Pristine Market Analysis & Watchlist 5/18

The one blow-off... to rule them all

Team,

Are we in a blow-off top? Is the debt ceiling going to pass or fail? Are we going to retest the lows? Who cares. Let’s keep flowing with the action and give it our best. No trader left behind!

-Andrew

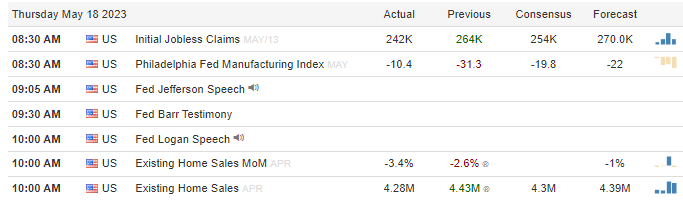

Economic Data

Today’s session kicked off with lighter than expected initial jobless claims:

Treasury Action

10Yr

ZN_F 10yr treasury futures finished in negative territory again! Today marked the fifth consecutive session of selling in the long end of the curve.

Over the past year or so since the inflation spike occurred, treasuries and the equities have shared a pretty tight correlation. That correlation has broken down recently, as equities had a strong day of positive movement.

Equity Dashboard

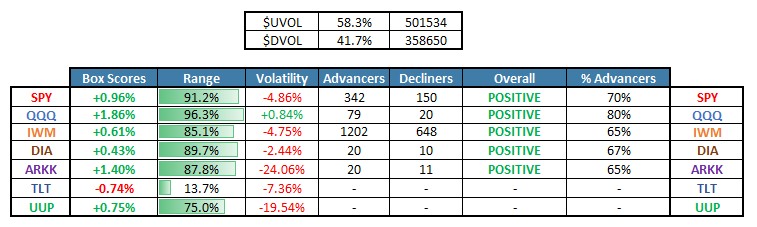

Wow! I was expecting to see 80% or more advancers, but today only had 58.3%. It felt much more uniform than it actually was. The key driver of today’s rally was the growth style factor, which had an excellent day. The UUP dollar index also ripped to the upside, which is unusual for a day where the headline indices finish so strong.

NVDA was today’s top megacap mover:

May Index Performance

The S&P 500 joined the Nasdaq and Russell 2000 and entered positive territory today.

Index Price Action

The ES broke out from the monthly value area and closed above it. The NQ Nasdaq blew through the R2 pivot and also finished on the highs. The YM Dow Jones and RTY Russell 2000 are a bit further behind in the price cycle, but they both made progress. Bitcoin and treasuries remain in downtrends.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities