Pristine Market Analysis & Watchlist 6/13

Flying into Fed Wednesday

Team,

The market just completely ripped into Fed Wednesday. What could possibly go wrong?

-Andrew

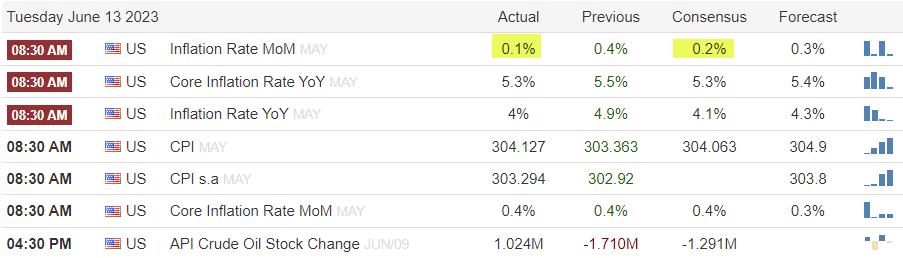

Economic Data

Today’s session kicked off with CPI data that came in lighter than expected:

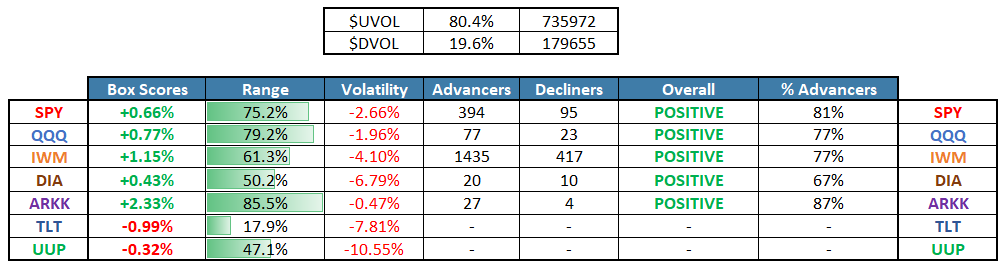

Equity Dashboard

Equities rallied once again, with IWM small caps and ARKK innovation stocks leading the pack. TLT US long-term treasuries still can’t catch a bid!

TSLA put in its 13th consecutive green session! This is completely unprecedented.

US Treasuries

I am shocked at how weak US treasuries were today considering the light CPI print. 10yr treasury futures put in an ugly red candle and closed on the lows!

Jaws!

The jaws setup expanded as QQQ technology traded higher while ZN_F 10yr treasury futures sold off. These jaws are going to snap soon, and investors will claim that no one could have ever seen this coming. All of the evidence is in plan sight.

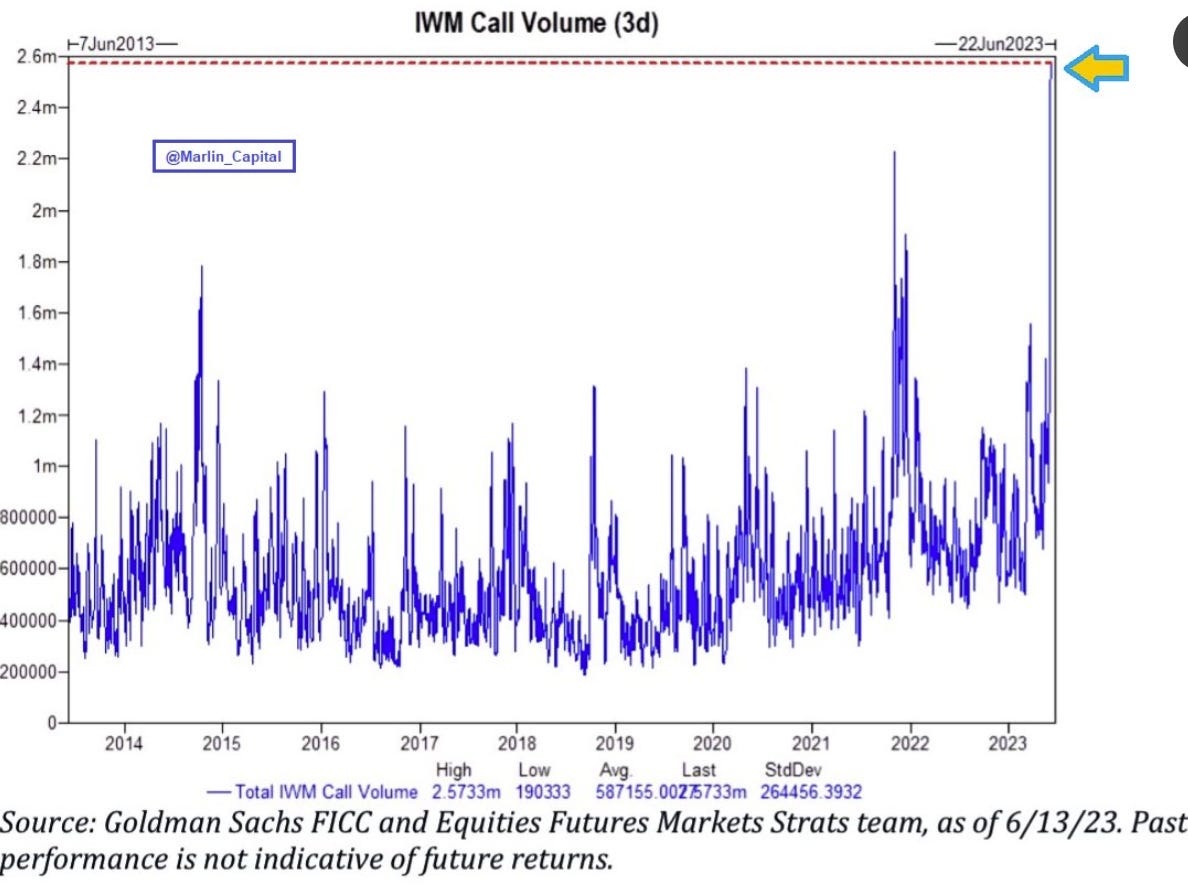

Record Call Volume

We are witnessing record call buying and speculation on an almost daily basis

.

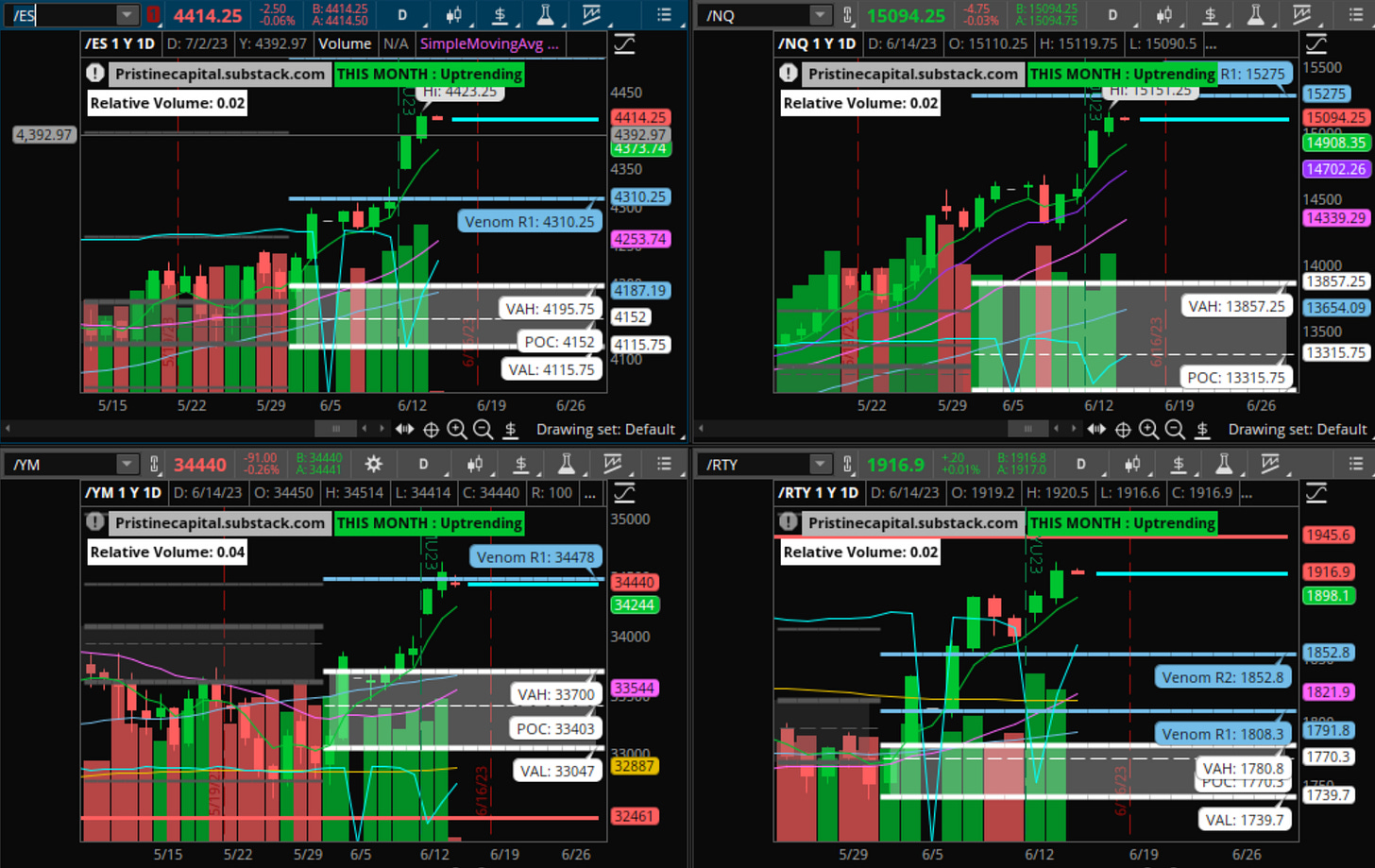

Index Price Action

ES S&P 500 -.06% after hours (Above monthly value area)

NQ Nasdaq -.03% after hours (Above monthly value area)

RTY Russell 2000 +.01% after hours (Above monthly value area)

YM Dow Jones -.26% after hours (Above monthly value area)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities