Pristine Market Analysis & Watchlist 6/29

Small Caps Soar on Strong Economic Data

Team,

Quarter end is upon us!

-Andrew

Economic Data

German inflation data came in slightly above estimates. US initial jobless claims were light, and US GDP came in well above estimates!

Fed Fund Futures

The strong US data put further pressure on bond yields across the curve. The market is pricing in a more aggressive fed into year end.

10Yr Treasury Futures

And the long end of the curve was smoked! 10yr treasury yields had been consolidating in a tight range, and they broke that range with a nasty red candle. Bonds have now given back almost all of their gains since the banking crisis began.

But equities have not.

Equity Dashboard

Breadth was strong as investors rotated into the more economically sensitive IWM small caps.

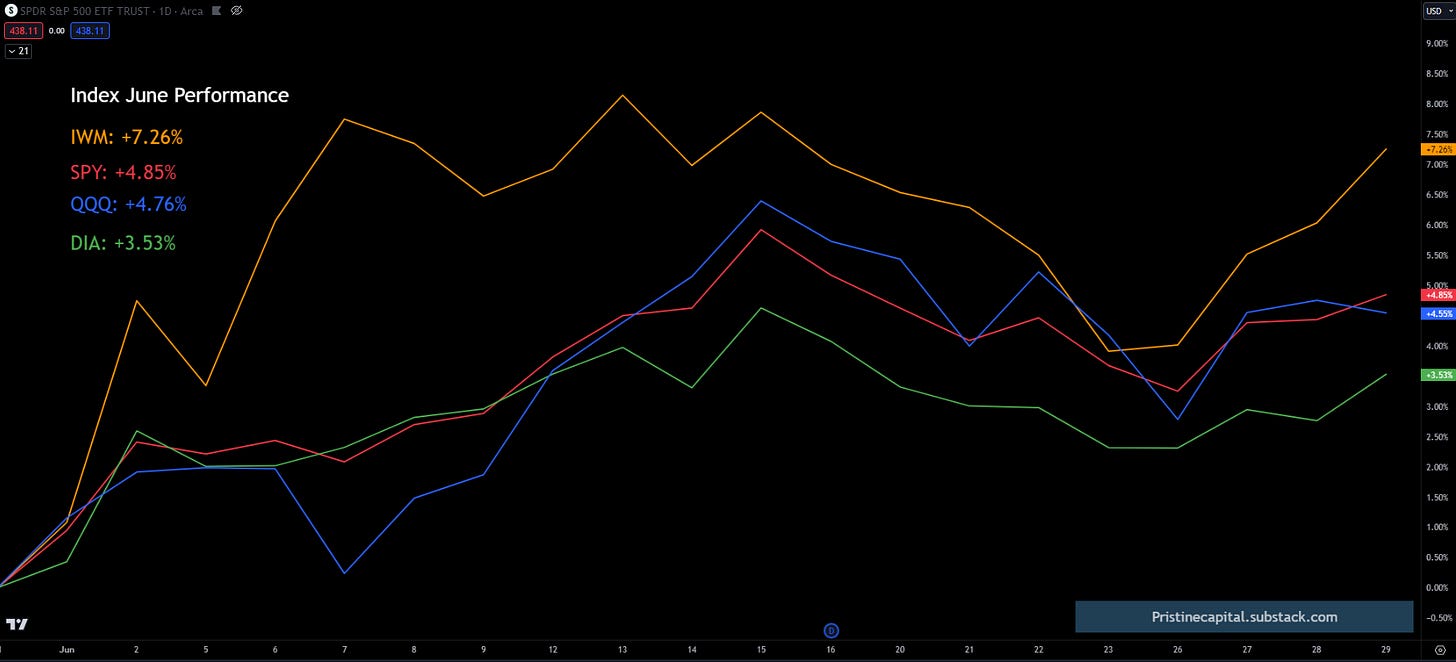

Index MTD June Performance

IWM has been flying under the radar, but it is the top performing index for June!

Index After Hours Price Action

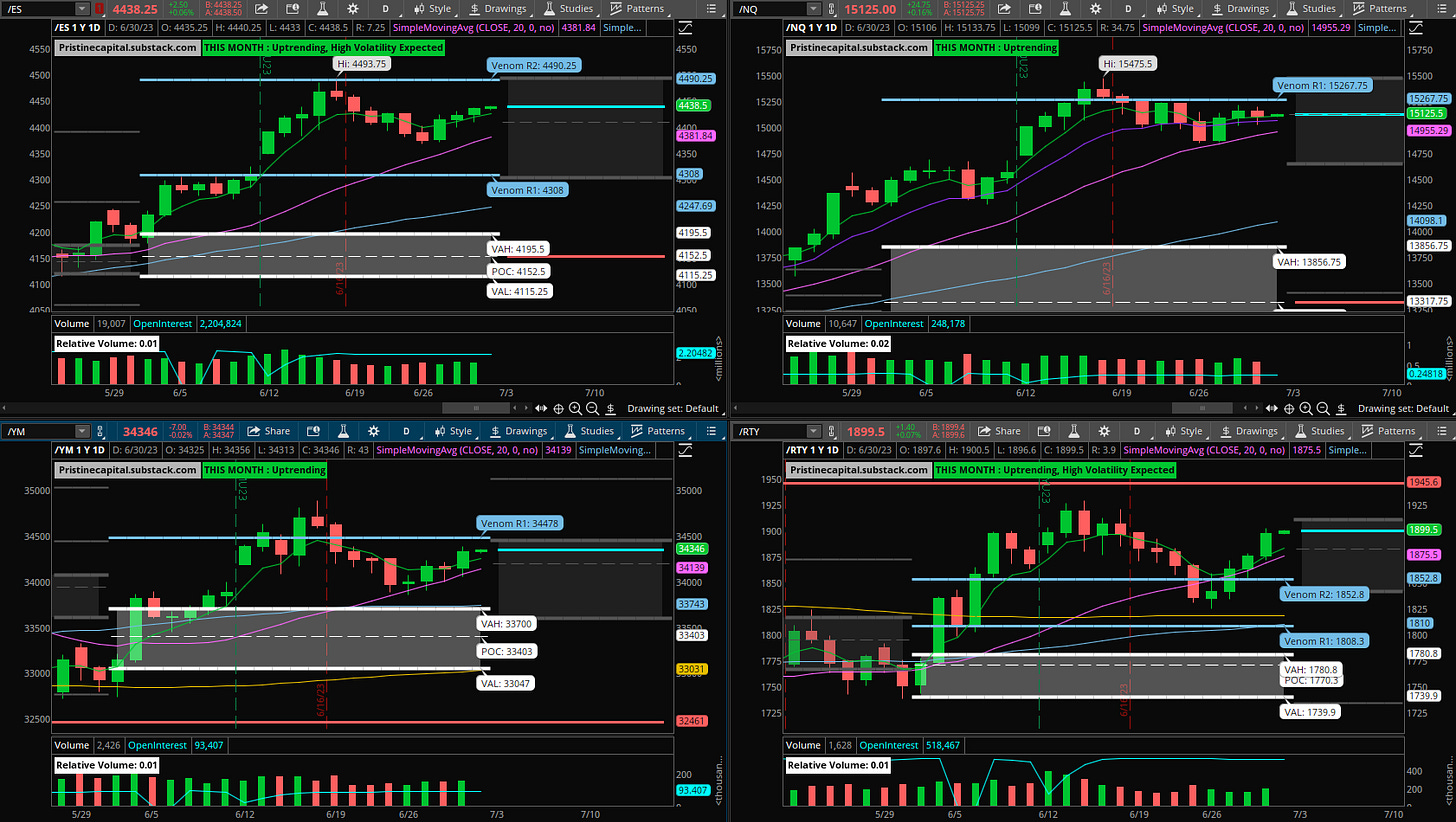

ES S&P 500 +.06% (20 SMA Bounce)

NQ Nasdaq +.16% (20 SMA Bounce)

YM Dow Jones -.02% (20 SMA Bounce)

RTY Russell 2000 +.07% (20 SMA Bounce) - VPOC above at 1945.6

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities