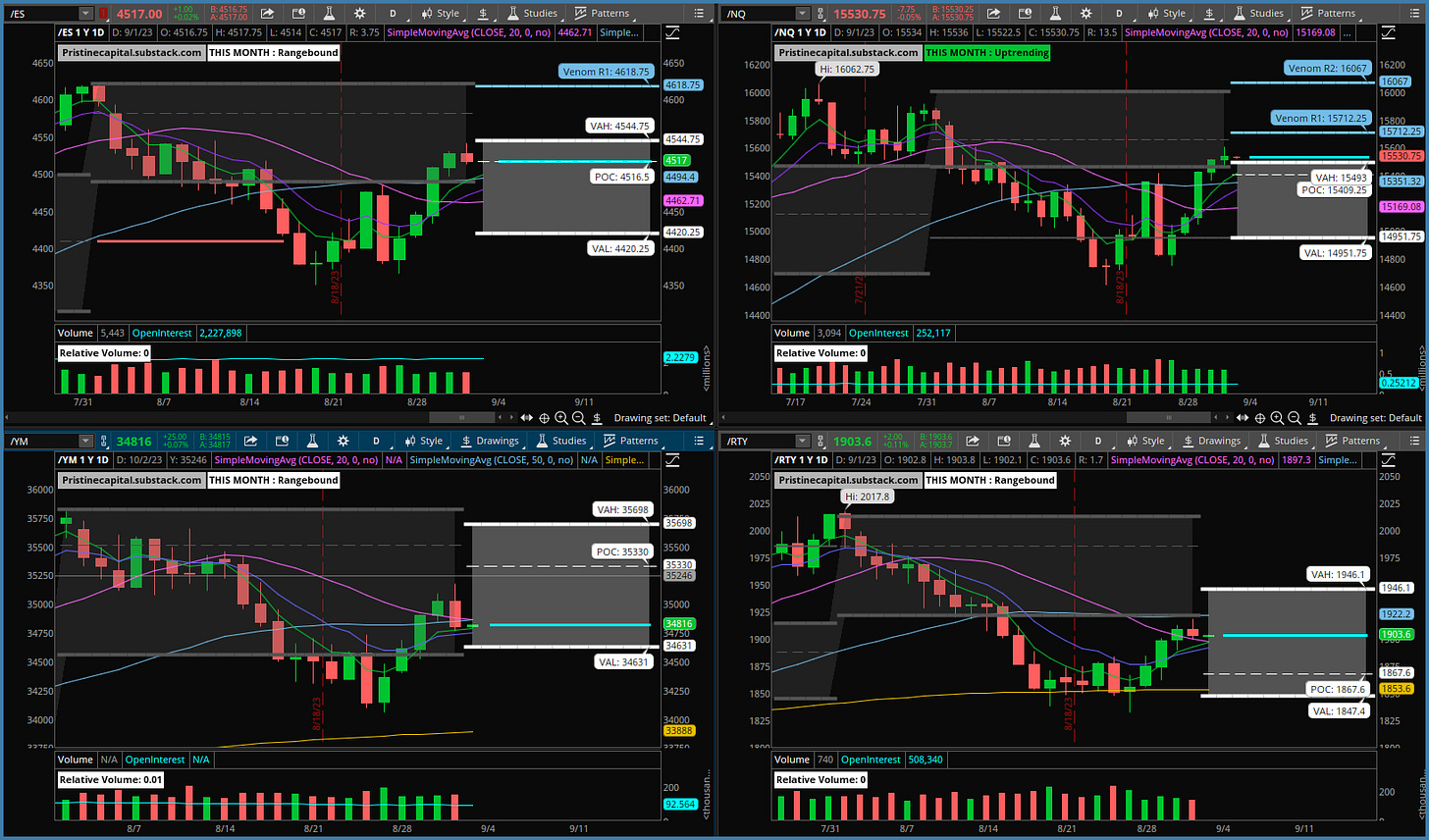

Index Price Cycle Monitor

We have new monthly value areas for September!

ES S&P 500 - Above key moving averages & Inside Monthly Value Area

NQ Nasdaq - Above key moving averages & Above Monthly Value Area

YM Dow Jones - Below key moving averages & Inside Monthly Value Area

RTY Russell 2000 - Above key moving averages & Inside Monthly Value Area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities