Pristine Market Analysis & Watchlist 1-30

Sidestepping the Selloff

Good evening everyone,

The first inning out of twelve this trading year ends tomorrow! Remember…we said 2023 was going to be our year…and we meant it! Cheers to your continued evolution as a trader!

-Andrew

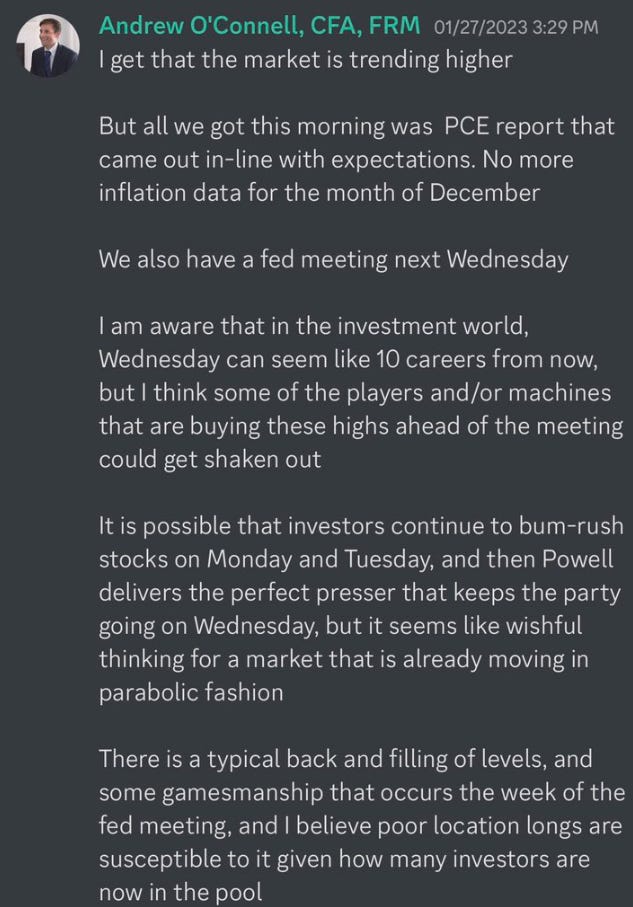

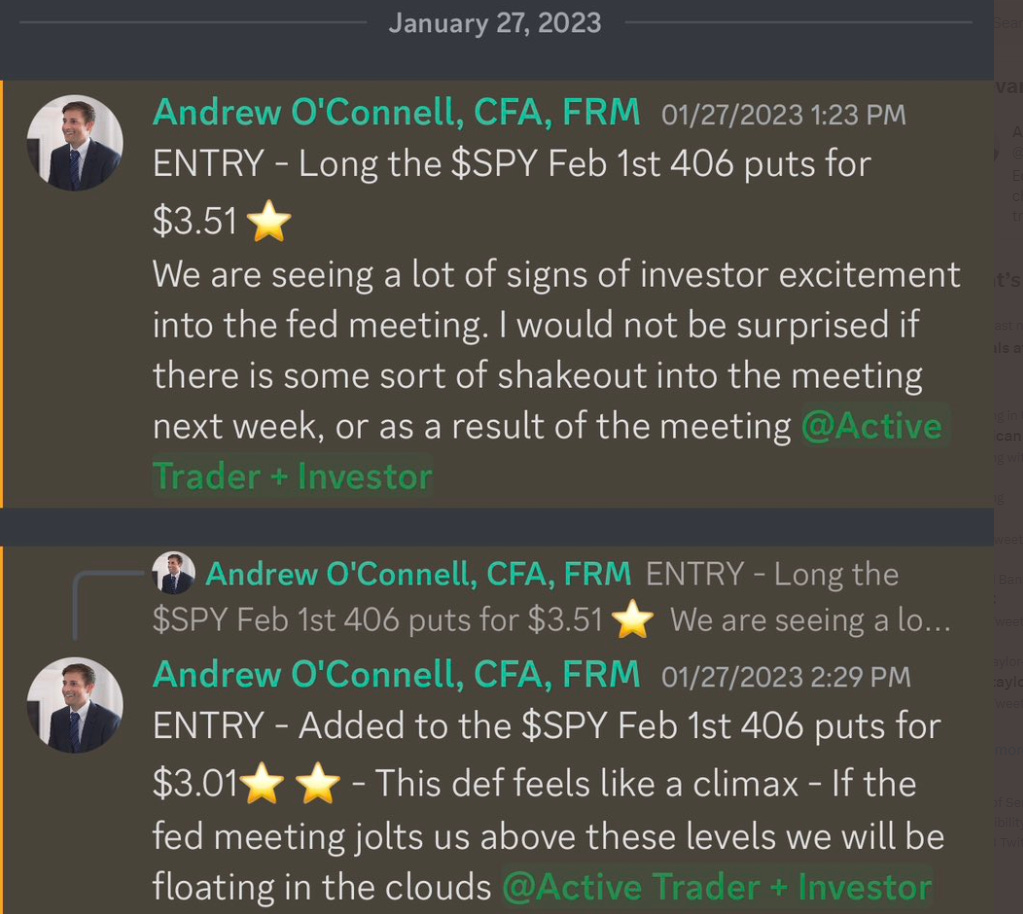

Fading The Euphoria

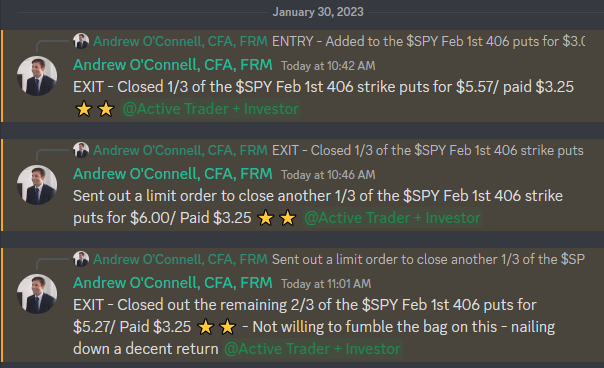

We noted the high likelihood of a pullback into the Fed meeting given Friday’s euphoria, and entered shorts via put options into Friday’s close as a result

We closed these positions during today’s session for a 50%+ winner, and sidestepped the market weakness in the process!

If you would like access to our live trades, daily market research routine, and join a community of traders getting 1% better at their craft every day, upgrade your subscription if you haven’t already.

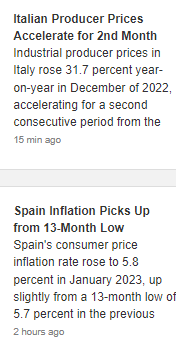

European Inflation…Accelerating?

Just when the macro narratives and positioning changed to reflect a victory over inflation, European inflation data came in hotter than expected overnight!

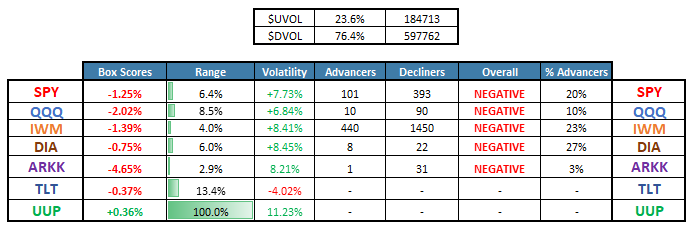

Equity Dashboard

US treasuries futures were weak throughout the trading session and the US dollar was bid! We know that the short dollar trade is crowded, and any incremental hawkishness from Powell could squeeze the shorts.

Finviz Heatmap

Large declines across megacap tech and energy! The market raced so quickly to the upside throughout January that even after the large declines, most technology names are still quite extended from the key moving averages

S&P 500 ES_F Price Analysis

The S&P 500 tends to trade in a tight range ahead of Fed meetings, so let’s zoom in to the hourly chart, and check out where we are in relation to the weekly value area.

Support - Weekly POC 4,033.25

Pre-Fed downside target - Weekly VAL 4,008.25

Pre-Fed upside target - Weekly VAH 4,073.5

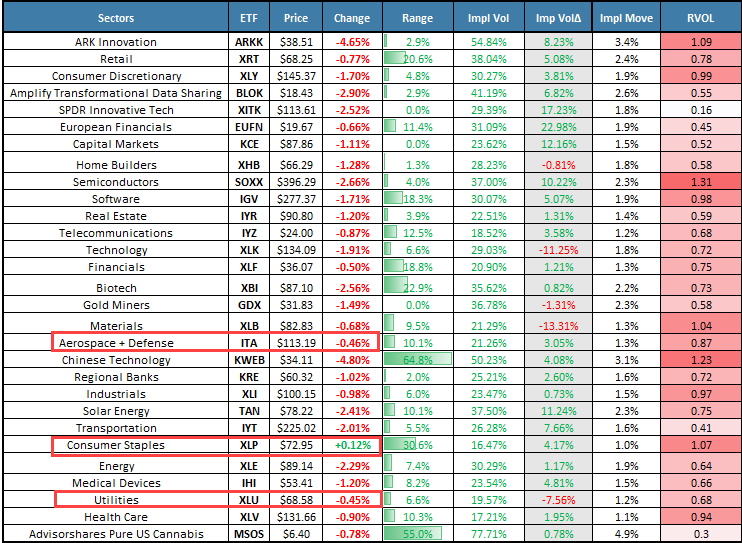

Sectors - Ranked by Momentum

Investors rotated out of risk-on ARKK innovation, KWEB China internet, and SOXX semiconductors and into risk-off ITA aerospace & defense, XLP consumer staples, and XLU utilities

Earnings on Tap

I am covering all of these reports and reactions in Discord

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities