Pristine Market Analysis & Watchlist 8/24

When the Music Stops

Team,

There’s a big difference between what we’d like the market to do, and what the market is actually doing! Let’s take a look under the new information we received from the market today.

-Andrew

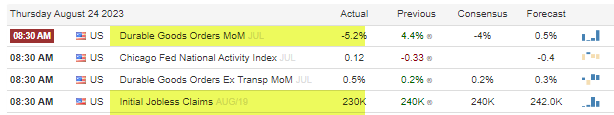

Economic Data

Today’s session kicked off with weaker than expected durable goods orders, and a light initial jobless claims report.

Treasuries

US Treasuries gave back a portion of yesterday’s gains on high relative volume.

The 30yr treasury put in it’s highest volume day all quarter!

While the MOVE index continued to consolidate at it’s downward trendline.

FX

And the DXY dollar wrecking ball made a new closing high

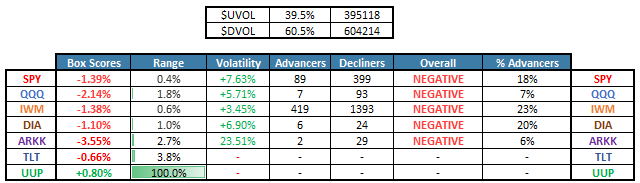

Equity Dashboard

NVDA put up another epic beat-and-raise quarter last night! If we were to have followed the same script from last quarter, the market would have closed bright green. We experienced the complete opposite! Equities were sold across the board.

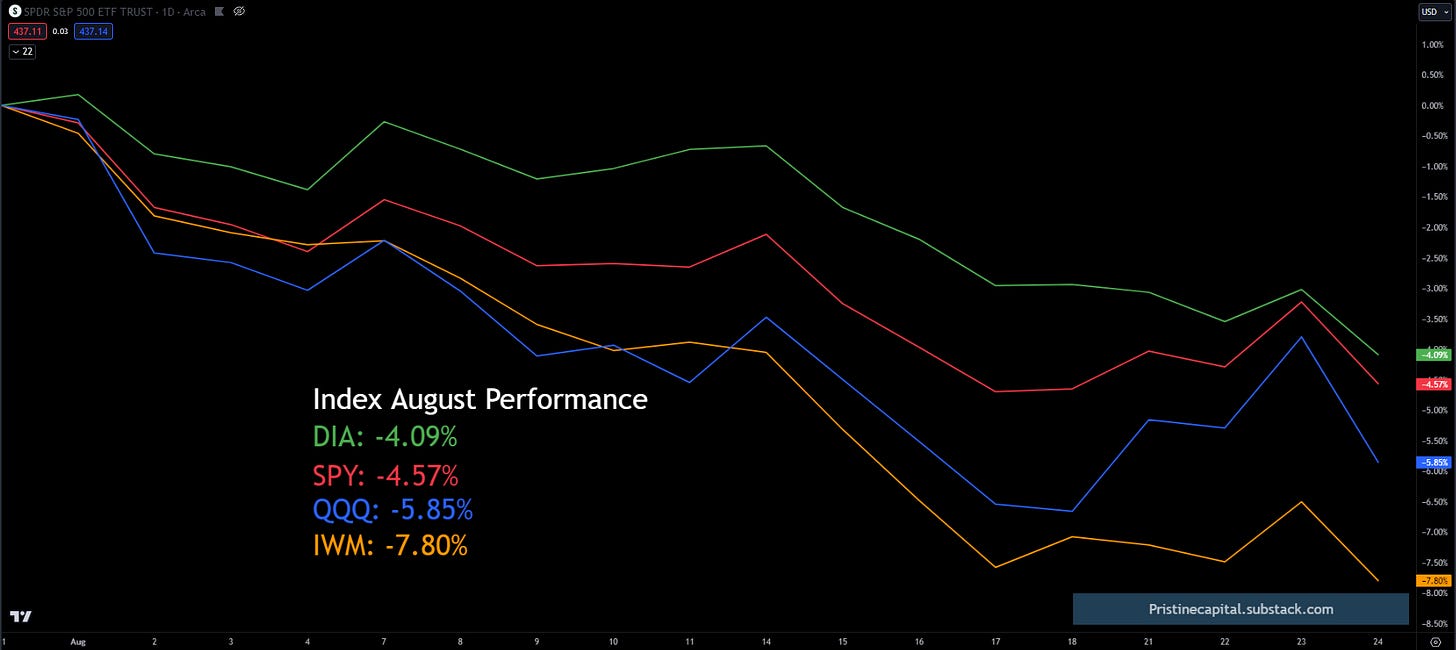

Equity Index MTD August Performance

The August selloff deepened on a headline index basis.

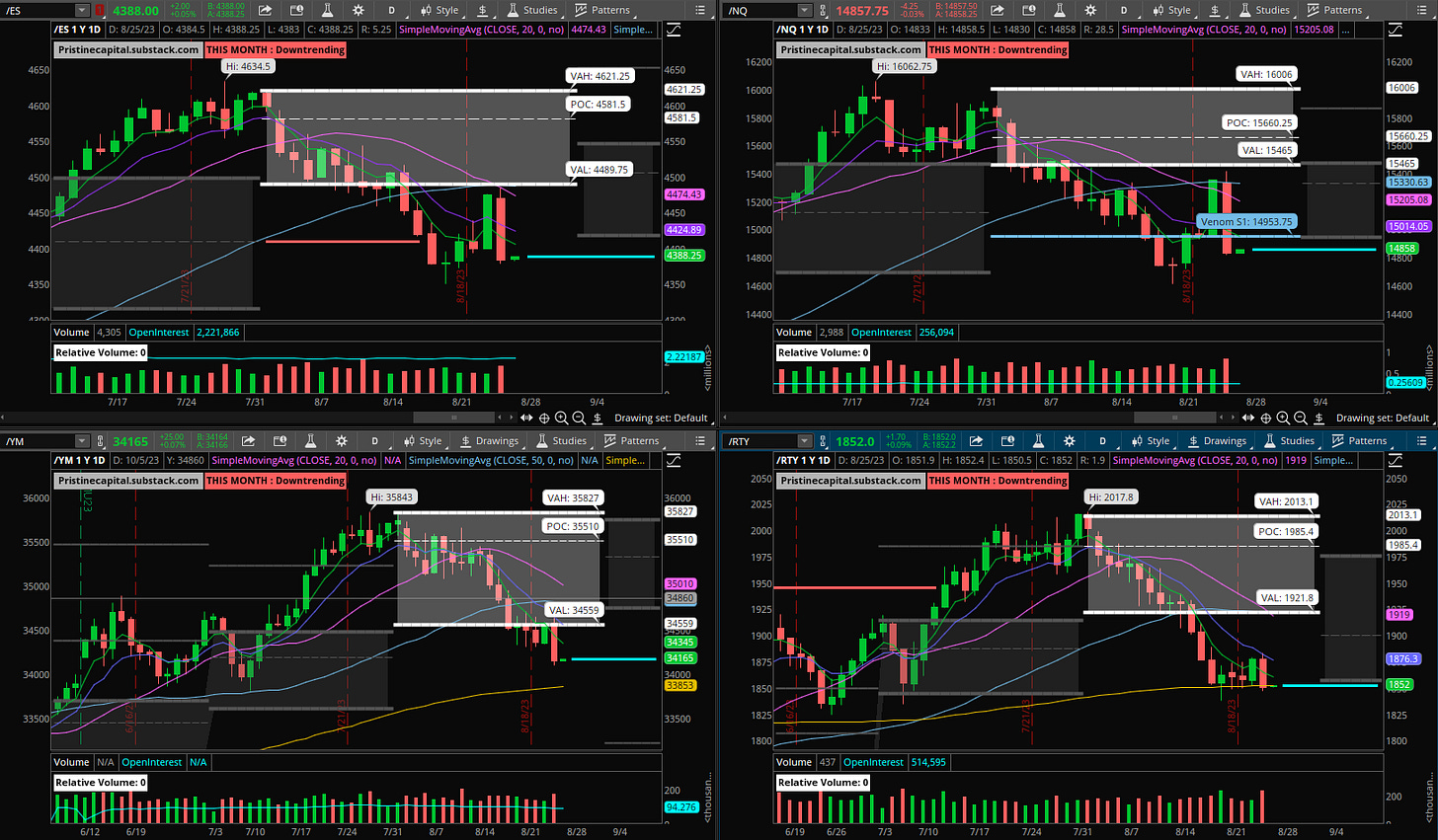

Index After Hours Price Action

ES S&P 500 +.05% - Below all key moving averages

NQ Nasdaq -.03% - Below All key moving averages

YM Dow Jones +.07% - Below 50 day SMA & Approaching 200 day SMA

RTY Russell 2000 +.09% - Basing at the 200 day SMA

Okay…Now let’s take a look at the setup heading into Jackson Hole.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities