Pristine Market Analysis & Watchlist 3/13

CPI Incoming

Team,

Our commentary from last week still applies:

Non-farm payrolls data is coming Friday 3/10, and CPI is coming 3/14. We remain in a high risk/low edge environment until these two data points are in the rear view. Patience is a virtue!

I’d like to recognize how well everyone in the group is managing through this crisis trading environment. It’s a lot of fun to bounce ideas around with you, laugh at some of the craziness unfolding in the world of markets, and I have no doubt that our patience and diligent analysis will allow us to weather this storm. Keep it up!

-Andrew

Over the weekend, you can bet your bottom dollar that every investment manager around the world spent an extraordinary amount of time getting up to speed on the unfolding banking crisis and resulting government bailout! Let’s take a look under the hood and see how they reacted:

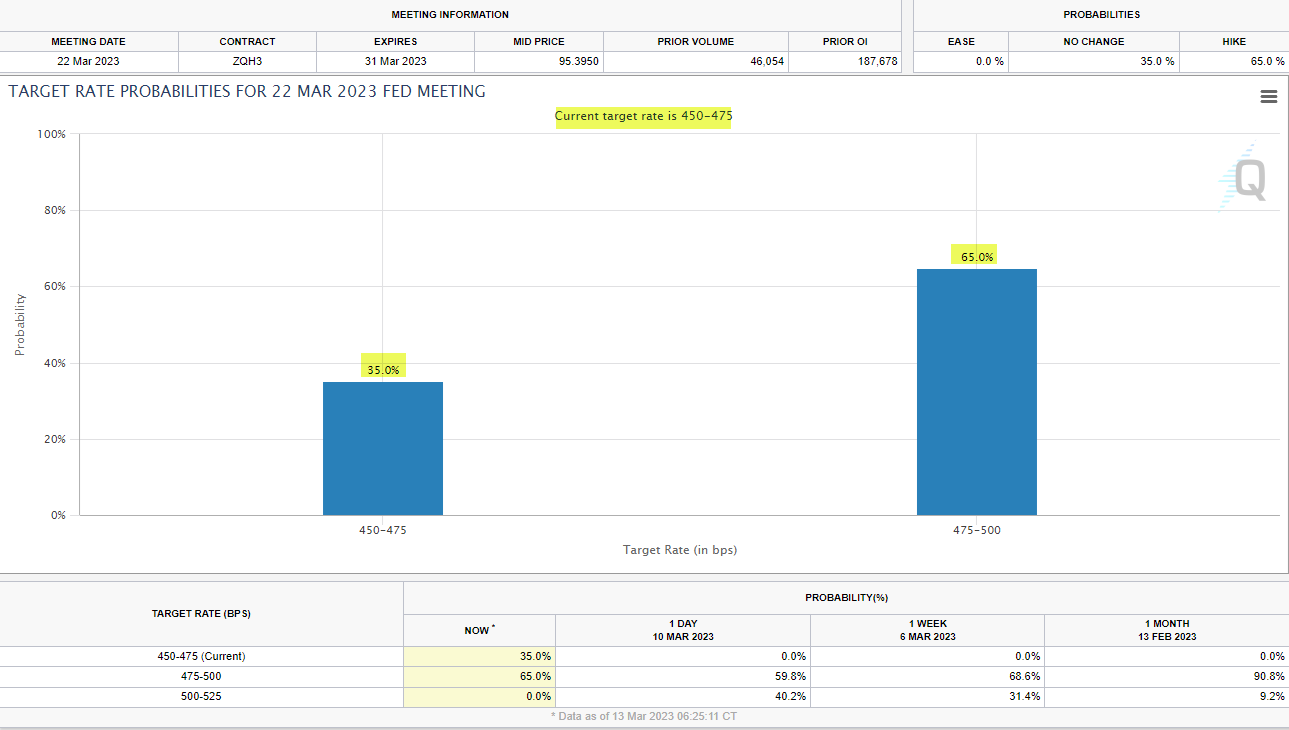

Fed Fund Futures

While the discussion last week was whether or not we would get a 50 basis point rate hike at the March 22nd Fed meeting, markets are now pricing in a a 65% chance of a 25 bps rate hike, and 35% chance that the fed doesn’t even hike!

Looking beyond the March Fed meeting, expectations for future rate hikes have absolutely collapsed over the last few sessions! Looking out to March 24’, the market was pricing in a fed funds rate of 5.365% three trading sessions ago, and is now pricing in 3.77% 🤯

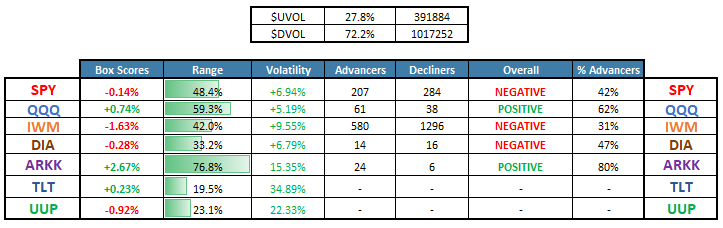

Equity Dashboard

The dollar index continued it’s selloff, bonds were bid but closed toward the low end of their day’s range, and equities were…mixed! The duration sensitive areas of the market QQQ ARKK outperformed and the IWM small caps were dragged down by the regional bank weakness.

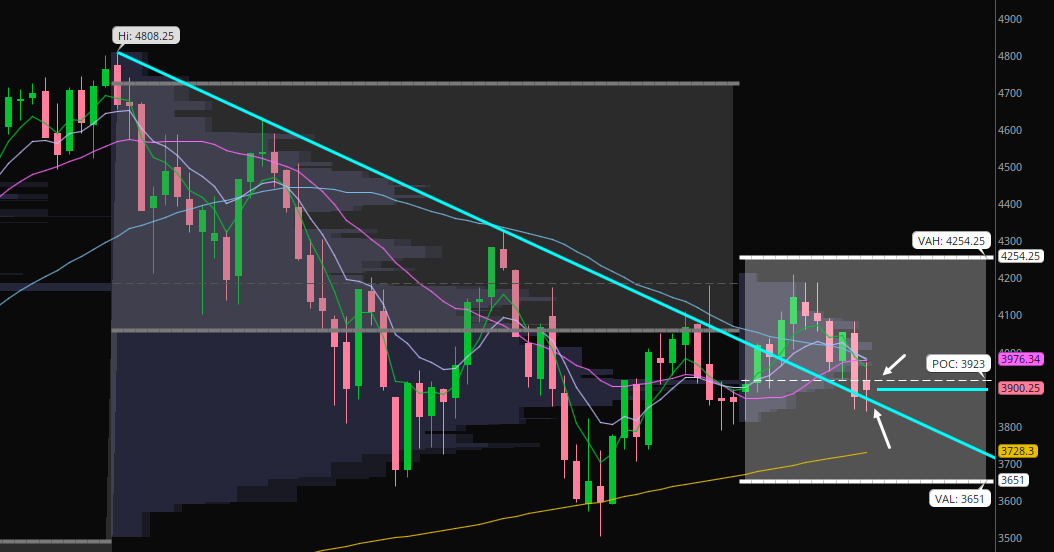

ES_F S&P 500 Price Action Analysis

The ES is trading above the teal downward trendline, but below the yearly point of control ~3923. Tomorrow’s CPI report and the resulting reactions in the bond market and regional banks KRE will likely determine if we do indeed slip into the abyss or not.

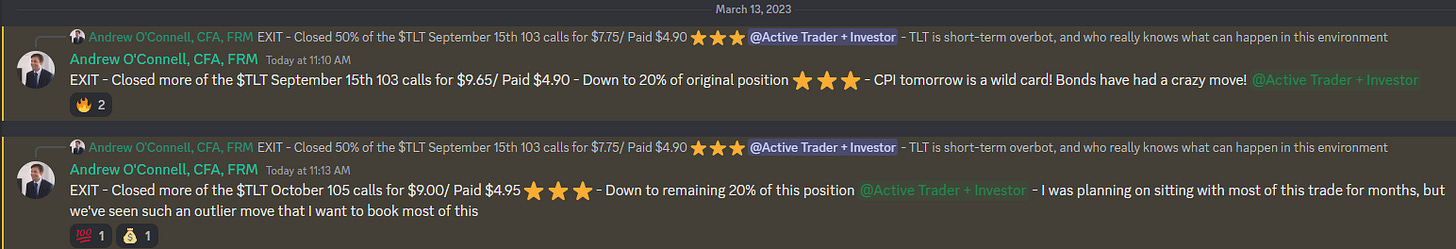

Beware the Jaws

The jaws setup between the Nasdaq QQQ ETF and the ZN_F 10yr treasury futures contract finally closed! We’ve cited this divergence since early February, and will be removing it from the newsletter beginning tomorrow. It took a great deal of patience, but this setup prompted us to enter our long TLT trade, which has been one of our best so far this year! Until next time, jaws!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities