Pristine Market Analysis & Watchlist 10/18

In the Fog of War...

Team,

The Israel-Hamas conflict is introducing uncertainty into the market, and we know that markets hate uncertainty. Let’s take look at under the hood of today’s market flush, and how NFLX + TSLA earnings might impact tomorrow’s auction.

We are in the fog of war 👊

-Andrew

News/Economic Data

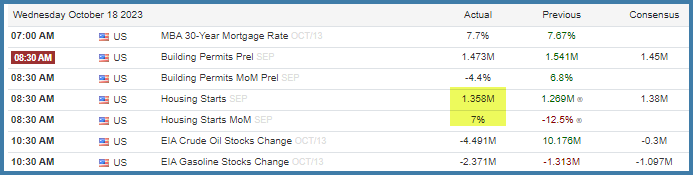

Today’s session kicked off with housing starts data that came in slightly higher than expected, and crude oil inventories that fell more than expected

FX Market

The dollar index is testing the low end of the bullish trend channel. Teetering on the edge of risk-on and risk-off.

Long-Term Treasuries

Interest rates remain at the mercy of geopolitical shocks in the middle east. Two ugly weekly candles are forming👇

While there may be fear of further supply chain disruptions as a result of conflicts in the middle east, and those fears are jolting markets in the short-term, it is important to acknowledge that the real-time Truflation rate is decreasing.

Energy

Crude oil price rejected at the bottom of it’s monthly value area

Equity Dashboard

Equities finished with only 16.5% advancers. Poor closing ranges across all tracked equity indices.

Follow through selling in NVDA, which has been a leadership stock all year.

Equity Index October Performance

3 out of 4 tracked indices are in positive territory MTD.

Index Price Cycle Monitor

Indices fell below their short-term moving averages 👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities