Pristine Market Analysis & Watchlist 7/6

Treasury Yields Blow Out On Strong Economic Data

Team,

Could a strong economy be bearish for risk assets? Let’s dive in!

-Andrew

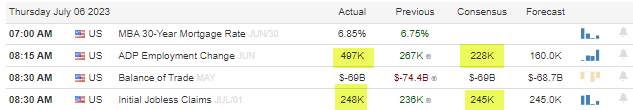

Economic Data

ADP employment data came in over DOUBLE the estimate at +497k vs 228k est. Initial jobless claims came in slightly higher than expected, but that was swept under the rug for all intents and purposes.

The monthly Nonfarm Payrolls report will be released tomorrow morning at 8:30 AM ET.

Could the strong ADP numbers foreshadow a hot NFP?! It is possible, but historically, the correlation between ADP and NFP is low and unstable

Fed Fund Futures

Fed fund futures advanced following the strong jobs data. The market is now pricing in potentially two more rate hikes into the end of the year!

10Yr Treasury Futures

The long end of the curve got smoked once again, on the realization that the fed might have to keep interest rates higher for longer than was previously expected. We undercut the lows from March before finishing the session right on said March lows.

The Nasdaq, which is typically the most duration-sensitive index, has not given back any of its gains despite bond yields trading back to the YTD highs. The higher yields go, the more risk there is of buying equities at these lofty YTD levels.

Equity Dashboard

10.7% advancers as equities pulled back. But the dip was bot! SPY and QQQ finished close to the high of the day! Absolutely bonkers.

Index MTD July Performance

All indices are red for July. And we are currently in the strongest seasonal period of the year! What happens when we exit the strong seasonality?

Index After Hours Price Action

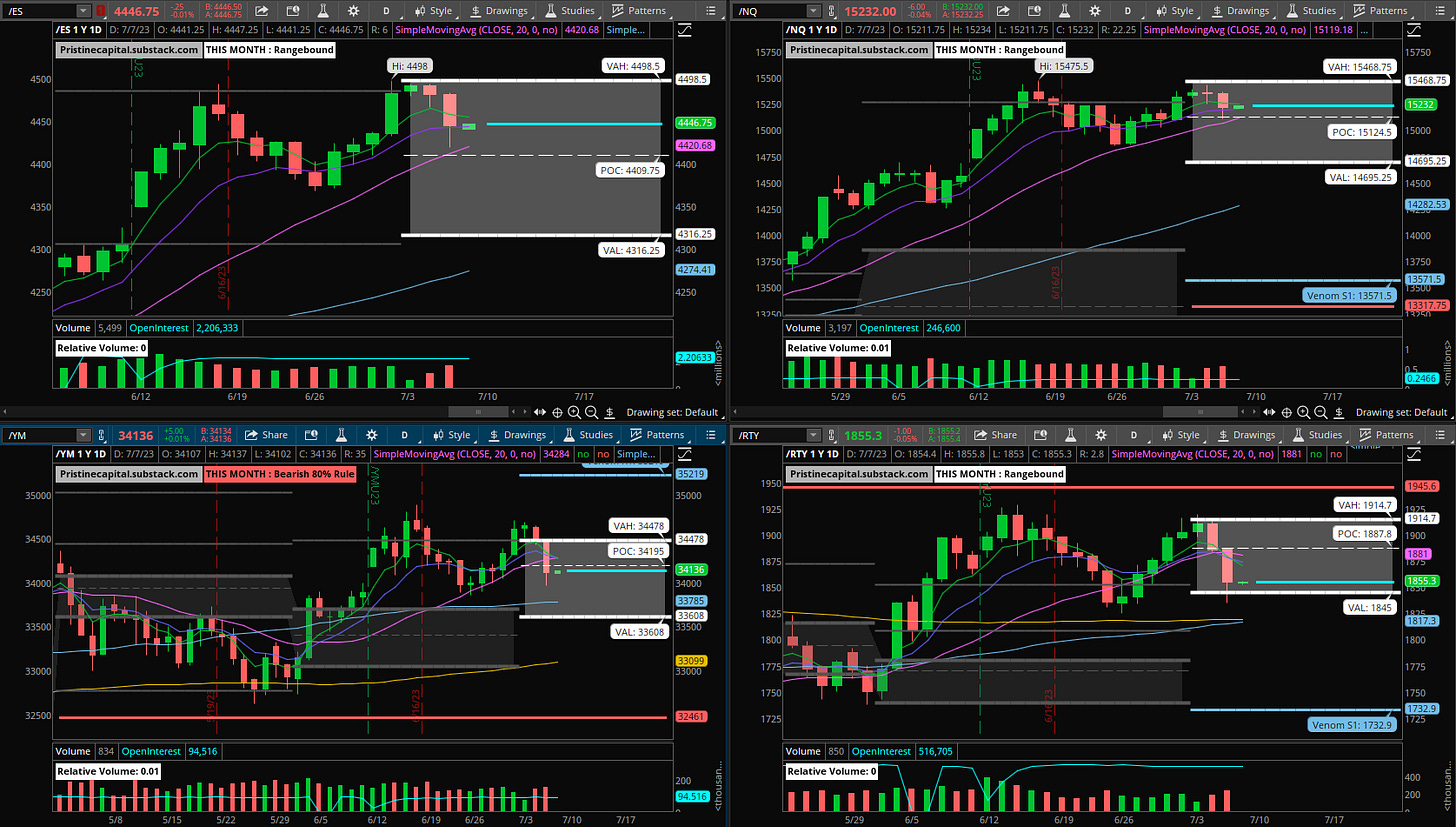

Headline index trends are weakening. We bounced off the 20 SMA last week, and were only able to remain above this key moving average for a few days before returning to it. Contrast this to May and June where we lived well above the 20-day SMA for multiple consecutive weeks. The character of the market is changing.

ES S&P 500 -.01% (20 SMA Pullback)

NQ Nasdaq -.04% (20 SMA Pullback)

YM Dow Jones +.01% (Below 20 SMA)

RTY Russell 2000 -.05% (Below 20 SMA)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities