Pristine Market Analysis & Watchlist - 1/19

Covering Shorts

Good evening everyone,

The beginning of the 23’ has been an absolute roller coaster ride, with plenty of opportunities on both the long and short side.

With so many big moves, it is easy to get hot and bothered by the price action, but remember, we are still in the first of 12 innings this year. Pace yourself! We are all going to make it 👊

-Andrew

Equity Dashboard

Equities indices pulled back, but we did not get much in the way of a volatility spike. And Nasdaq volatility contracted!

31.4% UVOL - Improvement from yesterday, but still weak

Finviz Heatmap

Megacap tech held the index up! This is definitely a change of character within the index. We also can’t ignore that energy stocks were the best group! That is not conducive to an outlook that inflation is completely in the rear-view mirror:

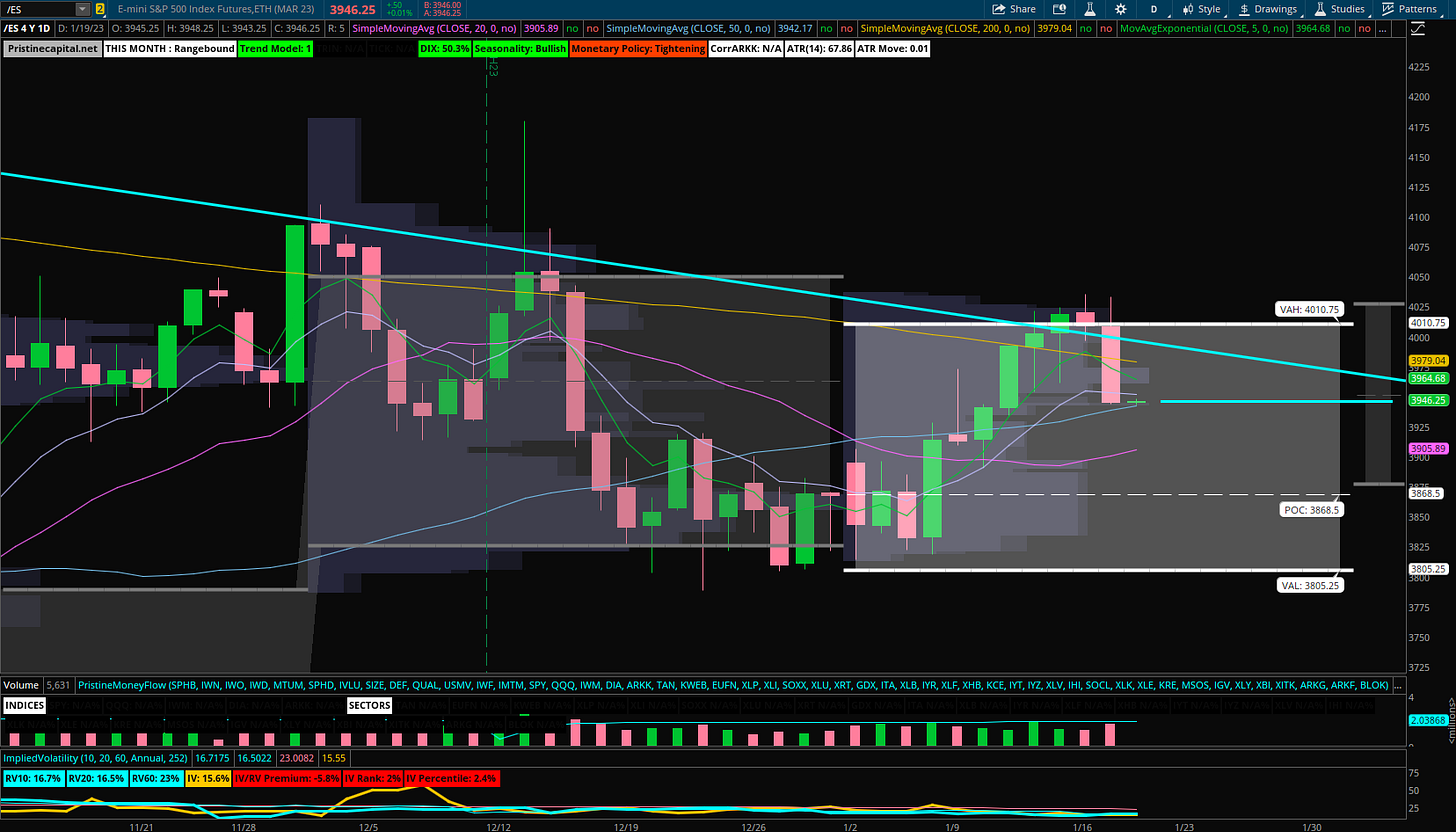

S&P 500 ES_F Price Analysis

The S&P 500 continued it’s weakness from the prior session and finished -.73%. I don’t think many realize what a slippery slope this is from a technical perspective. We’ve rejected the teal downward trendline and are putting in a bearish engulfing weekly candle! If we fail to hold the yearly POC of ~3921.5, we have to be open-minded to testing the yearly VAL of ~3678.25 at some point in 23’:

S&P 500 ES_F Falling Back Into Value?

We sliced through the 50-day SMA overnight like a knife through butter, and found buyers at the 20-day SMA. There was a strong wave of buying in the back half of the session, but it was unable to follow through and flip us green. Here is what we know so far:

The majority of longs from last week are under water

There is a fed meeting Feb 1st, and investors are likely to become more gun-shy the closer we get to the meeting. The highs of January are likely in

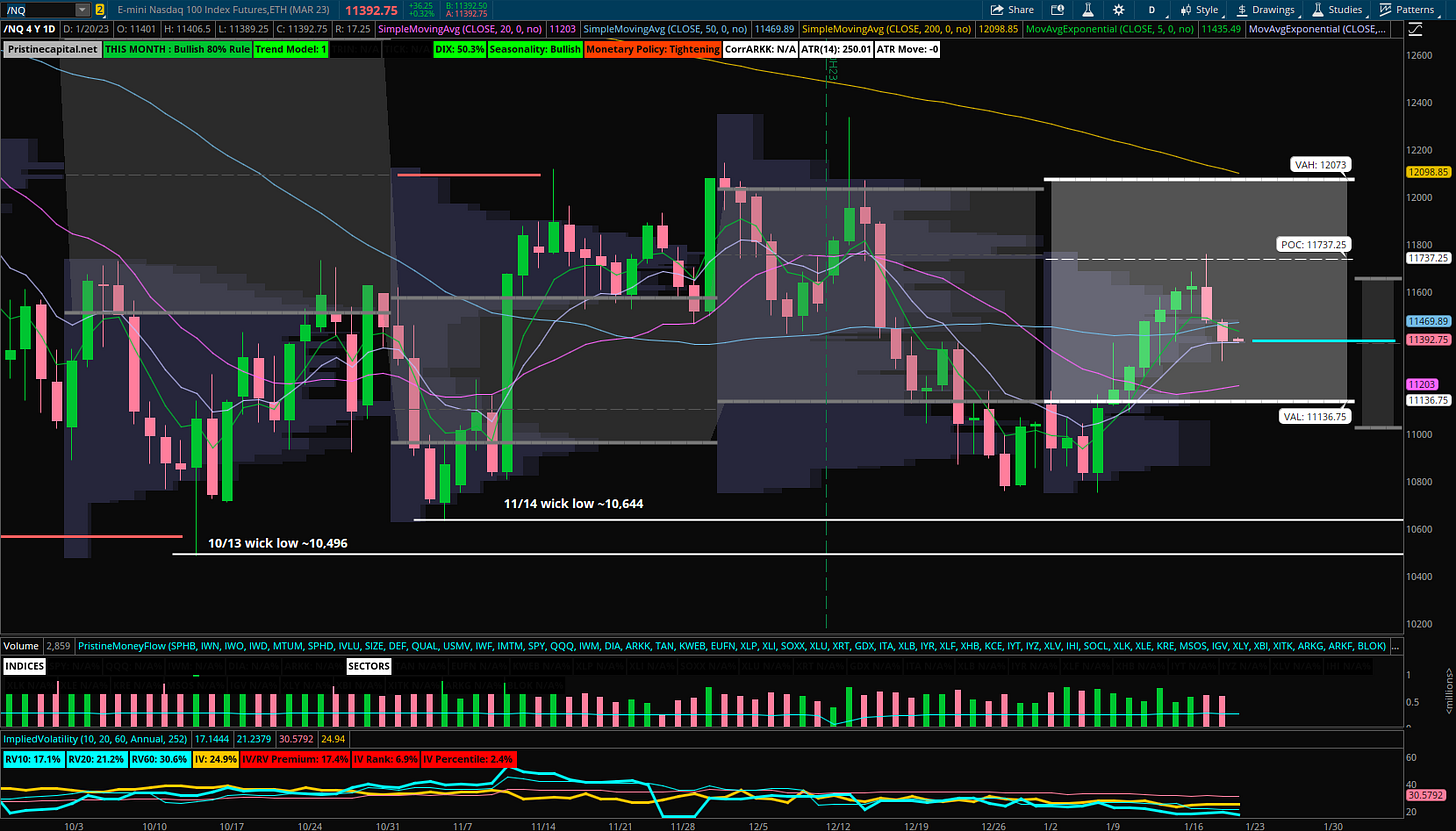

Nasdaq NQ_F Price Action Analysis

The Nasdaq pulled back -.98% and found support at the 10-day EMA:

NFLX reported earnings after the bell and is trading +7% in the after hours. With earnings season kicking off, most of the megacap tech stocks that comprise the Nasdaq will be reporting earnings in the next few weeks, so it is tough to get too opinionated on them.

Crude Oil - The Canary in the Coal Mine

Everyone is celebrating the end of inflation, meanwhile Crude oil is breaking out above the monthly VAH ~80.1 in the background! A big reason for the light December CPI print was lower energy prices, but as of this writing, crude oil is in positive territory for the month of January. How dovish can the fed really be at the Feb 1st fed meeting if energy prices are bid into the meeting?

Sectors - Ranked by Momentum

The BLOK blockchain ETF reclaimed our top momentum slot. Bitcoin is in positive territory today, which is a positive divergence for risk assets as a whole

KWEB China and XLE energy are surging higher in the momentum list

Earnings on Tap

I will be covering all of these reports and reactions in Discord

Key Takeaways

The S&P 500 is losing key technical levels

Crude oil is breaking out

Crypto is diverging from equities

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities