Pristine Market Analysis & Watchlist 9/13

CPI Aftermath

Team,

Congratulations. If you are reading this, that means you survived the CPI report! Let’s dive deep under the hood of the market to see what, if anything, has changed.

-Andrew

Economic Data

The highly anticipated CPI report came out largely in-line with expectations.

The YoY CPI increased from 3.2% to 3.7% and YoY Core CPI decreased from 4.7% to 4.4%.

But more important than the data itself, is how the market reacted. Let’s take a look 👇

FX Market

The dollar index remains in its bullish trend channel and put in a green candle.

Bonds

The bond reaction was the biggest signal out of a sea of noise. Think about it…we just witnessed the second consecutive month of inflation accelerating….but long-term treasuries put in long lower wicks and finished with green candles! If bonds are failing to move lower on accelerating inflation data, what will they do next month if inflation decelerates? My bias for long-term bonds remains to the upside given this reaction.

Equity Dashboard

Equities finished mixed, with only 37% advancers on the session. There is a small group of megacap tech stocks that investors are piling into as a flight-to-safety, but market participants are exiting almost every other area of the market as evidenced by the IWM small cap weakness.

Equity Index MTD September Performance

All indices are in negative territory for September.

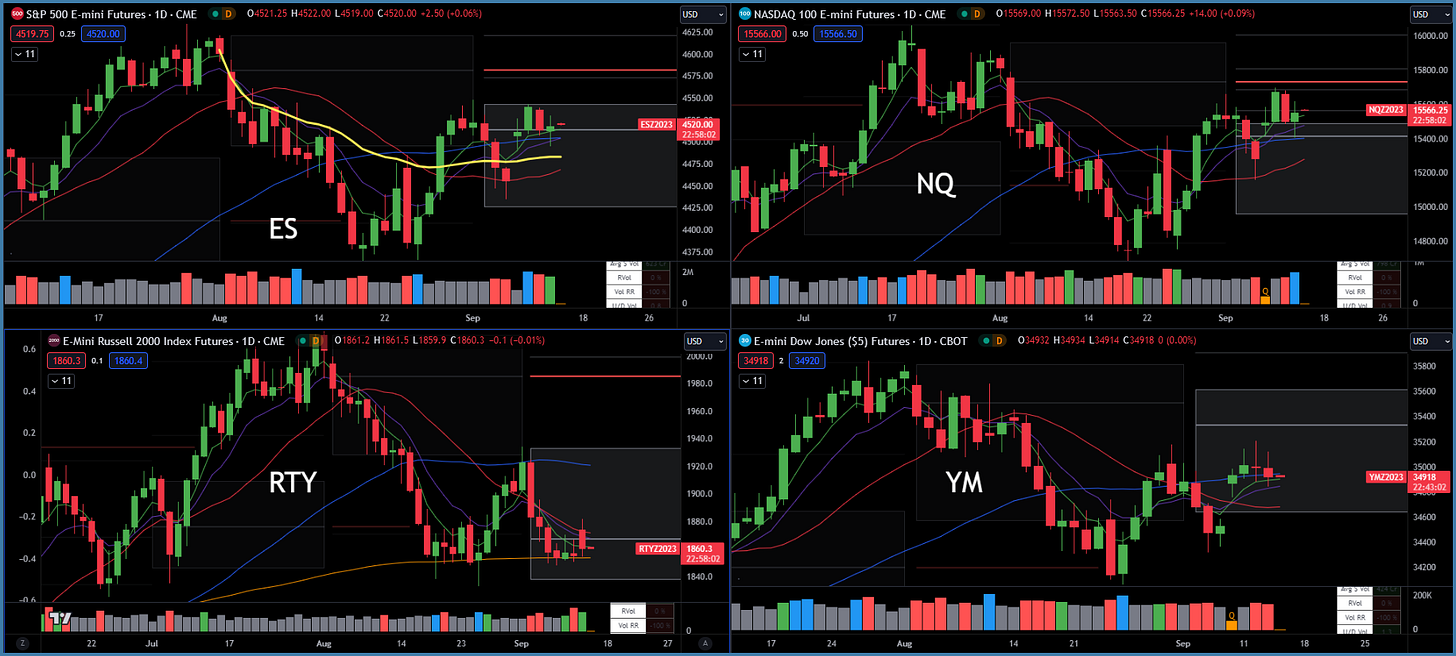

Index Price Cycle Monitor

ES S&P 500 - Above key moving averages and above monthly point of control

NQ Nasdaq - Above key moving averages and above monthly value area high

RTY Russell 2000 - Consolidating at the 200-day SMA

YM Dow Jones - Above key moving averages and inside monthly value area

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities