Pristine Market Analysis & Watchlist 9/19

No Pressure, Powell!

Team,

The market is sitting on the knife’s edge into Fed Wednesday. Let’s take a deep dive under the hood.

-Andrew

Economic Data

Housing Starts MoM -11.3% this morning.

FX Market

The dollar index remains inside the white bullish trend channel. Remember, there is no raging bull market in risk assets when the dollar index is in such a strong uptrend!

Bonds

The probability of a November rate hike decreased from 36.4% to 28.9%. This could certainly change after tomorrow’s Fed meeting. Stay tuned!

Long-term treasuries are testing their August lows into Fed Wednesday. It does appear that they are sitting on the knife’s edge, and Powell’s remarks will determine if they cascade to new lows, or put in a double bottom.

Equity Dashboard

The headline index SPY is holding up, but under the surface the breadth is weak. Today’s session finished with only 33.8% advancers, creating a challenging tape for the active trader.

The Nasdaq QQQ outperformance vs IWM Small caps we are seeing is unprecedented.

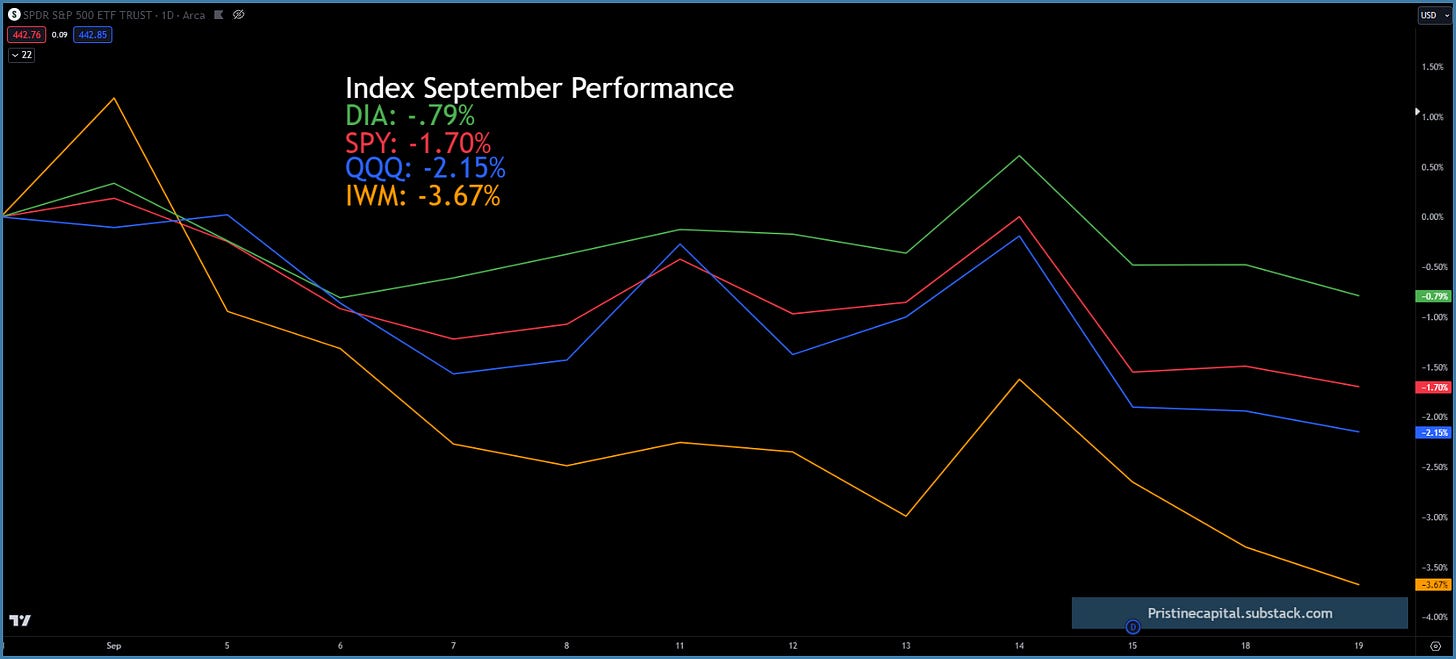

Equity Index MTD September Performance

The indices have largely chopped sideways in September.

Index Price Cycle Monitor

ES S&P 500 - Testing 20 day SMA and below monthly point of control

NQ Nasdaq - Below 20 day SMA and below monthly point of control

RTY Russell 2000 - Below 200 day SMA and below monthly point of control

YM Dow Jones - Testing 20 day SMA and below monthly point of control

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities