Pristine Market Analysis & Watchlist 12.7

📈GOOGL and AMD Emerge as new AI leaders?

Headline equity indices reclaim key moving averages

AMD & GOOGL lead the market on positive AI developments

Team,

NFP report incoming tomorrow at 8:30 AM ET. Buckle up! HAGE🍻

-Andrew

News/Economic Data

Today’s jobs data was mixed, and used car prices fell 👇

Tomorrow’s jobs report will be one for the legend books given how much economic weakness has already been priced into global asset markets. A HIGHER than expected jobs print showing that the economy is not as weak as everyone thought is the likely worst case scenario (as perverse as it is to say that).

Consensus is for 180k new jobs created👇

Treasuries

A light job’s report tomorrow could send the TLT to the upside, and vice versa if the data is strong. At this point, a lot of economic slowdown has been priced in very quickly. The next upside VPOC for TLT is +6.38% higher at $101.40.👇

FX Market

The dollar index failed at the 20-day SMA.

Energy

Crude oil is now trading below $70/barrel and all of the gains since June are gone. At what point does the Biden administration see this as an opportunity to reload the Strategic Petroleum Reserve (SPR)? Looks like a good opportunity.

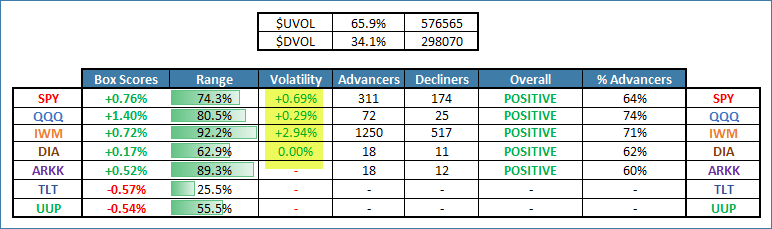

Equity Dashboard

The indices bounced back in textbook holiday season fashion. The only thing that was a bit odd…volatility increased👇

GOOGL outperformance on news of their new Gemini AI platform

Index Price Cycle Monitor

Equity indices reclaimed their respective key moving averages.

Index Performance Monthly

Four out of four tracked indices are in positive territory for the month👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - Our trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities