Pristine Market Analysis & Watchlist 4/17

Bank Earnings Incoming!

Team,

After a few weeks of patiently waiting, our MTB trade came to life today! Let’s discuss bank earnings and how the market is shaping up into opex.

-Andrew

Bank Earnings

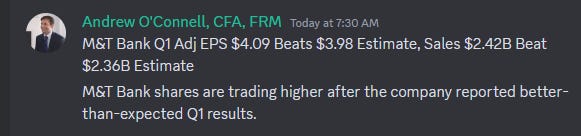

The morning’s festivities kicked off with earnings releases for SCHW STT, and our largest position; MTB!

After shaking out to the downside briefly after the open, MTB took flight and closed on the highs!

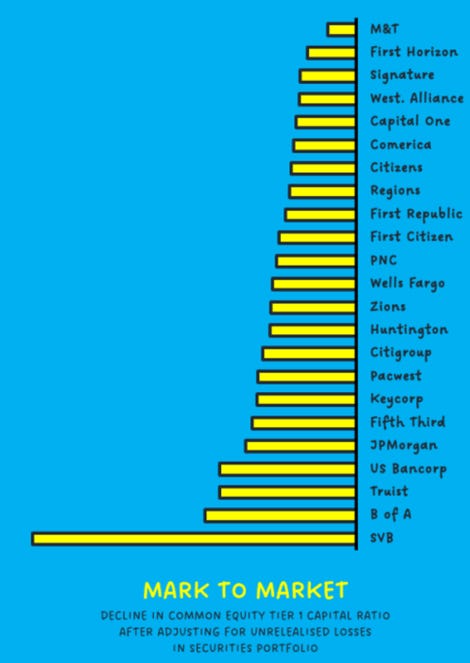

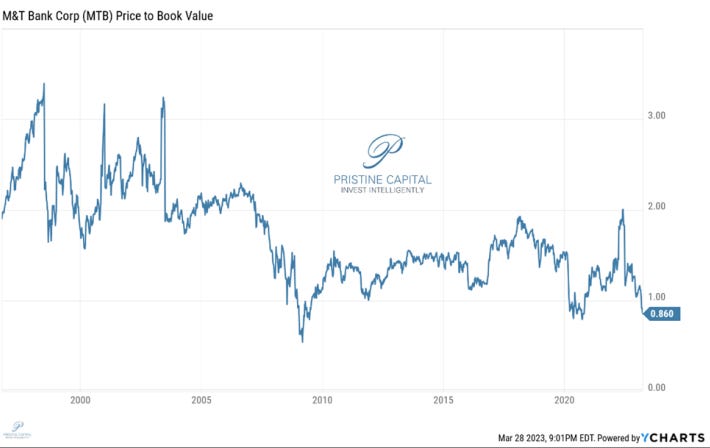

In our original thesis for this trade, we highlighted that MTB had minimal unrealized losses in its securities portfolio compared to its peers. Furthermore, the stock was trading at less than 1X book value when we entered the position! ☟

If you haven’t already, upgrade your membership for access to similar thematic trade ideas!

The Big Takeaway

In the last few days, I've listened to earnings calls from JPM, C, PNC, SCHW, and MTB, and my primary observation is that concerns about a banking crisis are greatly exaggerated for leading banks in the industry. While some banks may experience deposit outflows and suffer as a result, others will benefit. The fact that all banks, regardless of size, were sold off during the crisis highlights a clear market inefficiency. It's worth noting that some of the best investment opportunities arise during times of crisis when investors sell first and ask questions later.

Another important point to note is that every bank is preparing for a recession in the second half of the year. So, if you believe you're a genius because you foresee a recession, it's time to reconsider. The entire market is aware that a recession is impending.

10Yr Treasury Futures

With investors having realized that we avoided an economic catastrophe via strong bank earnings, the 10yr treasury sold off sharply. We must remember that treasuries benefited greatly from a flight-to-safety trade when the banking crisis emerged, so it’s only fair that they give back gains as we find out that the crisis may have been a bit overblown.

The Jaws…Are Back!

If you are a regular reader of our research, you’ll remember the jaws setup we discussed back in February! This setup occurs when treasuries sell off, but the duration sensitive Nasdaq QQQ ETF remains bid. This divergence tends to mean revert over time…more to come on this later.

Equity Dashboard

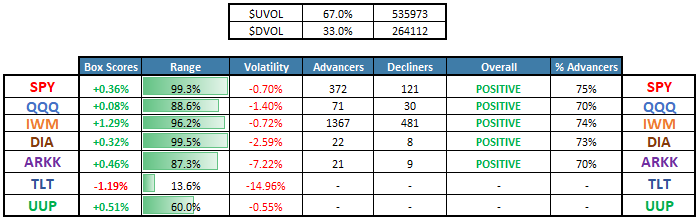

Equities finished positive on the day, with 67% advancers, and IWM small caps leading the charge! Small cap leadership tends to benefit active traders, as we tend to traffic in tickers other than megacap tech!

GOOG sold off on news that Samsung may potentially switch from Chrome to Bing as the default web browser on their phones.

ES_F S&P 500 Price Action Analysis

We’ve referenced this in plenty of recent research notes, but it is definitely important to keep the ~4,252 yearly value area high level on your screens as a logical upside target.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities