Pristine Market Analysis & Watchlist 10/12

Hot CPI, Cold Market Breadth

Team,

CPI created a tough environment for stocks today. Let’s take a look under the hood and assess the damage.

-Andrew

News/Economic Data

CPI MoM +.4% vs +.3% est

Hotter than expected 🔥

On a YoY basis, CPI moved sideways, and core CPI made downward progress 👇

FX Market

The dollar index put in an extended range green candle and reasserted itself back inside the bullish trend channel. This is BEARISH for risk assets.

Long-Term Treasuries

The good news…treasuries are putting in a green weekly candle

The bad news…treasuries gave back almost all of the weekly gains in one session 👇

Energy

Geopolitical tensions are flaring, but you’d never know looking at this crude oil chart.

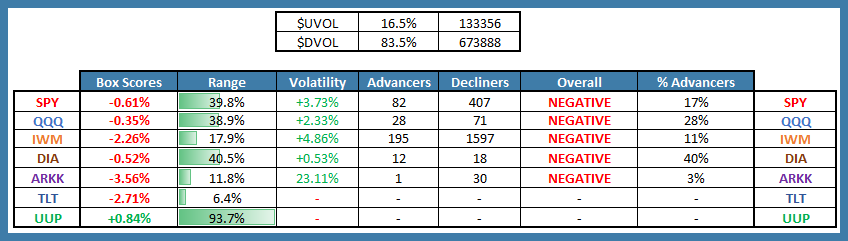

Equity Dashboard

Equities finished with 16.5% advancers. We are all too familiar with the below configuration…when the macro picture gets tough…dump small caps and crowd into megacap tech.

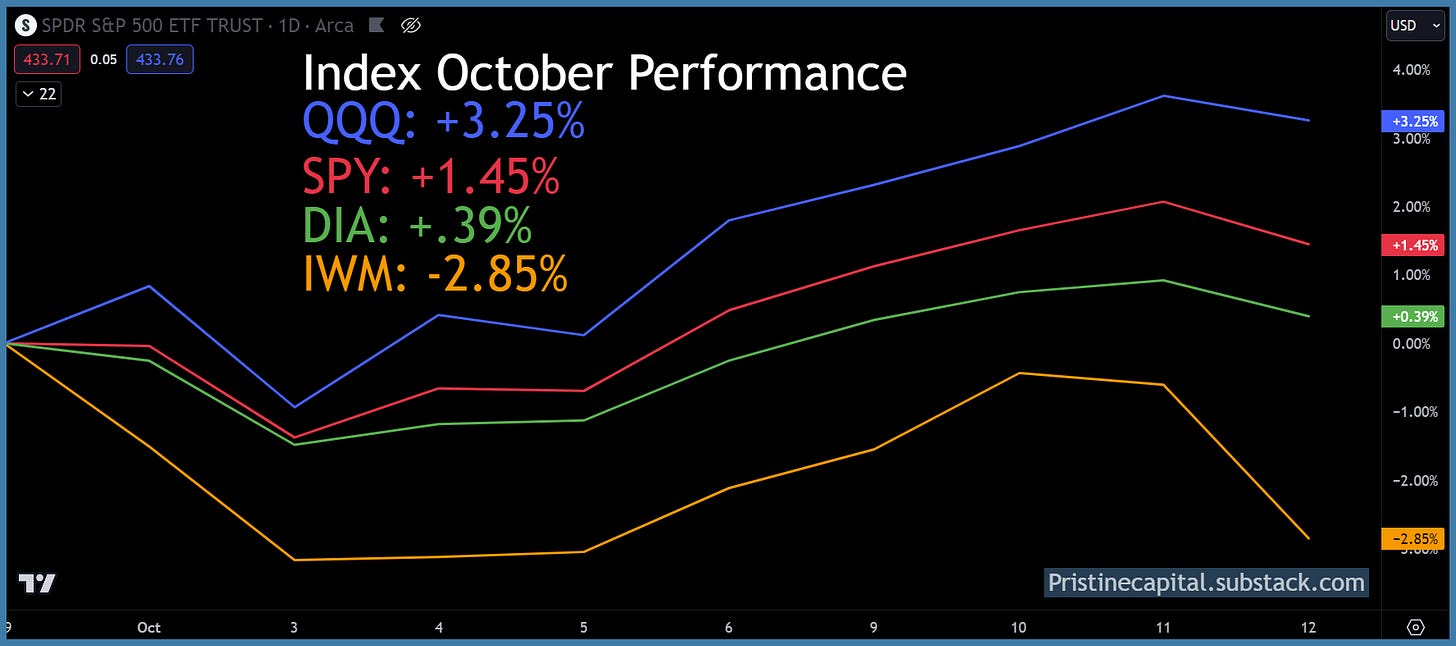

Equity Index October Performance

On a month-to-date basis, megacap tech is doing well, but not much else.

Index Price Cycle Monitor

ES S&P 500 - Testing 20-day SMA & inside monthly value area

NQ Nasdaq - ABOVE 20-day SMA & inside monthly value area

RTY Russell 2000 - BELOW 20-day SMA & BELOW monthly value area

YM Dow Jones - BELOW 20-day SMA and inside monthly value area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities