Pristine Market Analysis & Watchlist 12.26

📈 Building a 2024 Focus List!

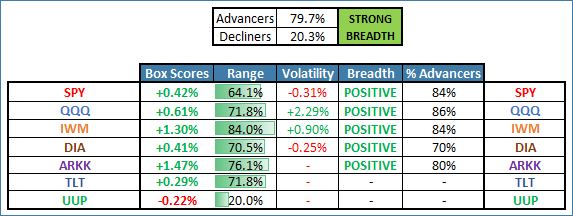

Small caps finishing 2023 with a bang! +1.30%

Team,

There are only 3 more trading sessions left in 2023! This final week of the year presents a fantastic opportunity to reflect on mistakes made during this year and how we can improve in 2024! Let’s crush it in the new year 🥳

-Andrew

News/Economic Data

U.S. BUYS 3 MILLION BARRELS OF OIL FOR STRATEGIC RESERVE UNDER MARCH 2024 PURCHASE AWARD -STATEMENT

The BTFP program is set to expire March 11th, 2024👇

Treasuries

The rally in stocks we’ve seen at the end of 2023 was underwritten by the rally in bonds. Since the Bill Ackman bottom, the TLT has respected the 10-day EMA, and it could retest the 10-day EMA as early as tomorrow. A close below this level would be a bearish change of character👇

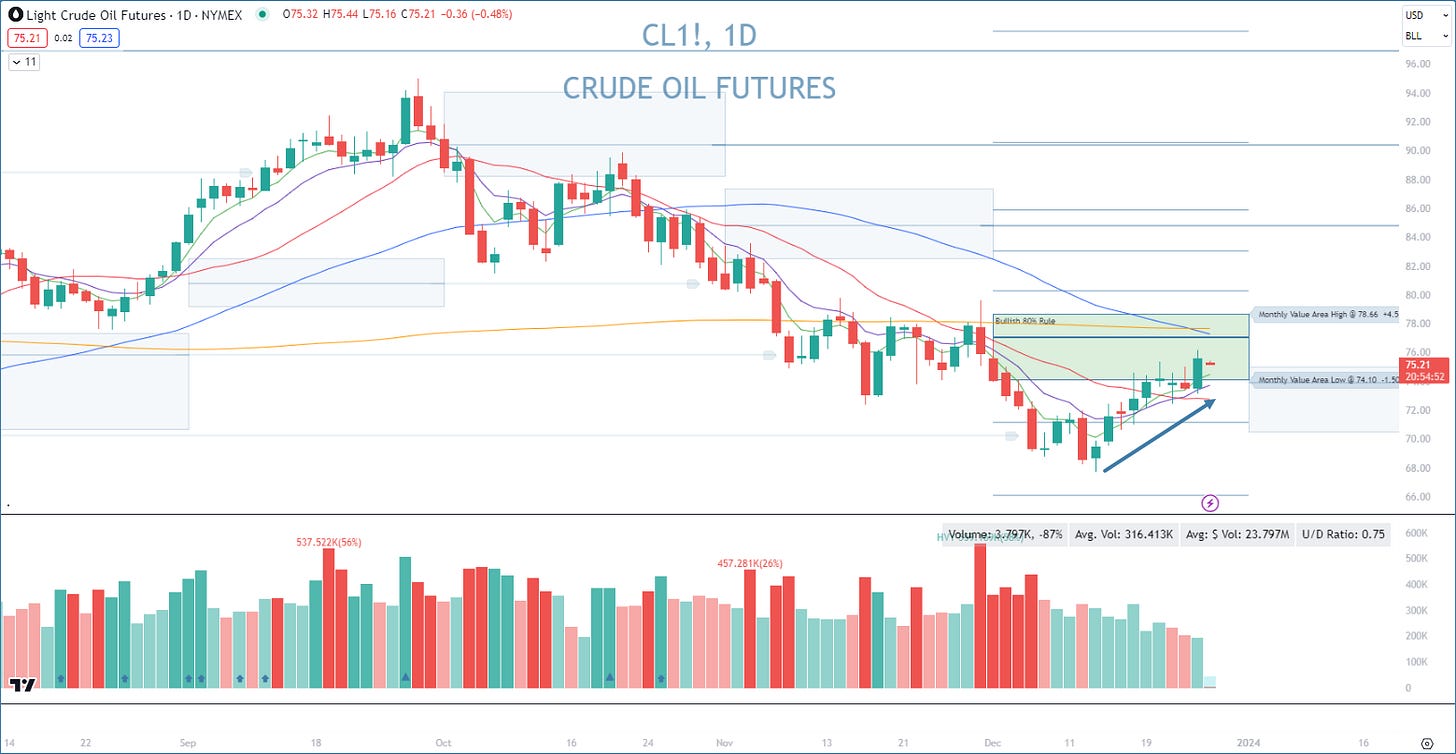

Energy

In two weeks, crude oil has quietly rallied from a low of $67.71 to $75.21 (+11%), and this certainly does not scream that inflation is dead! ❌

FX Market

The Dollar Index remains incredibly weak!✅

Equity Dashboard

The IWM small caps and ARKK innovation led the market higher 👇

Index Price Cycle Monitor

Index Performance YTD

The indices are all up double digits for the year 2023, which creates a ton of end-of-year momentum. It is worth highlighting that all of this YTD momentum disappears in 3 trading sessions when the calendar flips to 2024 👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - Our trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities