Pristine Market Analysis & Watchlist 8/23

Bonds Soar! NVDA Beats!

Team,

The market landscape is shifting team! Let’s unpack what is happening and how to react to the NVDA earnings report.

-Andrew

Economic Data

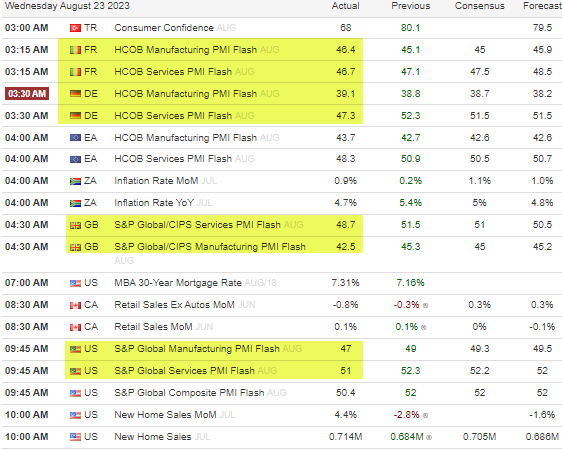

Today’s session kicked off with weak PMI data (sub 50 represents an economic contraction) out of France, Germany, and the UK, followed by below expectations flash PMI’s out of the United States

Treasuries

This ignited an epic rally in US treasuries! If you are a premium subscriber, you know that we were positioned for this bottom in treasuries, given our work on the inflation backdrop, growth backdrop, and our technical analysis.

The MOVE index fell back inside the downward trend channel!

FX

The dollar index put in a long upper wick, which is an encouraging sign.

Equity Dashboard

Against the backdrop of weak economic data releases and bonds bid, equities rallied, and the most duration sensitive indices QQQ ARKK led the charge.

Equity Index MTD August Performance

The Equity Indices remain in a pullback for August, albeit a smaller one than a few days ago.

Index After Hours Price Action

ES S&P 500 +.52% - Retesting the 50 and 20 day SMA’s from below

NQ Nasdaq +.92% - Retesting the 50 day SMA from below

YM Dow Jones +.03% - Below the 50 day SMA

RTY Russell 2000 +.12% - Basing at the 200 day SMA

Okay…let’s dig into these NVDA earnings and how they might impact the market ahead of Jackson Hole….

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities