Pristine Market Analysis & Watchlist 9/7

The Market Sees a Recession!

Team,

Four more trading sessions until CPI! Let’s take a look at how the price action is developing in the lead up to the event.

-Andrew

Overnight/Economic Data

Today’s session kicked off with initial jobless claims that came in lighter than expected.

Which kept the bid in the dollar index alive! I don’t think this massive run is getting the attention it deserves, and I’m shocked at how resilient global financial markets have been in the face of it.

China hit US markets with a curveball!

Equity Dashboard

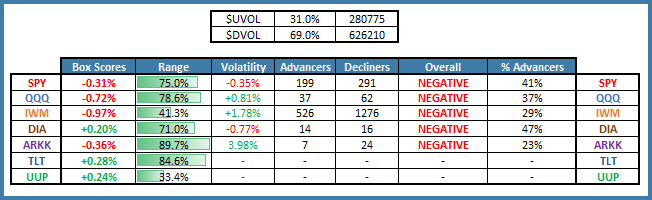

Equity breadth finished the session weak with only 31% advancers.

And AAPL showed relative weakness given the potential implications of the China ban. With how big of a weight AAPL has in the headline indices, today’s action could have been a lot worse, but some other names picked up the slack.

Equity Index MTD September Performance

All indices are in negative territory for September.

Index Price Cycle Monitor

ES S&P 500 - Below 50-day SMA & testing 20-day SMA

NQ Nasdaq - Below 50-day SMA & Testing 20-day SMA

RTY Russell 2000 - Below key moving averages

YM Dow Jones - Below key moving averages

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities