Pristine Market Analysis & Watchlist 6/26

Markets taking the elevator up and the stairs down!

Team,

The 20-day SMA is calling! Will the buyers step up to the plate? Let’s dive in!

-Andrew

Economic Data

Dallas Fed manufacturing index better than expected.

Fed Fund Futures

The market is pricing in one more rate hike by September and then a pause into year end.

10Yr Treasury Futures

Trading in a tight range and could be carving out a bottom.

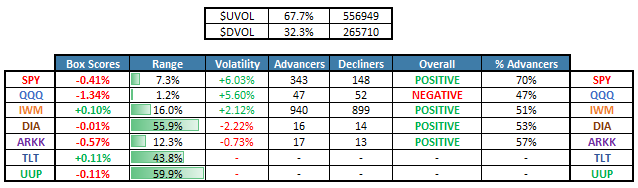

Equity Dashboard

Market breadth was strong despite some individual names that were hard hit.

Profit-taking in the megacap names that have been outperforming all year.

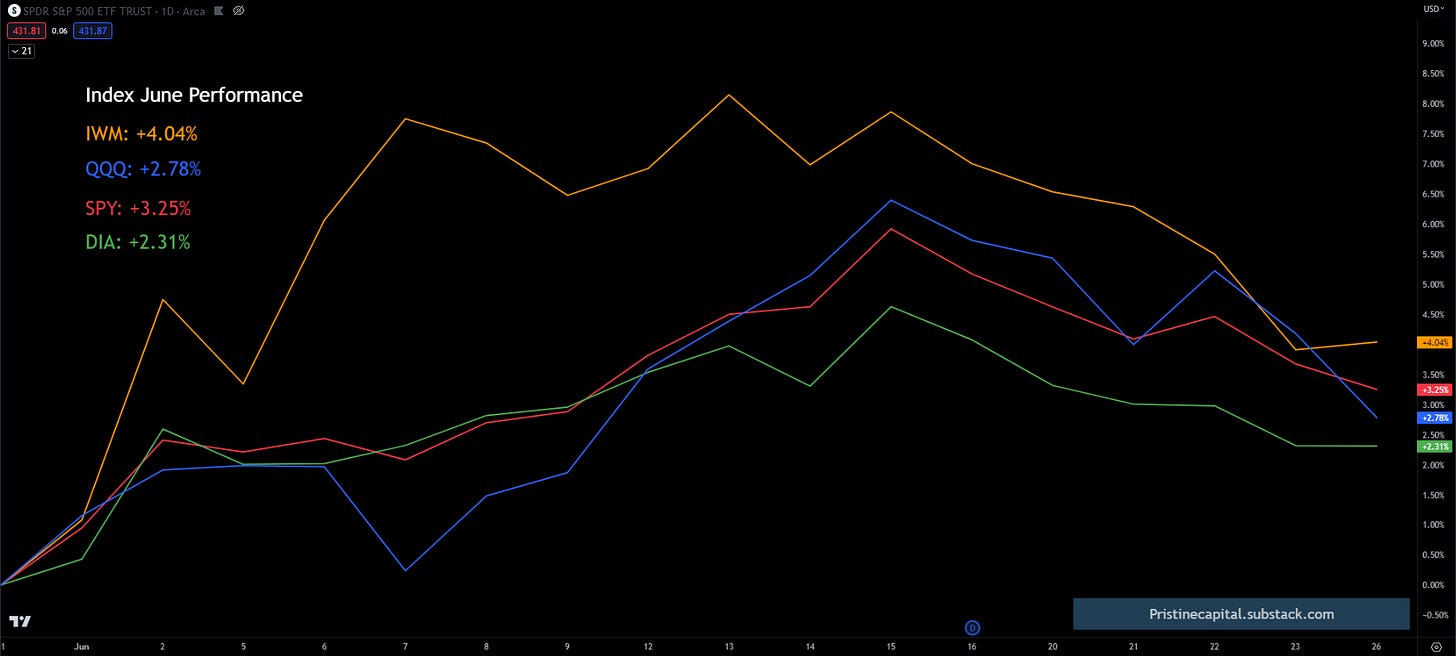

Index MTD June Performance

Despite the profit-taking we’ve seen over the past week, all of the headline indices are still sitting on hefty month-to-date gains!

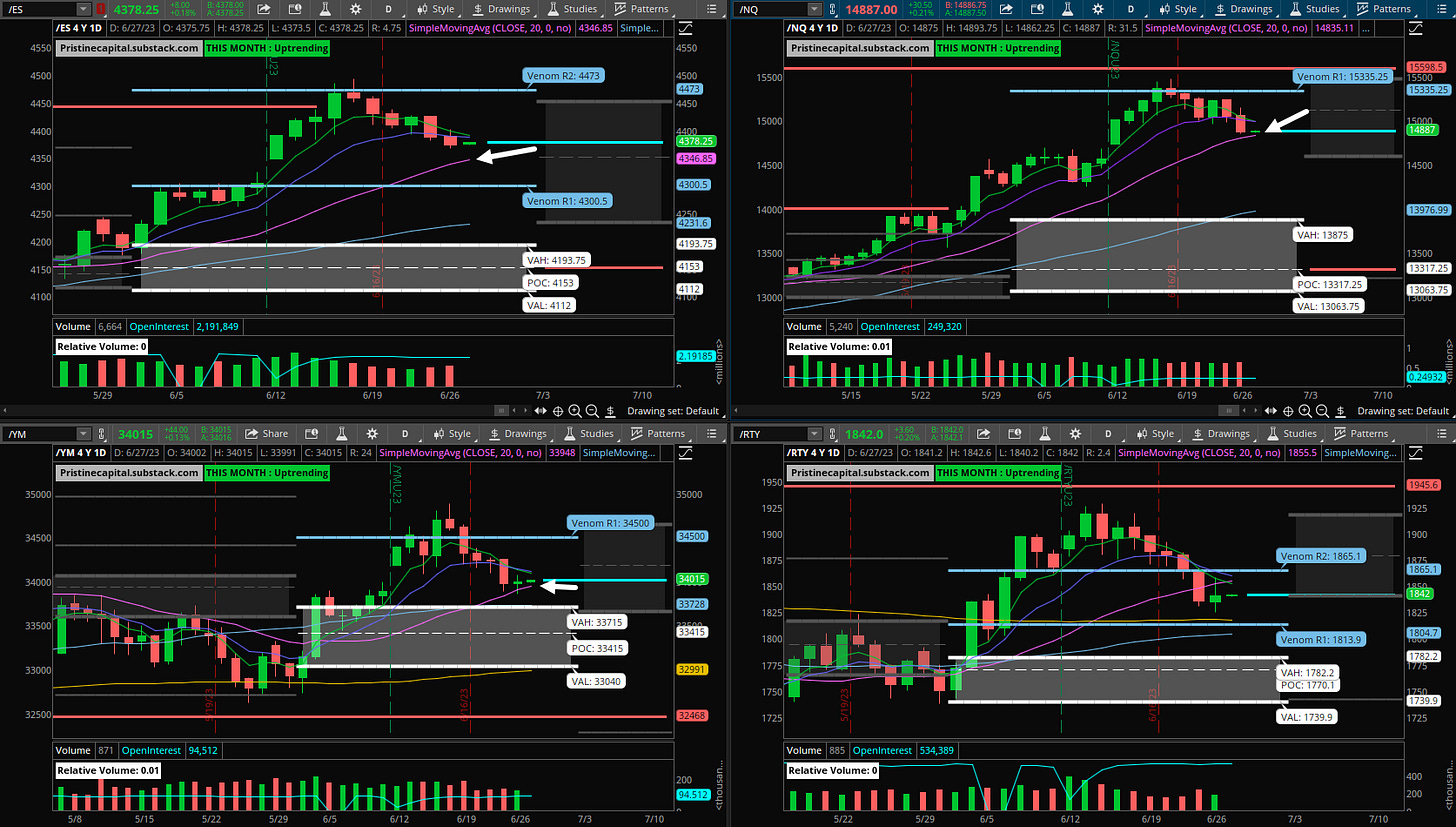

Index After Hours Price Action

3 out of 4 of the headline indices are sitting directly on top of their respective 20-day SMAs. In a strong bullish trend, buyers should emerge at this level. But a break below could invite more selling by trend following strategies that use the 20-day SMA as a buy/sell trigger.

ES S&P 500 -+.18% (20 SMA Pullback)

NQ Nasdaq +.21% (20 SMA Bounce)

YM Dow Jones +.13% (20 SMA Pullback)

RTY Russell 2000 +.20% (200 SMA Pullback)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities