Pristine Market Analysis & Watchlist 2/22

NVDA Saves the Day?

Team,

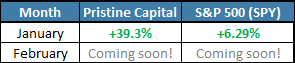

The January US Investing Championship results are out! We put up a +39.3% return in the first month, and made it onto the leaderboard. Our goal for the contest is to run at our own pace, and focus on what we can control, which is our own portfolio, not anyone else’s. I have no doubt that if we continue to prioritize risk control, we will nail down a decent return.

We’ve discussed in these nightly letters and in Discord, that the performance year is like a 12 inning game of poker. We are in the fortunate position to have racked up quite a few chips early on. For this reason, we can be MORE SELECTIVE, take FEWER TRADES, and sit out when the environment is uncertain. Through the magic of compounding, smaller base hit returns can still be meaningful, because they are being generated off a higher capital base.

Thanks for taking part in this marathon with us. We hope that you also have your best year yet, and that by navigating the market together, we all achieve a better outcome than had we taken this journey alone.

We said 2023 was going to be our year, and we meant it👊

https://financial-competitions.com/

-Andrew

Economic Data

All eyes were on the Fed minutes today, which ended up being insignificant. Global asset markets are already in the process of repricing for a more hawkish fed, and the minutes simply confirmed what they already knew. With this said, I’d like to point out that German and Italian inflation data will be released overnight. I won’t be shocked if global markets make a move in reaction to this data.

As I write this evening note, I’m drinking a coffee, that way I can stay up all night and watch the ES futures react to the European inflation data.

I’m kidding😂 Even I’m not that crazy… Or am I? I digress.

Equity Dashboard

Following multiple sessions of hard selling, equities found their footing and finished…mixed. Breadth was split evenly with 50% advancers and 50% decliners.

SPY Price Action Analysis

The S&P 500 topped on Feb 2nd, and has been stair-stepping lower in a narrow channel ever since. We tested the 50-day SMA today and the bottom of the trend channel! The short-term trend is down, but the risk/reward of shorting the bottom of a trend channel is not great.

Heading into the week, the options market implied a 2/28 SPY close between 398.24 and 415.76. Well guess what? We are already trading down to the market implied downside target with four trading sessions left to spare.

NVDA Earnings

Can NVDA bail out the underwater longs tomorrow? The company put up a better-than-expected earnings report after hours:

But the company still put big YoY declines in sales and EPS.

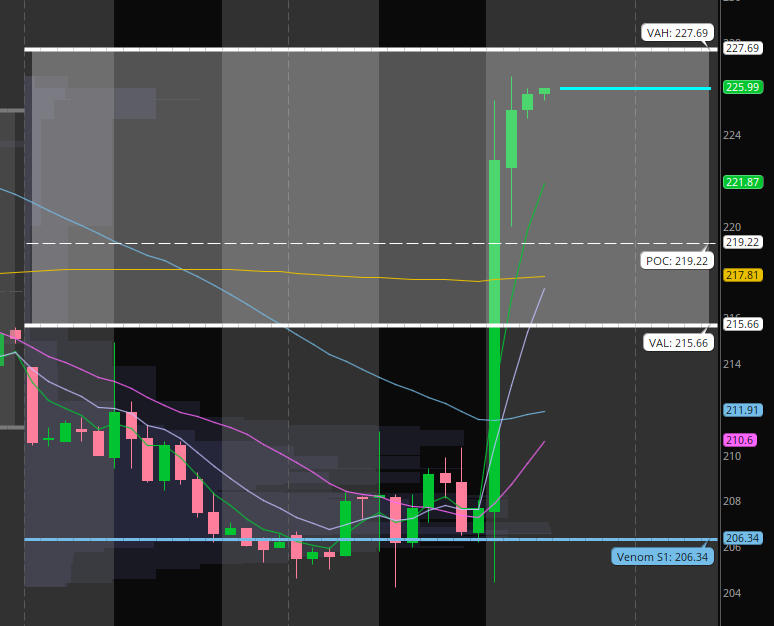

The market maker implied move was +/- 6.3%, with an upside target of ~$221.60, and the stock is currently trading at ~$225 after hours. I wouldn’t be surprised if this name opens toward the highs of the day, but keeping an open mind.

Beware the Jaws

While it’s tough to believe that the market could have more room to fall after the recent selling, the jaws setup between the Nasdaq and the 10yr treasury futures contract is still in play! A convergence here implies further downside for technology stocks.

So what’s the plan?

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities