Pristine Market Analysis & Watchlist - 1/3

TSLA Sparks a Growth Scare

Good evening everyone,

Hope you enjoyed your holiday, and had a great first day back on the trading desk 👊

We have a lot to cover tonight, so let’s dive in!

-Andrew

Top News

German inflation rate YoY +8.6% vs +9.1% expected (Tradingeconomics.com)

A recovery in subway use in China indicated Covid infections may have peaked in some of the country’s biggest cities (Bloomberg)

Former Fed's Dudley: A US recession is pretty likely because of what the Fed must do. If there is recession, the Fed could end it by easing policy (Bloomberg)

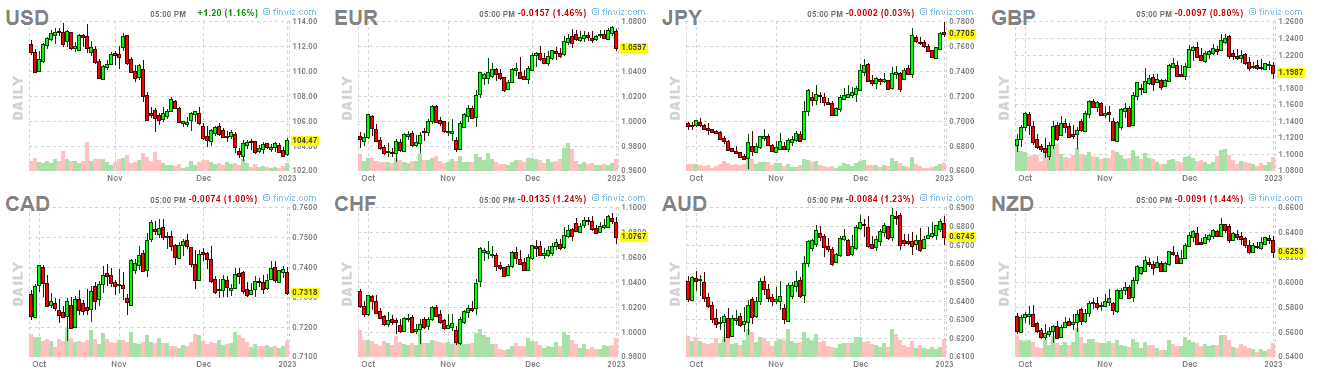

FX Volatility

FX and rates volatility feed through to equities, so it is definitely worth your time to monitor global FX markets in this uncertain environment:

The dollar index advanced 1.16% to begin the year, and strengthened vs all peers

One day of dollar strength does not a trend make

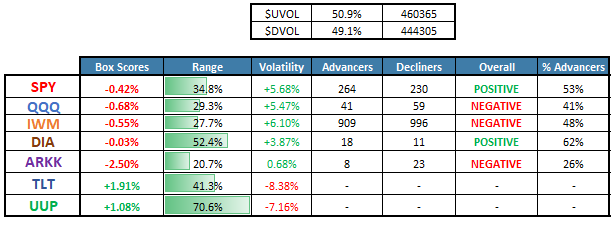

Equity Dashboard

50.9% UVOL - More advancing stocks than decliners despite red indices!

Equity volatility increased despite the muted index action

TSLA Vehicle Deliveries Miss

Megacap tech stocks faced significant sell pressure throughout the month of December, and this Tesla deliveries miss added fuel to the selling fire:

TSLA stock finished the session -12.24%, and retested the bottom of the long-term trend channel:

Finviz Heatmap

If Tesla’s delivery miss is a sign that the economy is weakening, what could that mean for Iphone sales? Or energy demand?

Relative weakness in AAPL, semiconductors, and energy stocks (growth scare?)

S&P 500 ES_F New Yearly Value Area

With the beginning of a brand new trading year, comes a new yearly value area! The shaded white value area below provides insight as to where the ES_F is currently trading in relation to 2022 price action:

Yearly VAH → ~4255

Yearly POC → ~3922

Yearly VAL → ~3649.75

Translation: 68% of the ES_F trading volume in 2022 occurred between 3649.75 (VAL) and 4255 (VAH), and the most highly traded price in 2022 was 3922 (POC)

S&P 500 ES_F Stuck in a Balance Area

While it is sooooo tempting to try to predict which direction the S&P 500 will resolve in, the veteran move is to err on the side of caution until we have more clarity:

AAPL New Lows

AAPL cascaded in sympathy with TSLA, and invalidated the undercut & reversal setup that formed into the weekend:

VPOC at ~121.27 that could serve as short-term support

Nasdaq NQ_F Price Action Analysis

Despite the 2nd (AAPL) and 7th (TSLA) largest holdings by market cap breaking down to new lows, the Nasdaq made a higher low during today’s session:

Price failed to revisit the prior lows from 11/14 and 10/13 🚨🚨🚨

If we were to remove these two holdings from the index (I know that is a big ask), the Nasdaq would have finished today’s session green!

This begs the key question: Was today’s action actually a selloff? Or was it just a rotation out of two highly weighted tech stocks? The jury is still out on this one.

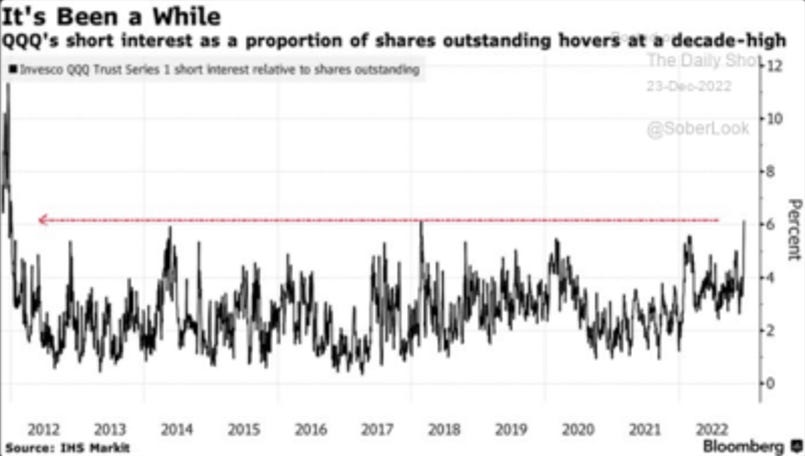

Nasdaq QQQ Short Interest

Let’s not forget that the Nasdaq QQQ ETF is still a consensus short:

Sectors - Ranked by Momentum

Chinese technology stocks KWEB, Gold miners GDX, and European Financials EUFN are at the top of the momentum leaderboard. It is also worth noting that the European equity indices finished today’s session green as did the Asian indices. Today’s weakness was US-centric:

Key Takeaways

The S&P 500 is still stuck in balance - not time to be a hero trader!

Either US megacap tech is going to pull the rest of global equities down, or global equities will lift US markets despite megacap weakness. I will continue to monitor to see which side wins out, and keep you updated.

The first session of the year left us with more questions than answers, and that is okay! This highlights the importance of sticking to a repeatable trading process, and being comfortable sitting out when you don’t have much clarity.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities