Pristine Market Analysis & Watchlist 4/4

Trading Through a Recession

Team,

Below is my plan for surviving this crazy market! Hope you enjoy!

-Andrew

Today’s trading session kicked off with the following employment data

Combining these low job openings with yesterday’s weak ISM manufacturing data, it’s not shocking to see that asset markets are pricing in a higher probability of recession by the day!

DXY Dollar Index

The dollar index broke down and is testing the February lows. Over the past two years, the dollar has moved in tandem with the US monetary cycle. It ripped higher last year on the prospect of future rate hikes, and is now falling on the prospect of…

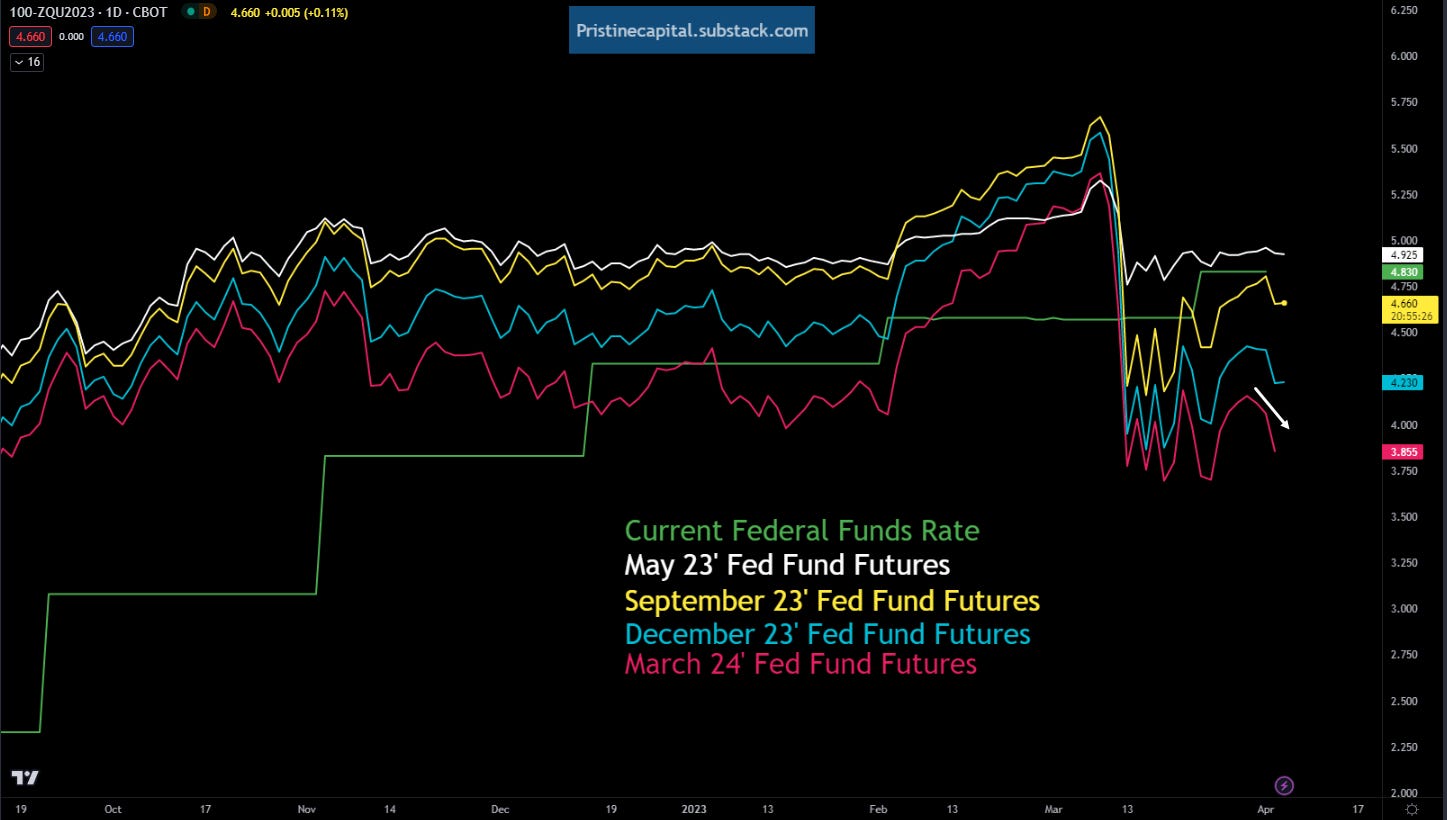

Rate Cuts?

The fed fund futures are in free-fall! It appears that the market is gaining conviction that the recession is fast approaching, and that the fed will be forced to cut interest rates to combat it.

Is a recession bullish for the market?

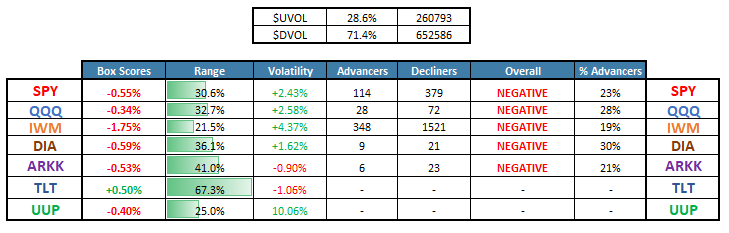

Equity Dashboard

It is clear via our dashboard that the prospect of recession is creating sell pressure in the more economically sensitive IWM small caps, and relative strength in the Nasdaq QQQ:

SPY S&P 500 Price Action Analysis

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities