Pristine Market Analysis & Watchlist 5/24

Covering Shorts..USIC Update!

Team,

Our official results are out for the US Investing Championship! We finished April with a +65% YTD return, which puts us in 2nd place for the division, and 5th place overall!

If you are reading this, you are one of my battle buddies, and I truly appreciate your support. Trading is a such a tough game, but I believe that we can all help each other get better and progress. Let’s keep doing the daily work, remain lost in our process, and give it our best. Everything else will fall into place.

-Andrew

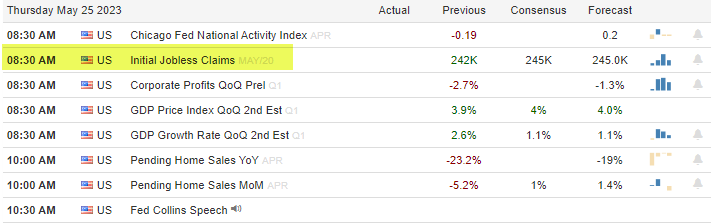

Economic Data

The FOMC minutes came out at 2pm today. My main take away was that the fed reiterated they are not interested in cutting rates at this time.

Initial jobless claims will come out tomorrow morning at 8:30 AM. These weekly numbers have been scrutinized by market participants that are hoping and praying for weakness in the labor market, so that the fed can get back to being stimulative! I expect the same for tomorrow’s print.

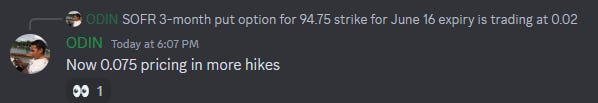

Fed Fund Futures

Future rate hike expectations have been shifting over the past few weeks. Look at the September contract moving up above the current fed funds rate!

As called out by our very own Odin in Discord:

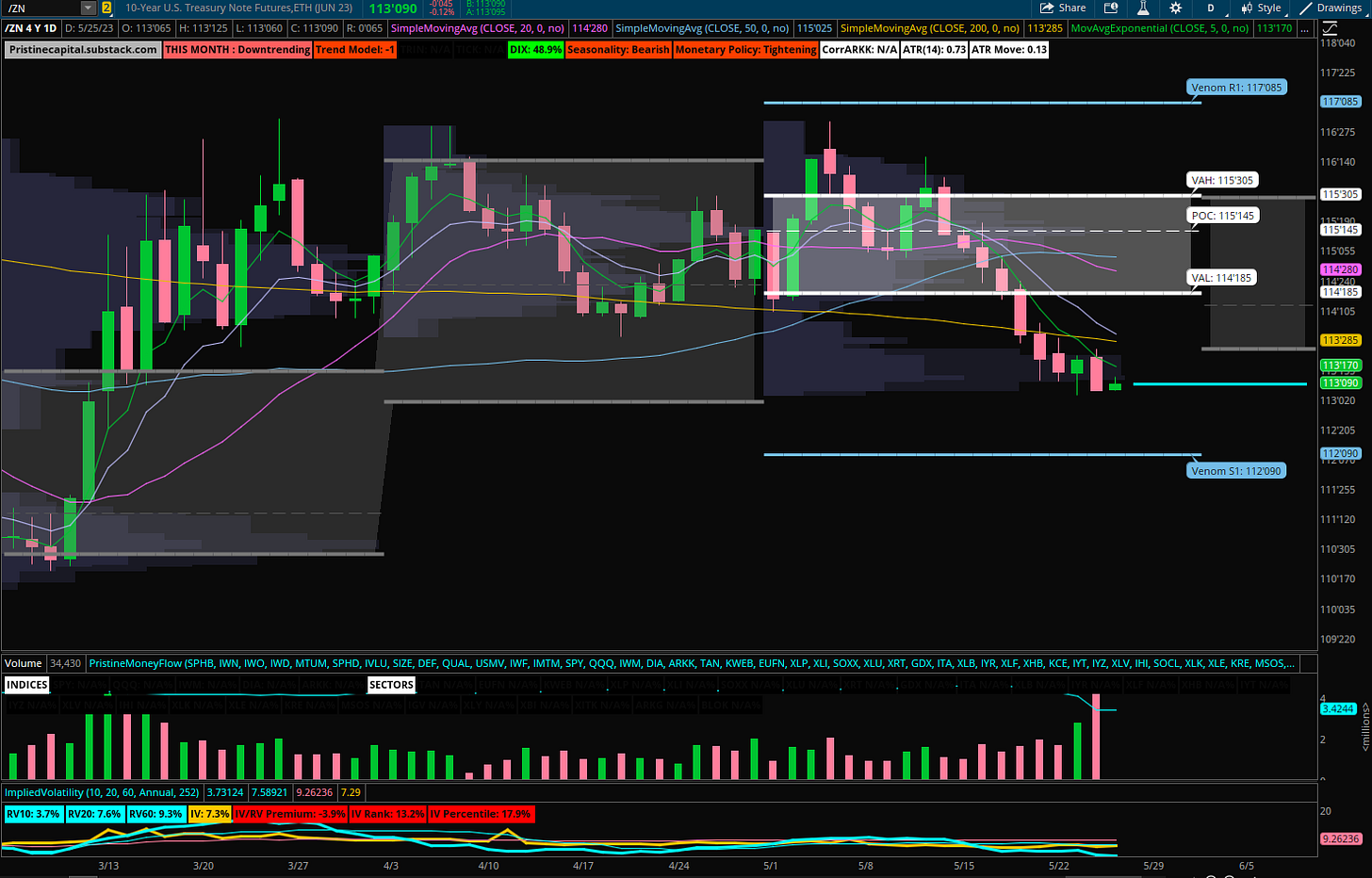

10Yr Treasury

ZN_F 10yr treasury futures are struggling to hold a bid as investors worry over a potential US debt default:

Equity Dashboard

Equities washed out today, with only 21.8% advancers and rising volatility across all equity indices:

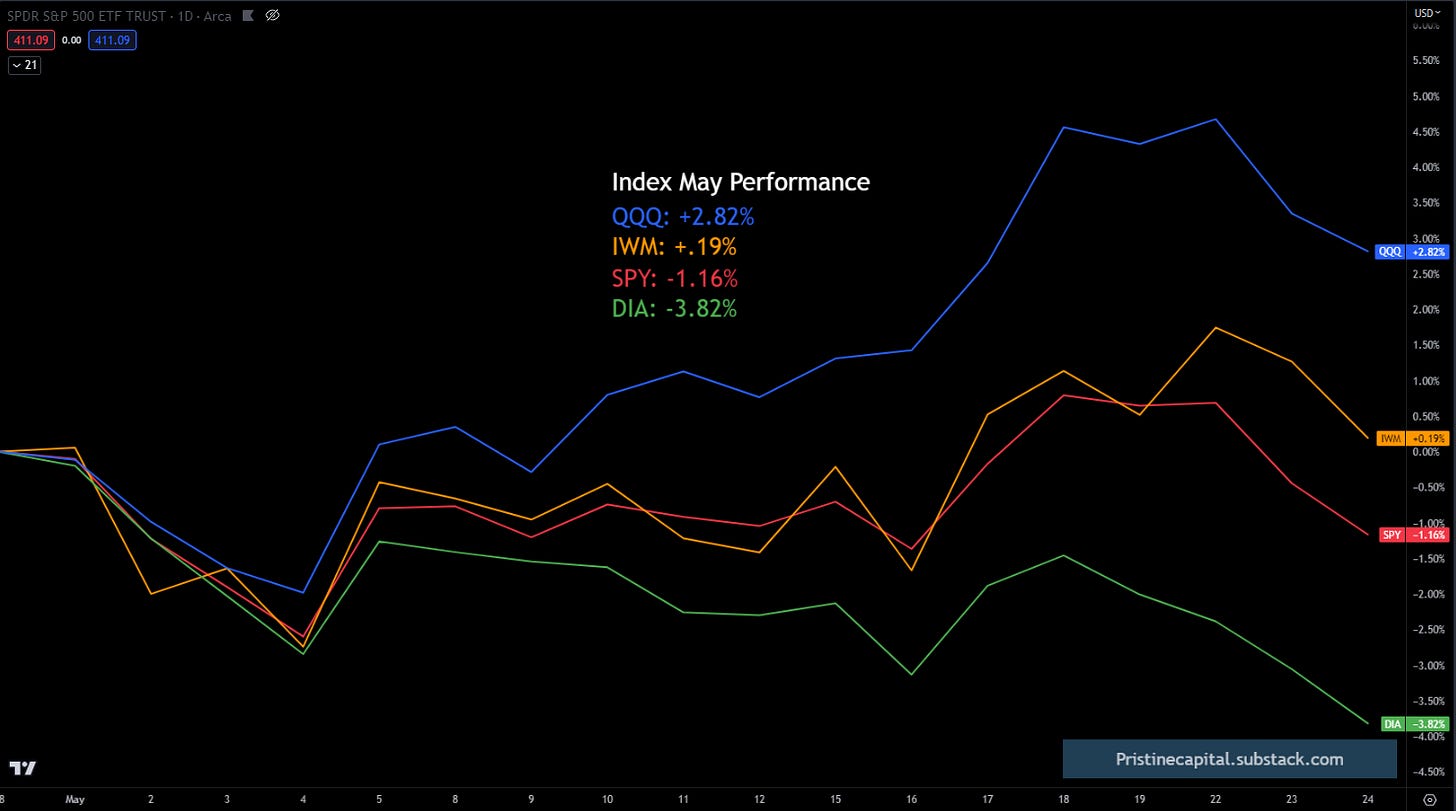

May Index Performance

SPY is back in negative territory for the month.

NVDA Earnings

NVDA reported the following earnings after the bell, which completely changed the tone of the market! When investors get jolted like this, it can provide great opportunities to capitalize on!

The big surprise here is the ‘24 revenue outlook. $11BB vs a $7.15BB estimate is a 53.8% guidance raise. Huge!

Index Price Action

ES S&P 500 +.43% after hours (Inside monthly value area)

NQ Nasdaq +1.42% after hours (Above monthly value area)

RTY Russell 2000 -.20% after hours (Testing bottom of monthly value area)

YM Dow Jones -.20% after hours (Below monthly value area)

ARKK Innovation (Testing top of monthly value area)

Bitcoin +.06% after hours (Below monthly value area)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities