Pristine Market Analysis & Watchlist 3/16

Money Printer Go Brrrrrrrrr

Team,

The money printer is back.

-Andrew

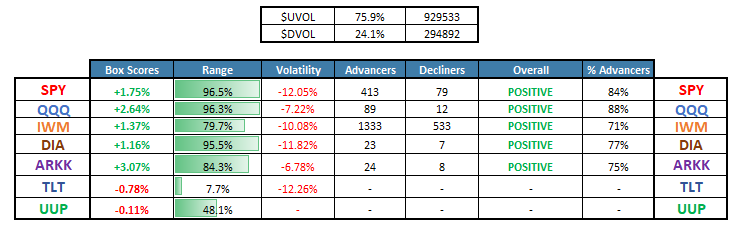

Equity Dashboard

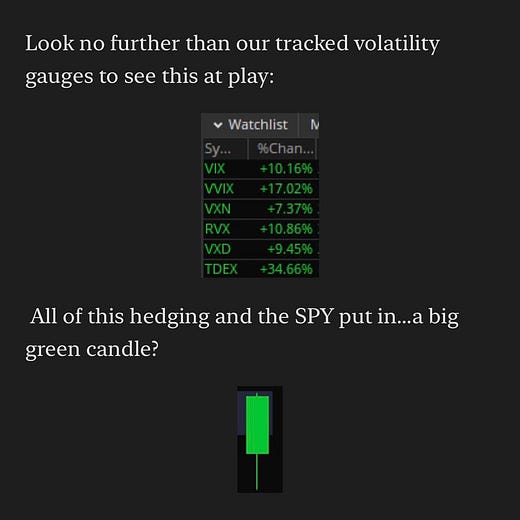

There were a million reasons to be bearish heading into today’s session, but the market did as it usually does, and functioned as a max pain machine to the upside. The duration sensitive QQQ and ARKK led today’s auction, and volatility was crushed! So much for all the panic puts.

Was this a shock for regular readers of our research? Absolutely not. There were plenty of signs that told us the poor location shorts could be in trouble yesterday!

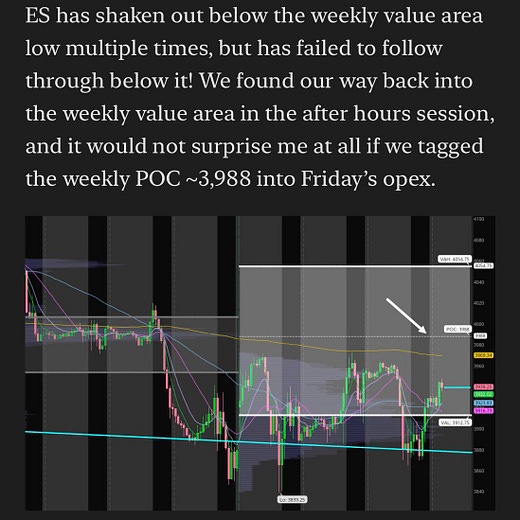

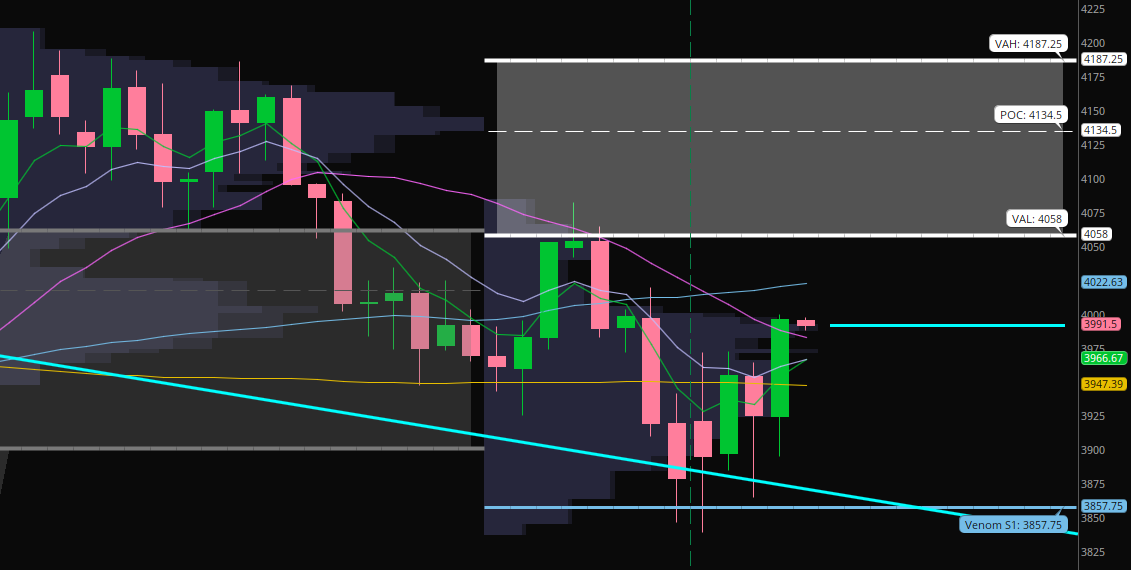

ES_F S&P 500 Price Action Analysis

The S&P 500 shook the tree this morning and traded in negative territory before zooming to the upside. In one fell swoop, we reclaimed the 200-day SMA, as well as all of the short-term moving averages!

When most players are either short or in cash, it’s tough not to get a positive reaction to headlines like the following that dropped early on in the session

Bond Rally

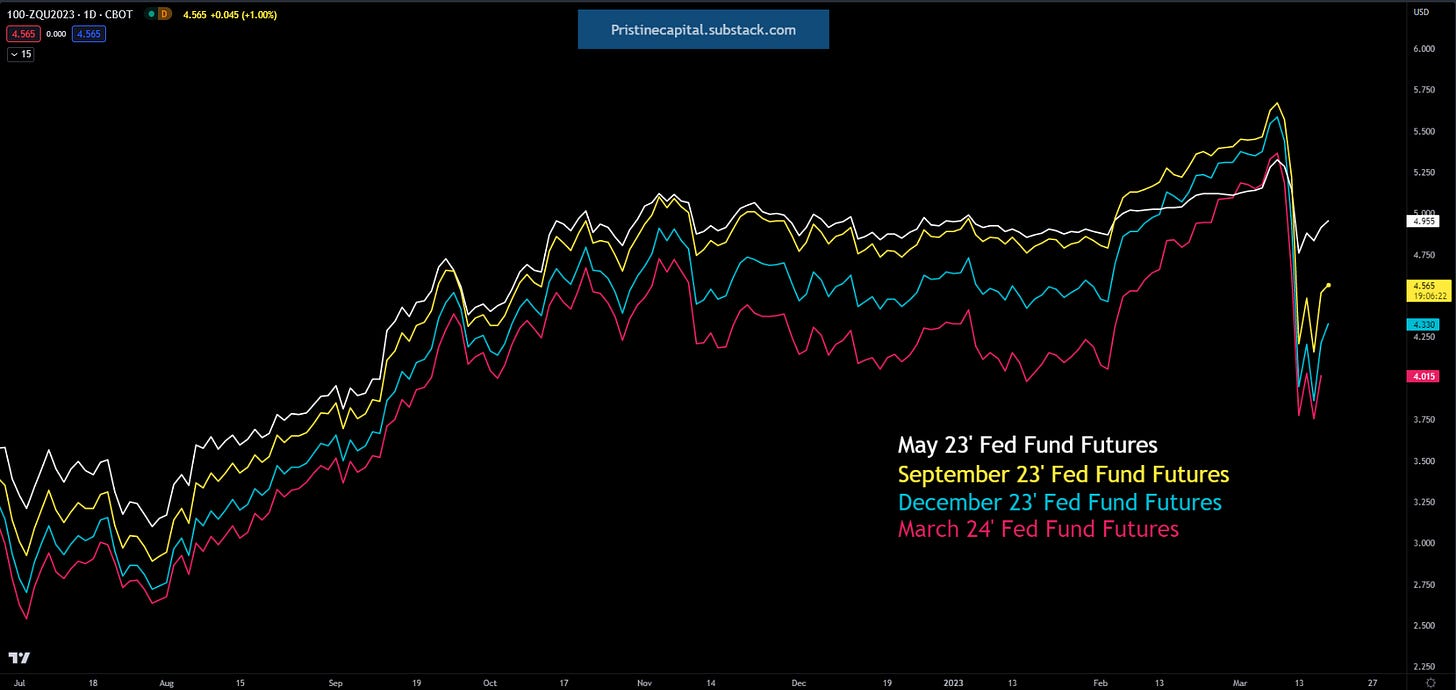

Fed fund futures are pricing in a 20.3% chance of no rate hike at the March 22nd meeting, and a 79.7% chance of a 25 bps hike. Barring another exogenous event, I’m expecting 25 bps next Wednesday.

Looking further into the future, the plot thickens! Our fed fund futures are once again moving higher, meaning the market is pricing incremental fed tightening back into the market!

Let’s discuss how this might affect the market into Fed Wednesday. If you haven’t upgraded to premium yet, now’s your chance!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities