Pristine Market Analysis & Watchlist 4/18

Taking some 'Chips' Off The Table

Team,

I have a lot to share with you tonight, including a unique, A+ short setup. Before we get started, be sure to drop a comment on the following tweet if you’ve been getting value out of these daily letters and would like to see me present at the Traderlion trading conference. Any support will increase the chances that they choose me as a speaker! Thank you!

https://twitter.com/RichardMoglen/status/1648351617211830272?s=20

-Andrew

Equity Dashboard

Today’s session finished with 51.6% advancers, and not a whole lot of movement at the headline index level. With this said, we did see some dynamism under the hood in specific groups, and we caught a nice breakout trade in HIMS!

Fed Fund Futures

Fed fund futures continue to move higher as market participants price in a lower probability of immediate economic catastrophe. It is worth continuing to monitor these movements, because the market is still pricing in at least one rate CUT into year end. If the market is forced to quickly price out all rate cuts, that could create ripples in equities.

NFLX Earnings

NFLX put up the following numbers after the bell:

Netflix Q1 EPS $2.88 Beats $2.86 Estimate, Sales $8.16B Miss $8.18B Estimate

After trading down to as low as $292.00 in after hours, the company recovered all losses and is now sitting at ~$333.25. The buy-the-dip mentality lives on!

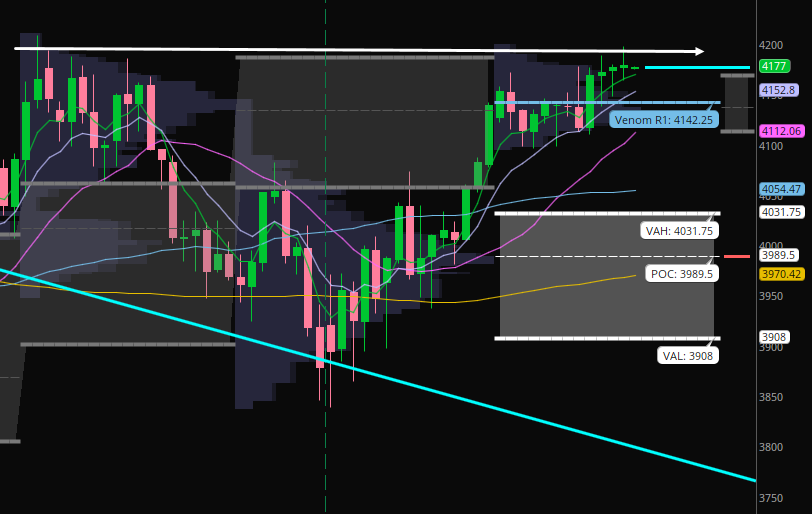

ES_F S&P 500 Price Action Analysis

With the NFLX recovery in place, the S&P 500 lives to fight another day! Sorry bears.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities