Pristine Market Analysis & Watchlist 10/16

Breadth Improves!

Team,

The market priced in the potential for a major geopolitical escalation into the weekend…but luckily…we live to fight another day!

-Andrew

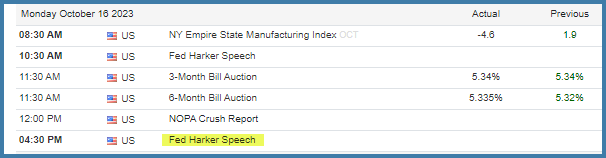

News/Economic Data

No big economic releases this morning 👇

But we did get the following soundbite from Harker of the federal reserve:

The fed is clearly stating that the rate hiking cycle is over! 🔥

FX Market

The dollar index fell outside of the bullish trend channel. This is BULLISH for risk assets 🐂

Long-Term Treasuries

ZN ZB both kicked off the weak with red candles. Still trading inside the range from the last two weekly candles 👇

Energy

Crude oil gave back a small portion of Friday’s gains. Energy and commodities remain wild cards into year end.

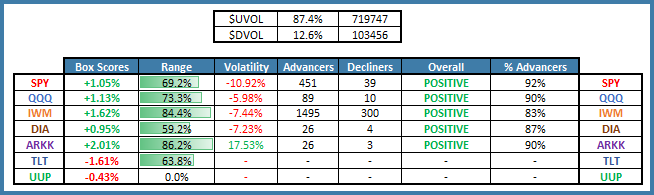

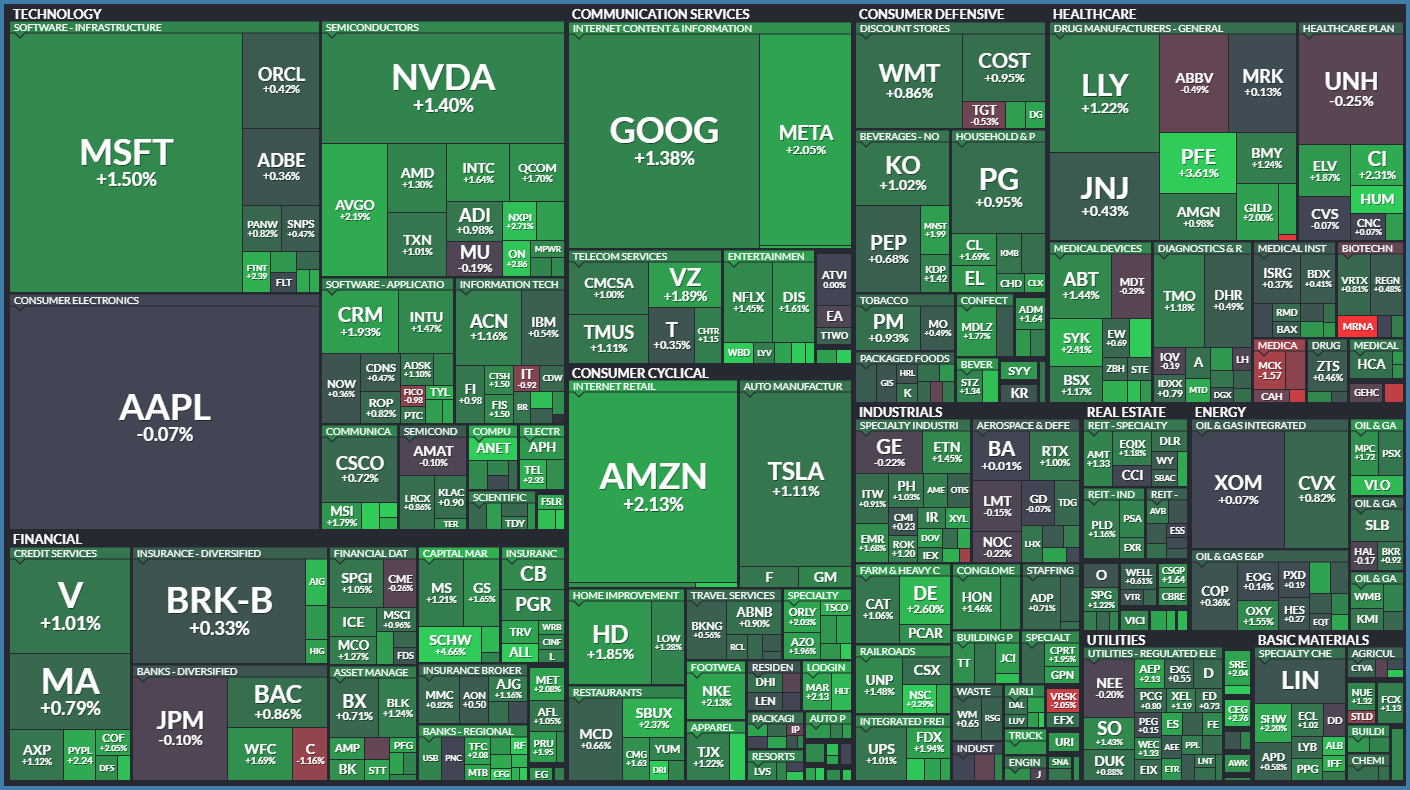

Equity Dashboard

Equities finished with 87.4% advancers. IWM Small caps led the way 💪

Equity Index October Performance

On a month-to-date basis, megacap tech is doing well, but small caps are lagging.

Index Price Cycle Monitor

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities