Pristine Market Analysis & Watchlist 6/5

Volatility crush! Now what?

Team,

From the ISM data, to the AAPL event, to an A+ trading setup, we have a lot to cover tonight. Let’s dive in!

-Andrew

Economic Data

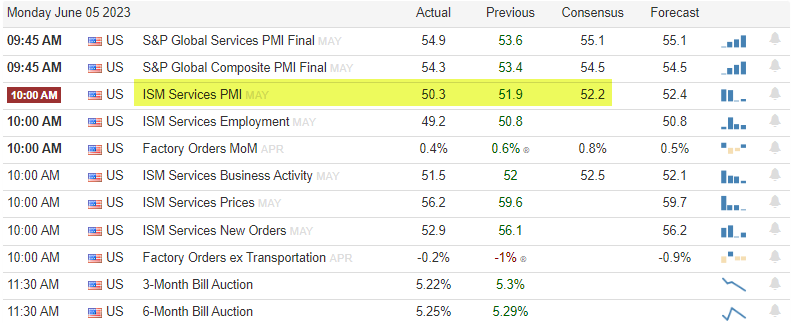

ISM Services data came in weaker than expected this morning:

Looking under the hood of this report, the services sector is clearly decelerating since the beginning of the year. While readings above 50 are expansionary, if this trend were to continue, a sub-50 reading next month would not be out of the ordinary. Combining this with the ISM manufacturing print of 46.9 last week, it is clear that the economy is decelerating.

I know a lot of investors are looking for an expansion of breadth in the stock market, but I can’t see cyclical stocks rallying as we head into a recession. It appears that if the market is to continue rallying, it will be on the back of the megacap tech stocks.

Equity Dashboard

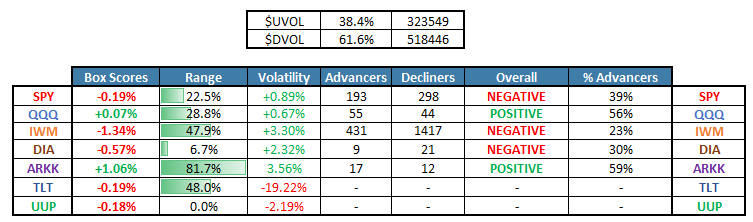

38.4% advancers and most indices closed toward the low end of their daily ranges. The ARKK innovation ETF was the standout, finishing in positive territory for the day.

Index Price Action

ES S&P 500 -.12% after hours (Above monthly value area)

NQ Nasdaq -.17% after hours (Above monthly value area)

RTY Russell 2000 -.10% after hours (Above monthly value area)

YM Dow Jones -.09% after hours (Inside monthly value area)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities