Pristine Market Analysis & Watchlist 5/31

The Liquidity Trap is In Place - US Investing Championship Update

Team,

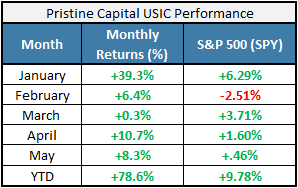

May is in the books! We finished out the month with a +8.3% return, which brings us to +78.6% YTD. We’ll be sending these results out for the US Investing Championship.

We said 2023 was going to be our year, and we meant it! Thanks for being a part of this historic run.

-Andrew

Economic Data

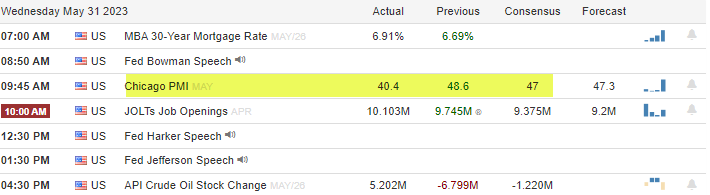

Today’s session kicked off with Chicago PMI data that came in below expectations:

10Yr Treasury

ZN_F 10yr treasury futures put in another green candle. The price action has been a bit better here since the debt deal was announced. Who would have thought a lower risk of default would lead to more demand?!

Equity Dashboard

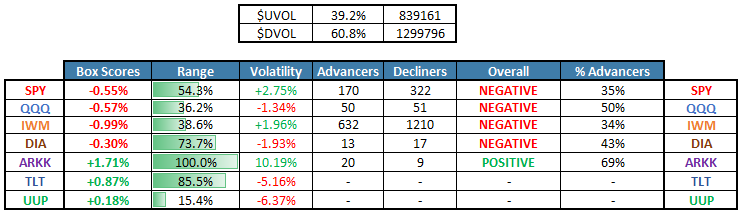

Breadth was weak with 39.2% advancers. The ARKK innovation ETF was the only positive performer.

May Index Performance

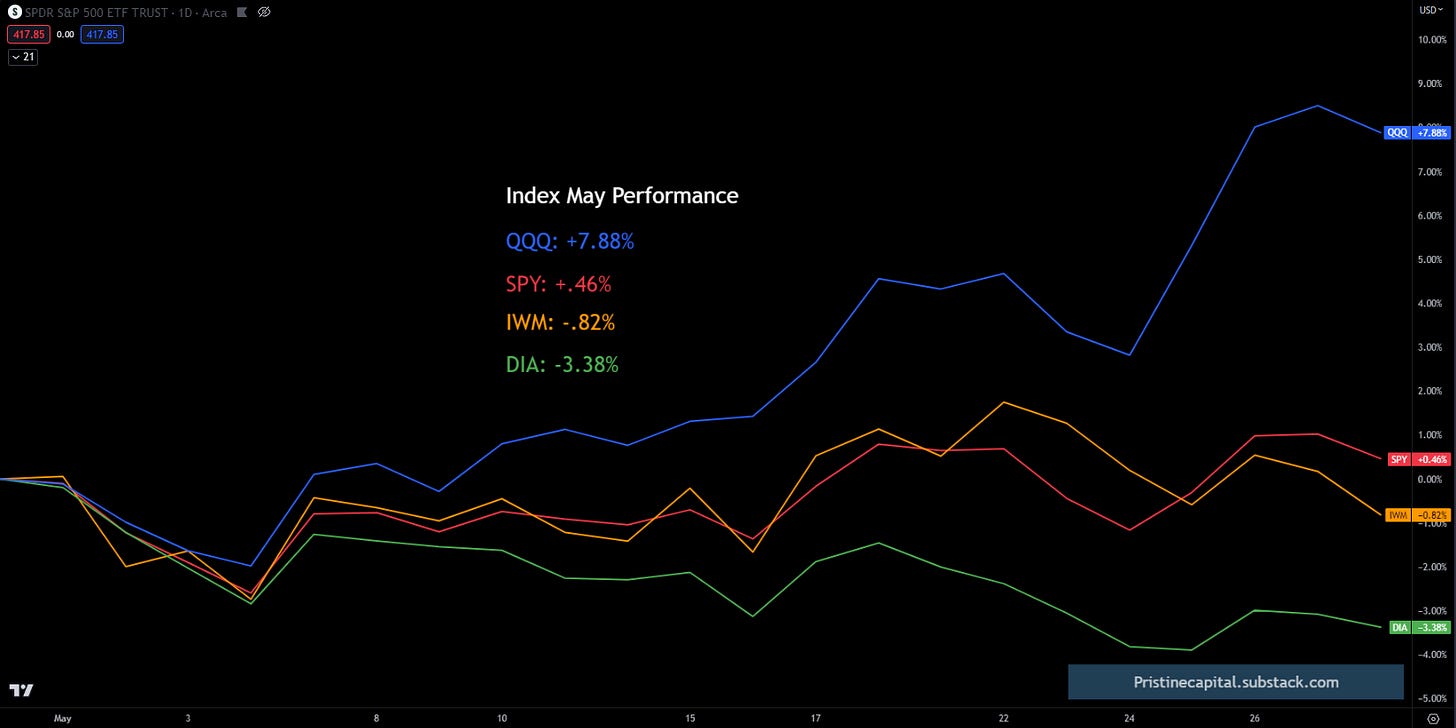

The Nasdaq QQQ and S&P 500 SPY finished in positive territory for the month of May, while the small caps IWM and dogs of the Dow DIA finished in the red. The Nasdaq put up a stellar +7.88%, so naturally, traders think it is just going to keep doing that every month 😂

Index Price Action

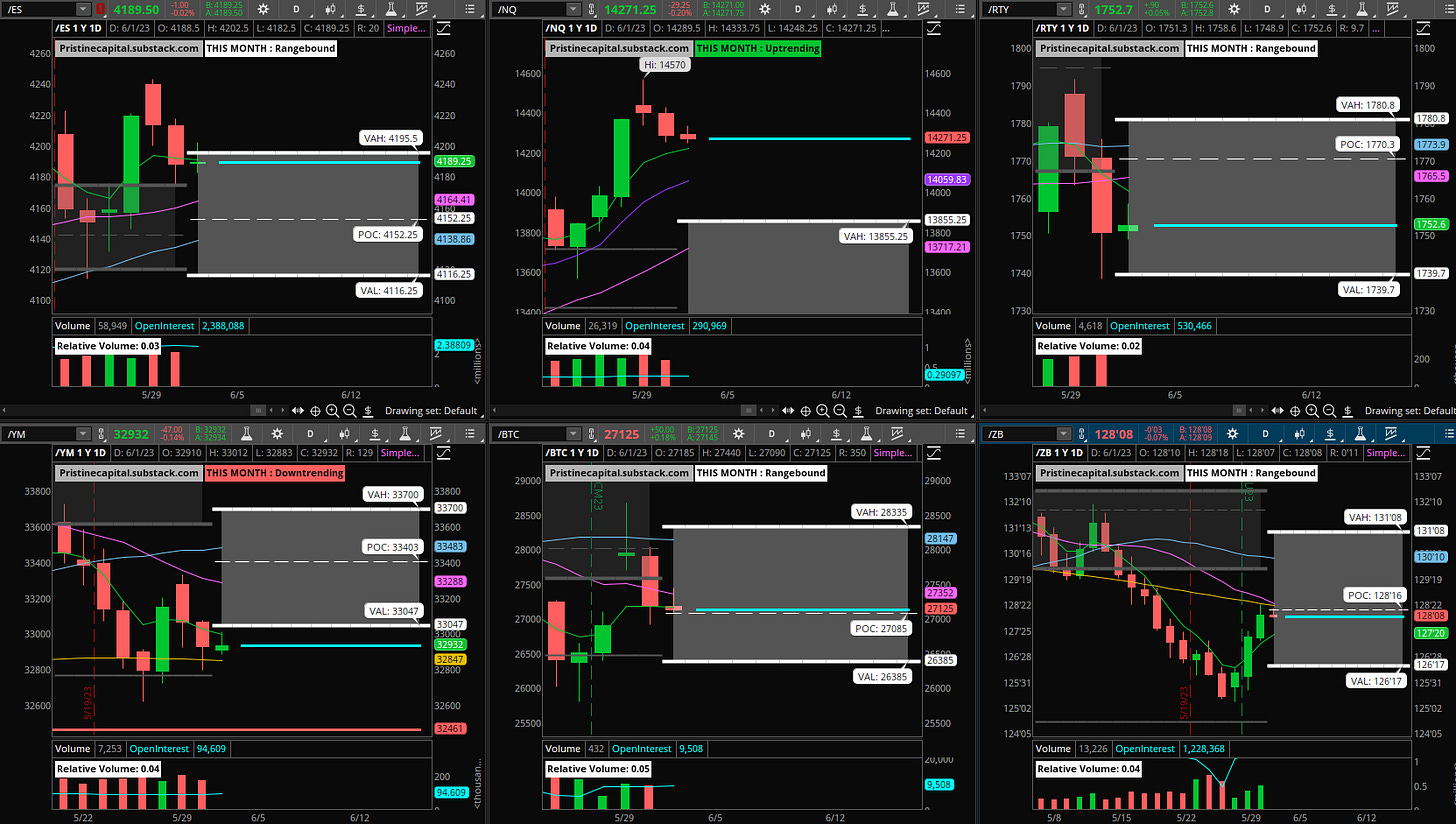

With the new month of June upon us, we have new monthly value areas Team!

ES S&P 500 -.02% after hours (Inside monthly value area)

NQ Nasdaq -.20% after hours (Above monthly value area)

RTY Russell 2000 +.05% after hours (Inside monthly value area)

YM Dow Jones -.14% after hours (Below monthly value area)

Bitcoin +.18% after hours (Inside monthly value area)

ZN_F -.07% after hours (Inside monthly value area)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities