Pristine Market Analysis & Watchlist 3/28

The Fat Pitch is Coming

Team,

Three more days till quarter end. The economy is DEFINITELY heading into a recession. The market must go go down. The next shoe to drop is commercial real estate!

I can’t get long. Must be short.

But wait, the market is failing to move lower…there’s a few stocks that are breaking out! What if this is the bottom and I’m missing the turn. The fed is going QE now!!! I need to ADD exposure.

As you can see, there’s plenty of ways to look at this market. Let’s take a deep dive through the lens of market generated information.

-Andrew

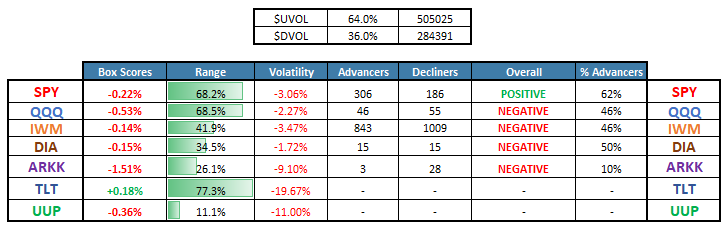

Equity Dashboard

As the banking crisis earlier this month unfolded, we saw a rotation out of all things value and economically sensitive (IWM DIA) and into growth (QQQ ARKK). Since the announcement that a buyer for SIVB was announced this Sunday, we’ve seen mean reversion in that trend. With that trend, comes better breadth, which we saw today in the form of 64% advancers. It is tough to say if this better breadth means investors are actually allocating to new areas of the market, or if its just mean reversion of the crisis flight-to-safety trade.

ES_F S&P 500 Price Action Analysis

The ES failed to break back into the monthly value area two weeks ago…bearish! But then it failed to break down below the 200-day SMA…bullish! But then it failed to reclaim the 50-day SMA…bearish! But then it failed to break down below the 20-day SMA…bullish! If I were to tell you that I’m highly convicted in which direction the market is going to resolve…I’d be lying! The price action is not giving us much signal into quarter end.

Let’s continue the discussion below. Goodnight free subscribers!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities