Pristine Market Analysis & Watchlist 6/7

Healthy Rotation to Small Caps? Or a Pairs Trade Blowup?

Team,

Did long QQQ short IWM traders blow up today? Let’s piece this puzzle together.

-Andrew

Today’s fierce rotation from leaders to laggards began in Asia, where the Nikkei 225 bearish engulfed it’s prior two days of price action. The Nikkei has been one of the most high momentum indices around the globe this year, so it was not a shock that we saw profit-taking in high momentum US stocks as well.

Equity Dashboard

This is where things get weird…we finished the session with 70.7% advancers, but the megacap tech stocks that most investors are now overweight sold off sharply.

Now, I know what you are thinking…market breadth was so weak…it is a good thing that money is rotating from megacaps to small caps! While that often times is the correct way to think about these things, I don’t believe that is the case in this particular instance. Given the extent to which the Nasdaq QQQ had been outperforming the IWM small caps this year, it is clear to me that being long QQQ vs short IWM had become a crowded trade. It makes a ton of sense, right? We suffered from the regional banking crisis in March, which hamstrung the IWM, and the AI theme bolstered the QQQ. This pairs trade has been a layup for months.

But now look how quickly the IWM has advanced in just 5 trading sessions vs QQQ! Is +7.75% in five trading sessions healthy rotation? Or is it a violent reversal of a crowded trade. I believe the latter.

The IWM has been riding the 3 standard deviation bollinger band, which is not typical in a healthy uptrend. This appears to be a violent squeeze! Applying simple logic, do you really think investors are going out of their way to establish bullish positions in regional banks that are hitting overbot conditions, when everyone knows that a recession is highly likely to hit in the next 12 months. Probably not. Today’s action was likely driven by the unwind of a crowded pairs trade.

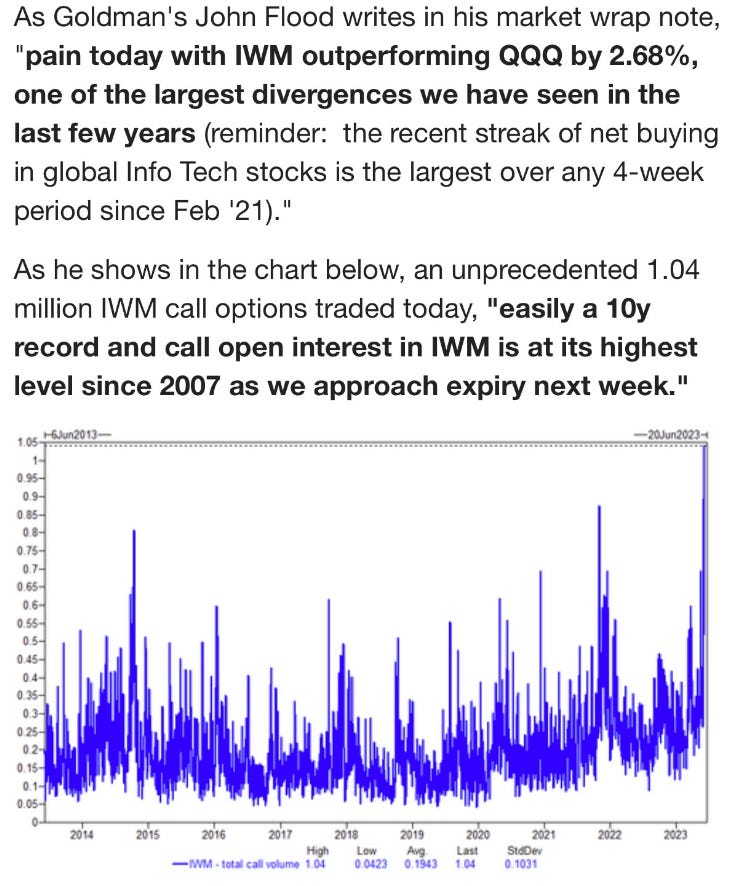

Record Call Volume

And the highest IWM call volume since 2007 certainly helps!

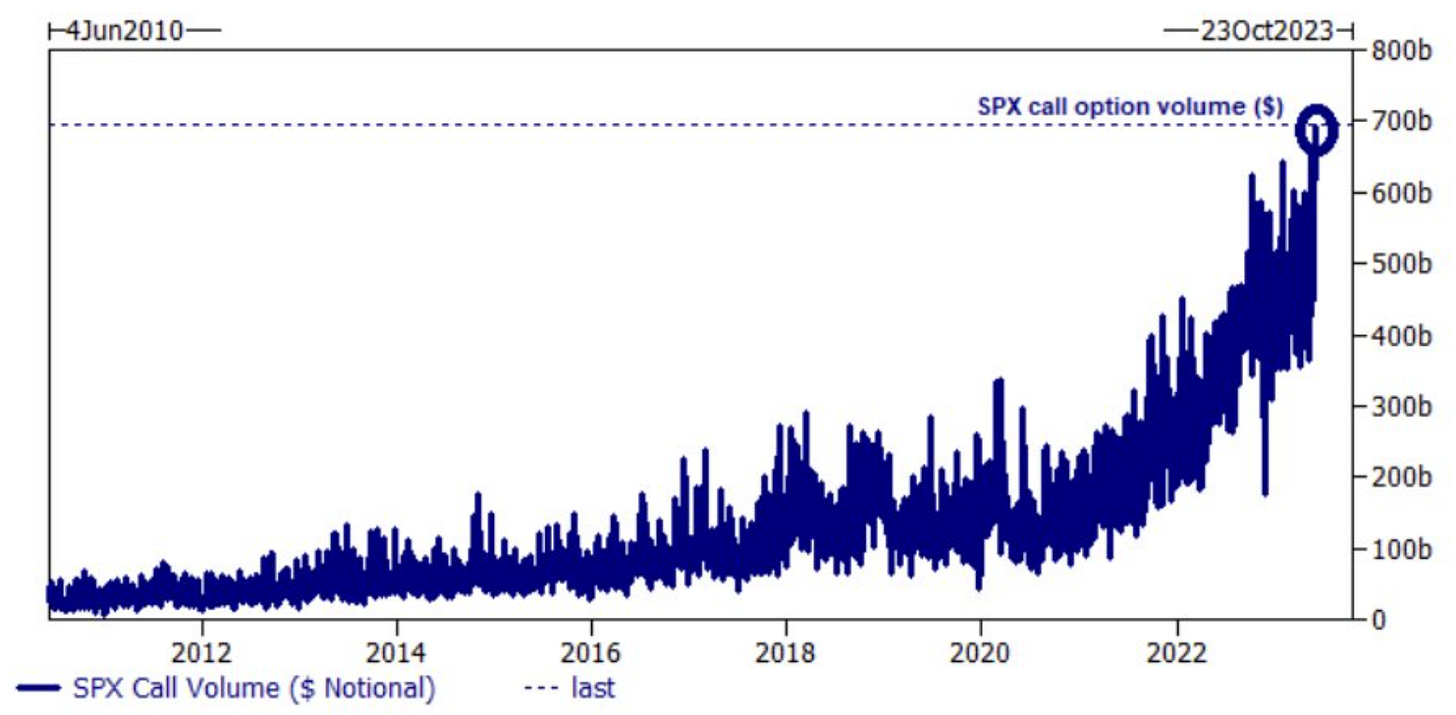

Don’t forget, we also recently celebrated the highest SPX call volume on record! Players are getting carried away with leveraged upside, so it makes sense that we would see violent moves in markets that cut both ways!

Index Price Action

ES S&P 500 +.01% after hours (Above monthly value area)

NQ Nasdaq +.01% after hours (Above monthly value area)

RTY Russell 2000 +.19% after hours (Above monthly value area)

YM Dow Jones -.04% after hours (Inside monthly value area)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities