Pristine Market Analysis & Watchlist 3/20

Recession Incoming

Team,

Banks are blowing up and monetary authorities are firing bazookas. Remember…there are old traders, and there are bold traders, but there are no old, bold traders. Stay mentally flexible, and forgive yourself for not being perfect.

-Andrew

UBS agreed to purchase CS for pennies on the dollar this week. Banking crisis over? As much as we’d love to believe it is, these events are never resolved on a Tiktok timeframe! It’s great that the monetary authorities stepped in, but they likely did so because things are about to get ugly in the real economy. Check this out 👇

American’s giving up on the banking system is one of the most alarming things I’ve seen in recent years. With banks struggling to hold onto deposits, the US credit creation system will likely take a big hit, and with less credit comes big problems for real Americans in the real economy. We are likely headed for a significant recession, and with it, weak future earnings. But if this results in more liquidity for financial markets, can this end up being a good outcome for stocks? As perverse as it is to say it, we can’t rule it out. And we also can’t rule out more monetary intervention! Check out the story that just dropped on Bloomberg 👇

We are in a crisis of CONFIDENCE, and the fed knows it. The world changed drastically last week, and the market is still in the early stages of reacting to this new world. It’s important during this time to understand that one green candle does not mean that the market is going to new highs, and one red candle does not mean the world is ending. The market will likely reward the humble and adaptable traders, and punish those that are stubborn. Let’s take a look at today’s action and the setup into Fed Wednesday 👇

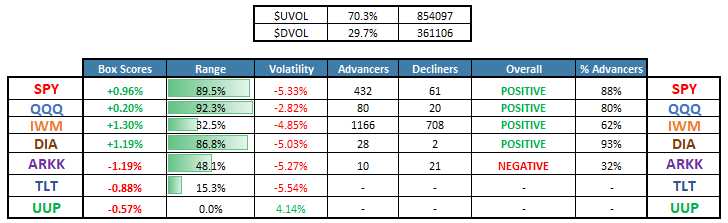

Equity Dashboard

Today was the first session in many where there were more advancing stocks than declining stocks. The chances of this being an oversold bounce vs the start of a meaningful trend change are about 50/50 as far as I can see.

ES_F S&P 500 Price Action Analysis

The S&P 500 had a violent shakeout in the overnight trading session, but finished above all of the short-term moving averages. Definitely a step in the right direction, but this can all change on a dime as a result of Fed Wednesday! So it is tough to make too much of this action.

Bond Rally

Fed fund futures are pricing in a 73.8% probability of a 25 basis point rate hike. So shall it be written, so shall it be done! The Fed ALWAYS does what has been priced in by the market, so 25 bps it is!

Markets are not going to move based on the Fed hiking 25 bps! They are going to move based on how Powell’s speech impacts probabilities of FUTURE policy moves!

The market is pricing in significant easing later this year…if Powell is firm in saying that the fed will not cut rates any time soon, that can present major problems for financial markets.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities