Pristine Market Analysis & Watchlist 10/2

Utilities Crater!

Team,

How long can the magnificent 7 hold the market up? That is the question!

-Andrew

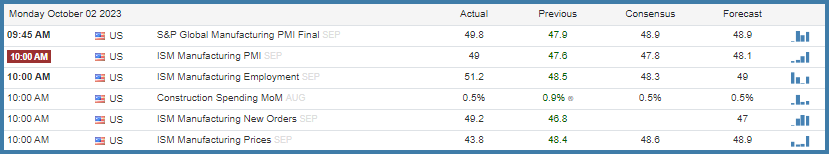

Economic Data

ISM Manufacturing came in at 49.0, which was better than expected, but still a contraction.

The prices component was a bright spot for this report, coming in at 43.8!

FX Market

But it appears that the cake was already baked before the session even began, as the dollar was bid in premarket and followed through to the upside throughout the session.

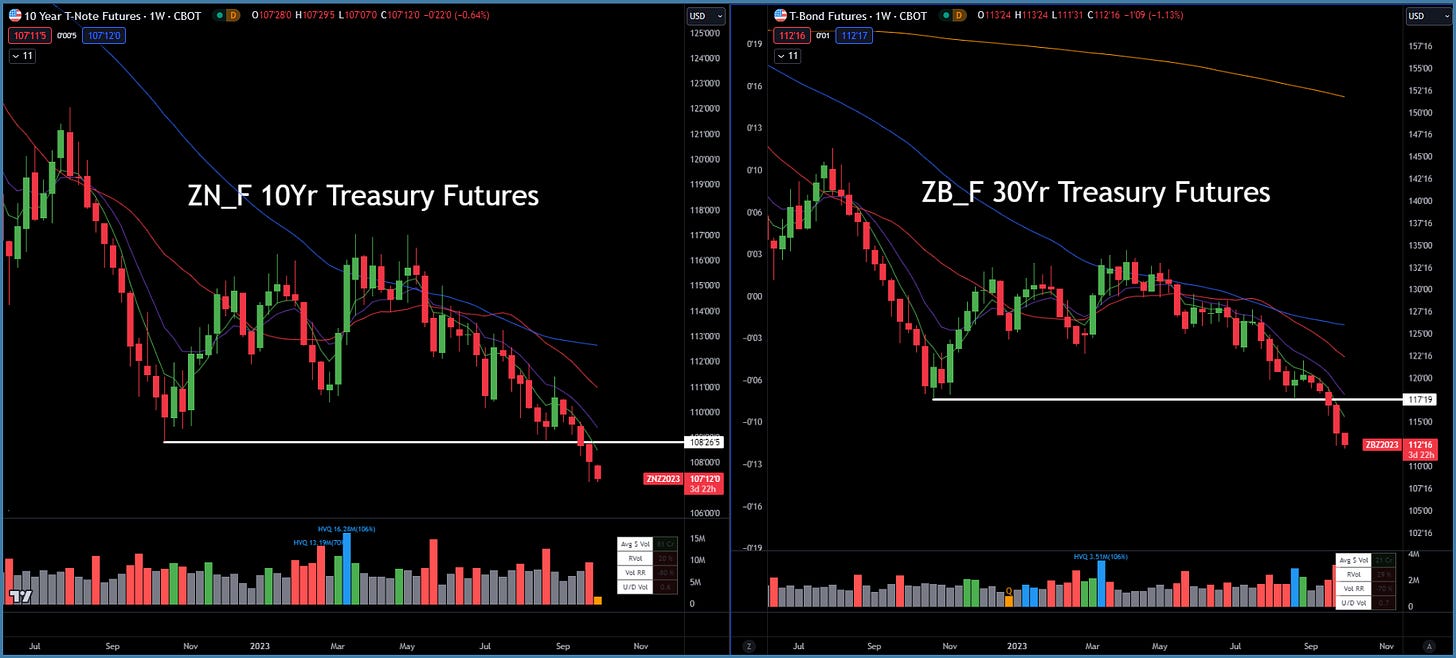

Long-Term Treasuries

Long-term bonds began selling off in premarket as well. This type of relentless trading that happens for seemingly no reason often occurs at the end of trends. The only catalyst for the selling is often that there was selling in the prior trading sessions, and downside trigger levels being hit induces further selling, and further selling results in more downside trigger levels being hit! This reinforcing pattern results in violent moves that often occur before meaningful bottoms.

Crude oil fell and closed below the 20-day SMA.

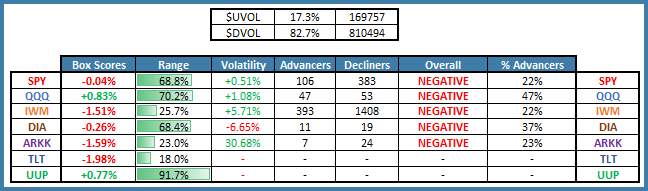

Equity Dashboard

Equity breadth was weak with only 17.3% advancing stocks.

Megacap tech stocks were bid while almost everything else sold off.

Equity Index October Performance

Significant dispersion between equity indices to begin the month of October.

Index Price Cycle Monitor

ES S&P 500 - Below key moving averages and below monthly value area

NQ Nasdaq - Reclaimed 10 EMA and inside monthly value area

RTY Russell 2000 - Below key moving averages and below monthly value area

YM Dow Jones - Below key moving averages and below monthly value area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities