Pristine Market Analysis & Watchlist 12.19

📈Dismounting from CHWY

Laggards lead! FDX disappoints on earnings

VVIX risk model count begins

Team,

Only 7 more trading sessions in 2023! Let’s take a deep dive into today’s action, and the setup into Christmas. HAGE 🍻

-Andrew

News/Economic Data

The fed is attempted to walk back the market’s pricing of rate cuts in 2024👇

GOOLSBEE SAYS MARKET GOT A LITTLE AHEAD OF ITSELF ON CUTS

But did the market care? Not really. Sounds like a 2024 problem 😎

Treasuries

The TLT is on day three of a much needed pullback/consolidation. If you are looking to jump aboard this trend for a trade up to the $101.40 VPOC, look for a retest of the 10-day EMA, as that level has been respected since the Bill Ackman bottom 👇

Energy

Crude oil testing the bottom of the monthly value area $74.10. With how much bonds have rallied over the past two months, if crude were to reclaim the monthly value area, that could become problematic for poor location longs👇

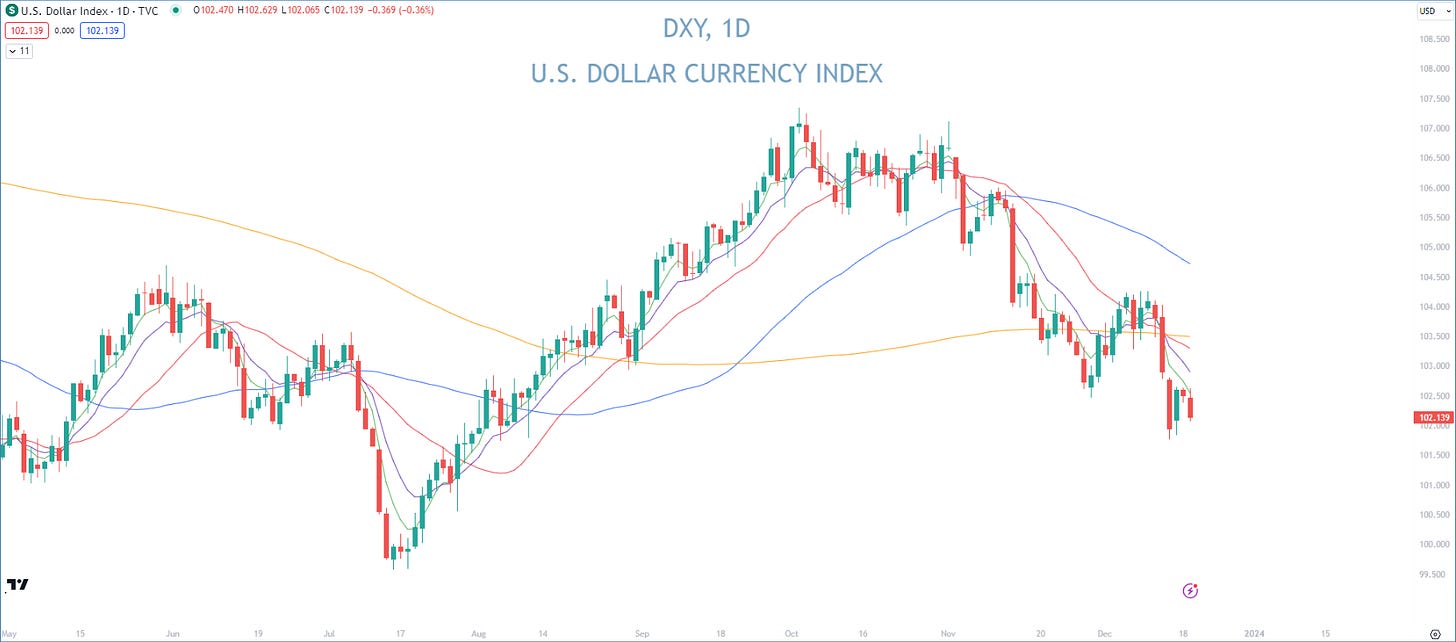

FX Market

The dollar index rolled over to the recent lows✅

Equity Dashboard

ARKK innovation stocks and the IWM small caps ripped higher 👇

Index Price Cycle Monitor

The indices continue to trend higher, and their respective 5-day EMA’s can barely keep up🔥

Index Performance Monthly

The IWM small caps are up a whopping 11.44% for December. Let that sink in…👇

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - Our trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities