Pristine Market Analysis & Watchlist 8/21

Equities Bounce on Rising Bond Yields

Team,

The S&P 500 bounced off oversold conditions and retested the 5-day EMA. Let’s dive in and check out the landscape as we cruise into NVDA earnings and Jackson Hole.

-Andrew

Economic Data

German PPI came out -6% YoY overnight

So far we have seen deflationary data out of China and now Germany, but that has not been enough to stem the tide of selling in global sovereign bonds.

Treasuries

10yr treasuries are testing their November ‘22 lows.

As are 30Yr treasuries.

The MOVE index broke out of its recent downtrend.

FX

The dollar index continues to live above the 200-day SMA.

Equity Dashboard

Considering the weakness in bonds and early strength in commodities, equities did okay. Breadth was on the weaker side for a green session, with only 46.8% advancers.

Investors flocked to the safety of NVDA ahead of its 8/23 earnings report. What could possibly go wrong there?

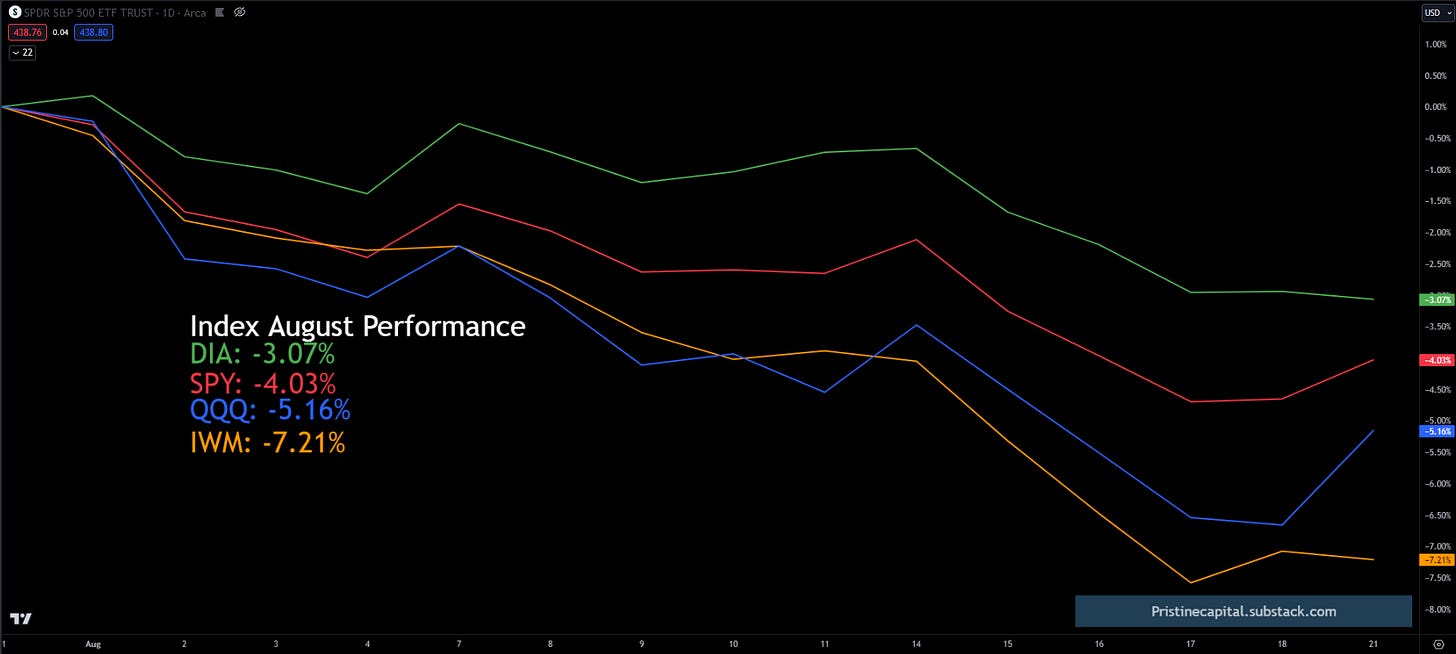

Equity Index MTD August Performance

The indices are experiencing a pullback in August.

Index After Hours Price Action

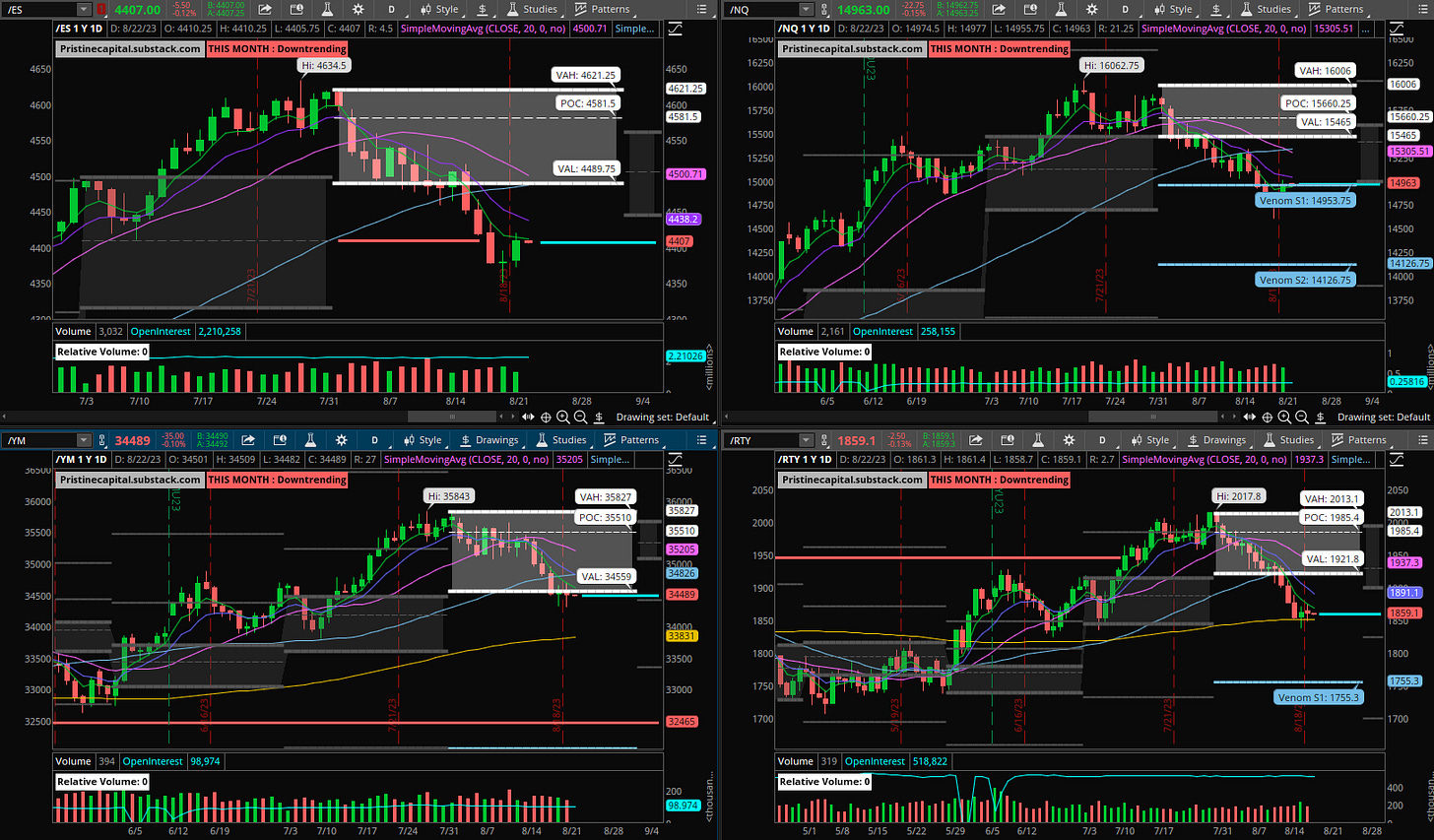

ES S&P 500 -.12% - Below 50-day SMA & Testing June POC

NQ Nasdaq -.15% - Below 50-day SMA

YM Dow Jones -.10% - Below 50-day SMA

RTY Russell 2000 -.13% - Below the 50-day SMA

Economic Data

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities