Pristine Market Analysis & Watchlist 11/9

📈Time to Panic?

Weak 30yr bond auction sparks a day of risk-off price action

CPI 11/14 will determine the next move for markets

Team,

We came into the week expecting a short-term pullback/consolidation, and so far that is exactly what we are seeing. When in doubt, zoom out! HAGE 🍻

-Andrew

News/Economic Data

Initial jobless claims in-line with expectations

And tough talk from Powell

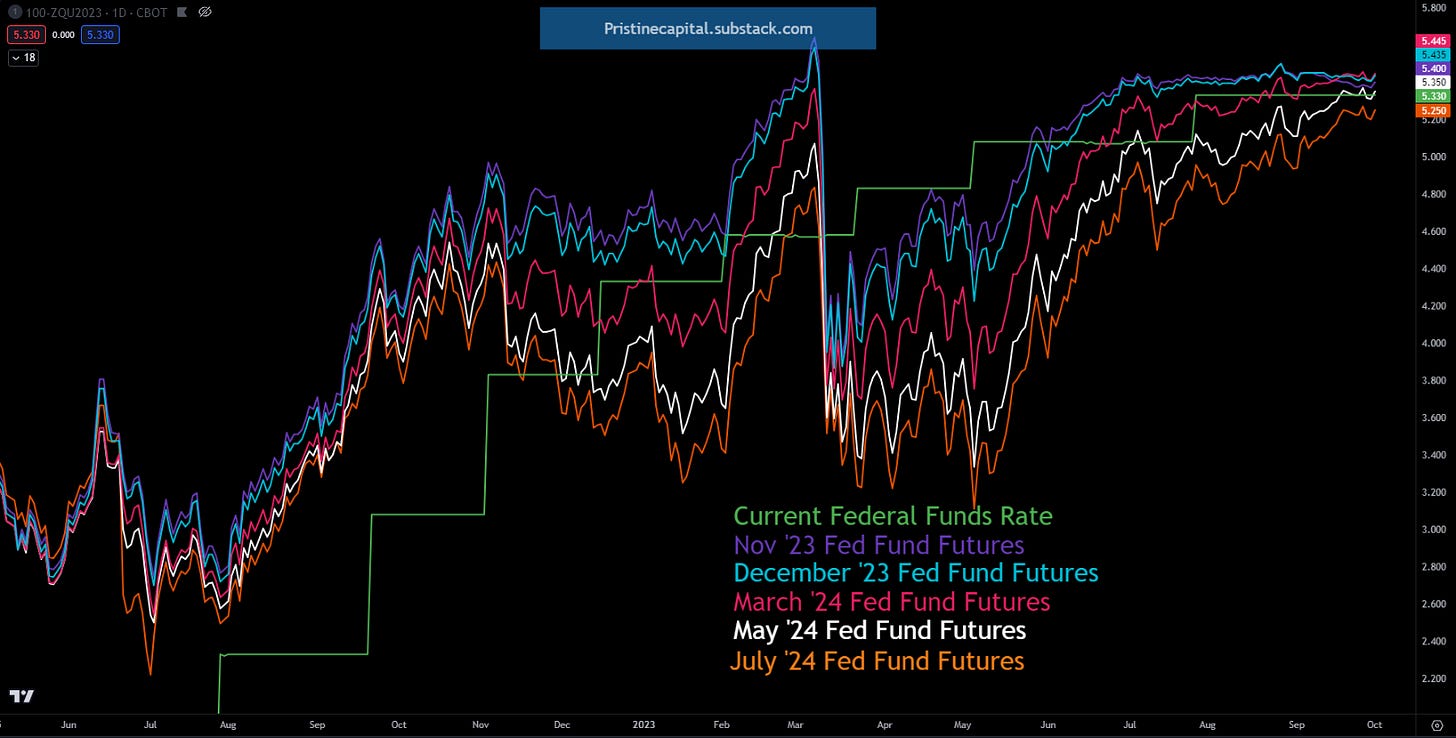

But did Fed fund futures have a big reaction to Powell’s comments? Absolutely not.

This proves that, for now, Powell is all bark and no bite!

Long-Term Treasuries

-1.65 ATR move for TLT after a weak afternoon 30yr bond auction. Bad look on the goldfish timeframe, but in the grand scheme, the Bill Ackman bond bottom is still in play👇

FX Market

DXY below the 20-day SMA, which is bullish for risk assets✅

Energy

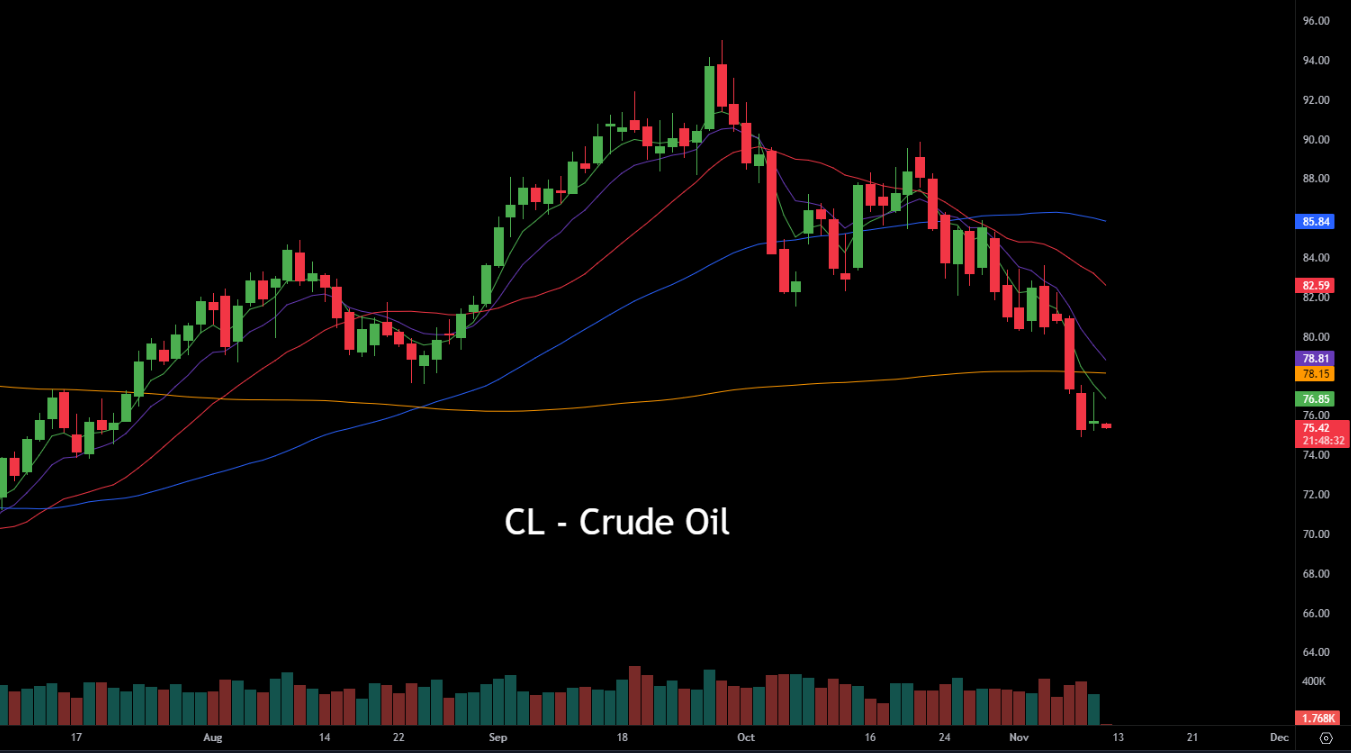

Crude oil is trading at $75.42/barrel, down from its peak of $95.00/barrel. Deflationary?

Equity Dashboard

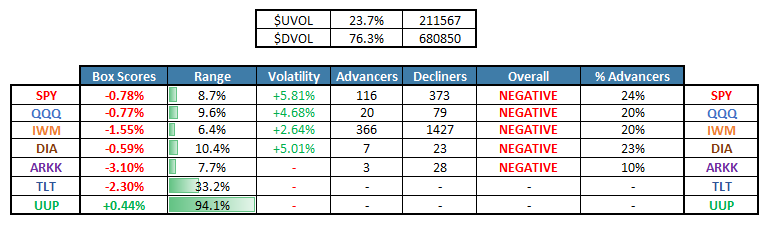

23.7 % advancers on day three of this market ‘pullback’ 👇

Index Price Cycle Monitor

Seeing an early crack in the foundation of this rally via the weakness in small caps. 👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities