Pristine Market Analysis & Watchlist 5/23

Nasdaq Falls Back To Reality

Team,

The blow-off top is over…

-Andrew

Economic Data

Today’s session kicked off with hotter than expected US services data and lighter than expected US manufacturing data. Same story, different day!

Fed Fund Futures

The real question is not whether the fed is going to keep raising interest rates, but rather when they are going to cut interest rates! The market is currently pricing in one rate cut into the end of ‘23, and an additional rate cut in Q1 ‘24. This re-rating is a large driver behind the recent bond market weakness as a whole.

10Yr Treasury

ZN_F 10yr treasury futures FINALLY finished in positive territory!

Equity Dashboard

Equities sold off, but market breadth was not all that bad at 42.1% advancers. Far from a washout.

Megacap tech was sold:

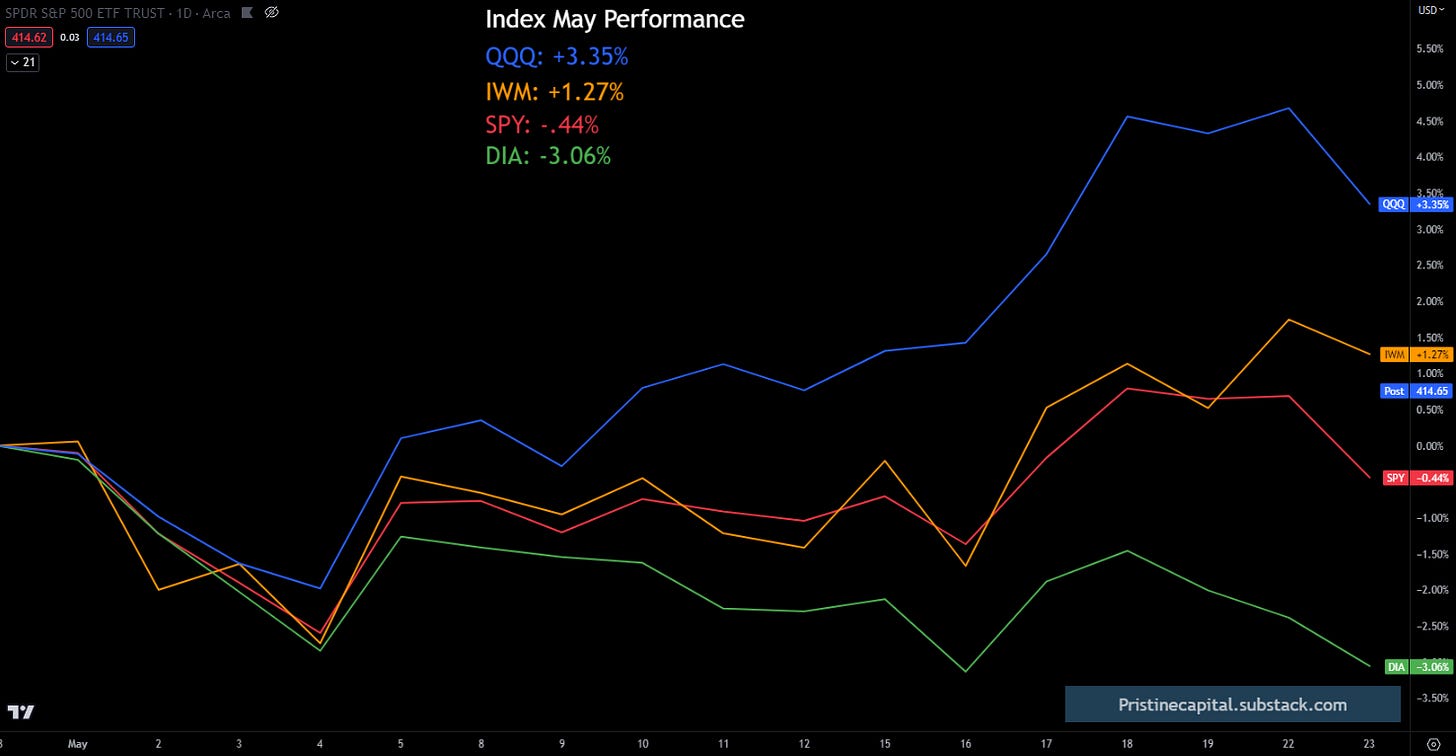

May Index Performance

SPY is back in negative territory for the month.

Index Price Action

ES S&P 500 - Inside monthly value area

NQ Nasdaq - Above monthly value area

RTY Russell 2000 - Inside monthly value area

YM Dow Jones - Below monthly value area

ARKK - Above monthly value area + Bearish reversal candle

Bitcoin - Below monthly value area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities