Pristine Market Analysis & Watchlist 10/19

Geopolitical Risk

Team,

The waters remain choppy and volatile, but the SPY remains above out 9/27 line in the sand. Keep your head up!

-Andrew

News/Economic Data

Initial jobless claims lighter than expected…another sign of economic resilience.

And of course the geopolitical headlines are coming a mile a minut

FX Market

The dollar index is now trading below the low end of the bullish trend channel.

Long-Term Treasuries

Interest rates remain at the mercy of geopolitical shocks in the middle east. Two ugly weekly candles are forming👇

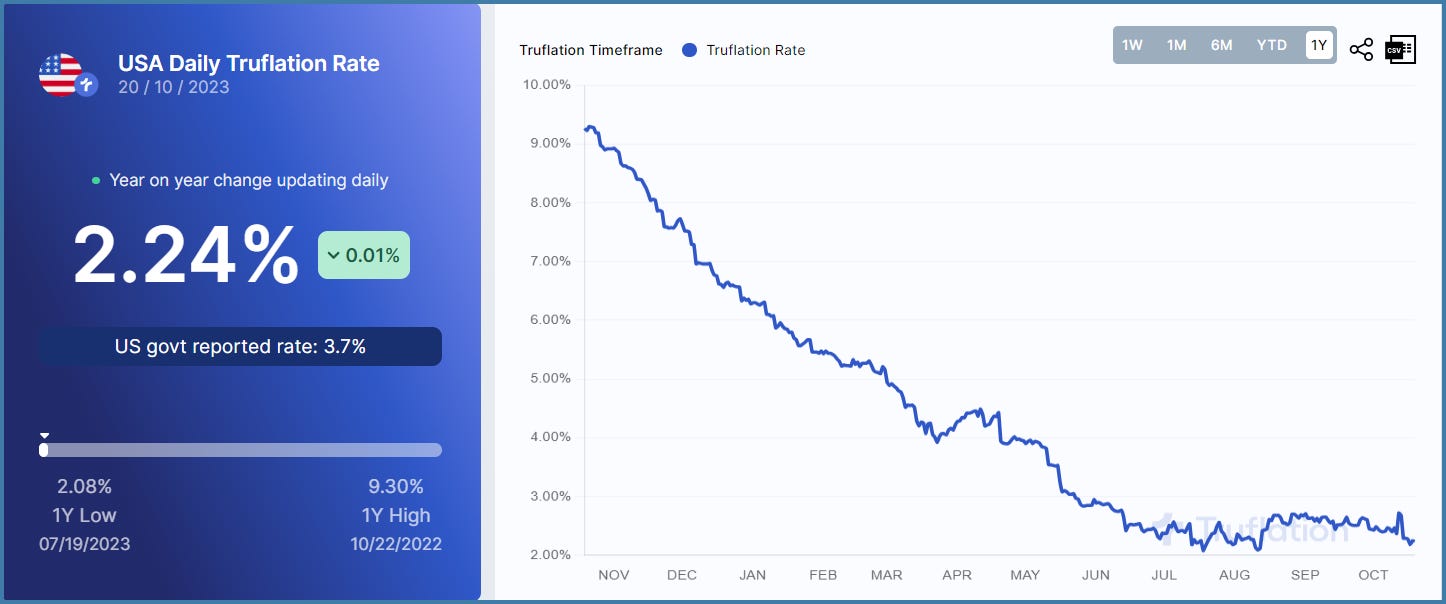

While there may be fear of further supply chain disruptions as a result of conflicts in the middle east, and those fears are jolting markets in the short-term, it is important to acknowledge that the real-time Truflation rate is decreasing.

Energy

Crude oil price rejected is trading back inside the monthly value area. There is no bull market in risk assets if energy/commodities rip higher on geopolitical tensions.

Equity Dashboard

Equities finished with only 21.3% advancers. Poor closing ranges across all tracked equity indices, and a spike in volatility

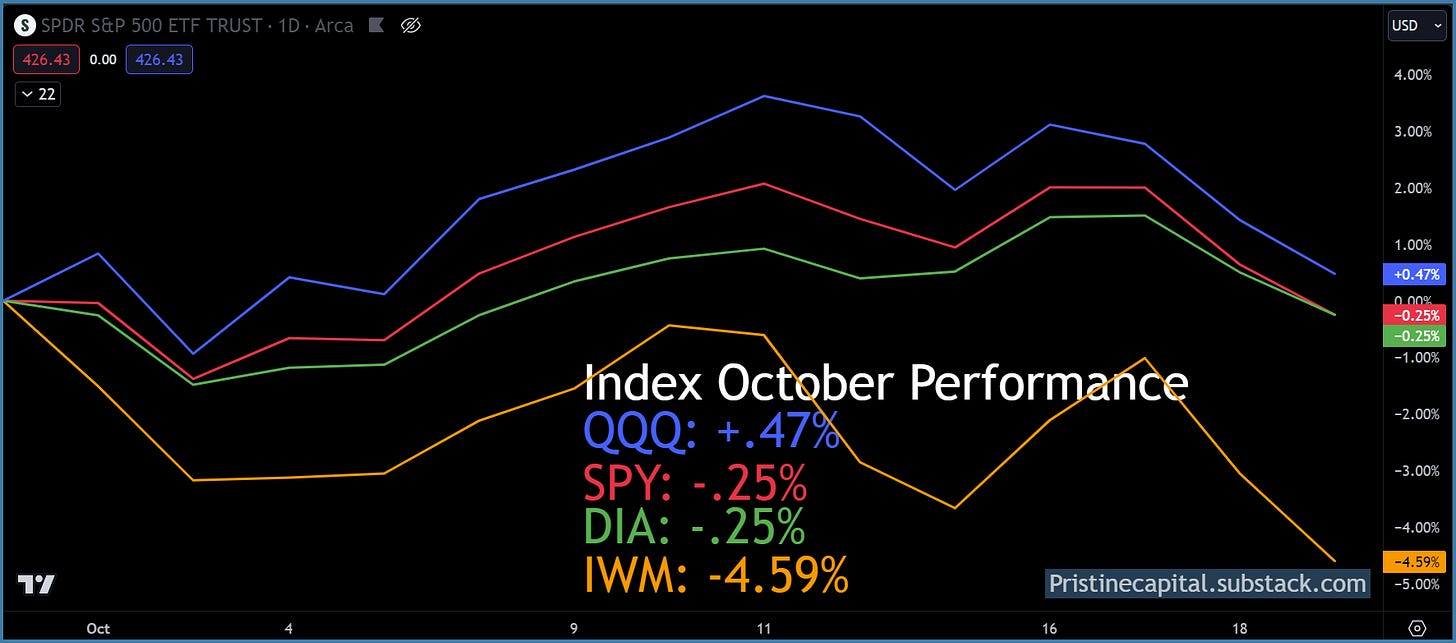

Equity Index October Performance

1 out of 4 tracked indices are in positive territory MTD.

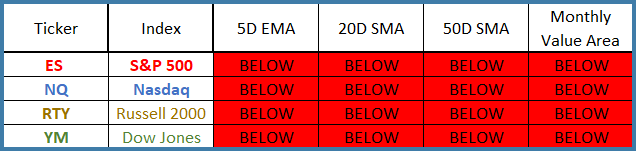

Index Price Cycle Monitor

Indices fell below their short-term moving averages 👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities