Pristine Market Analysis & Watchlist - 1/18

Sidestepping the Selloff

Good evening everyone,

I’d like to start by letting you know how proud I am of everyone in the group for staying disciplined in the first few weeks of January.

We said 2023 was going to be our year and we meant it! Keep it up 👊

As always, a ton to cover today, so let’s dive in

-Andrew

Economic Data

The day’s events kicked off with the US PPI report:

Analysts were expecting a -.1% MoM reading, and it came in at -.5%! This was the largest decline since April 2020, and a sign that inflation is CLEARLY decelerating:

Over the last few weeks, we’ve seen multiple cool inflation prints around the globe, and most economic indicators pointing to a slowing economy and/or recession:

FX

In the immediate aftermath of the PPI report, the dollar index sold off and undercut the recent lows, only to rally throughout the session and finish the session completely flat +0.00%. Not what I’d expect given such a light inflation print:

Perhaps it is because most players are already short the dollar 👀

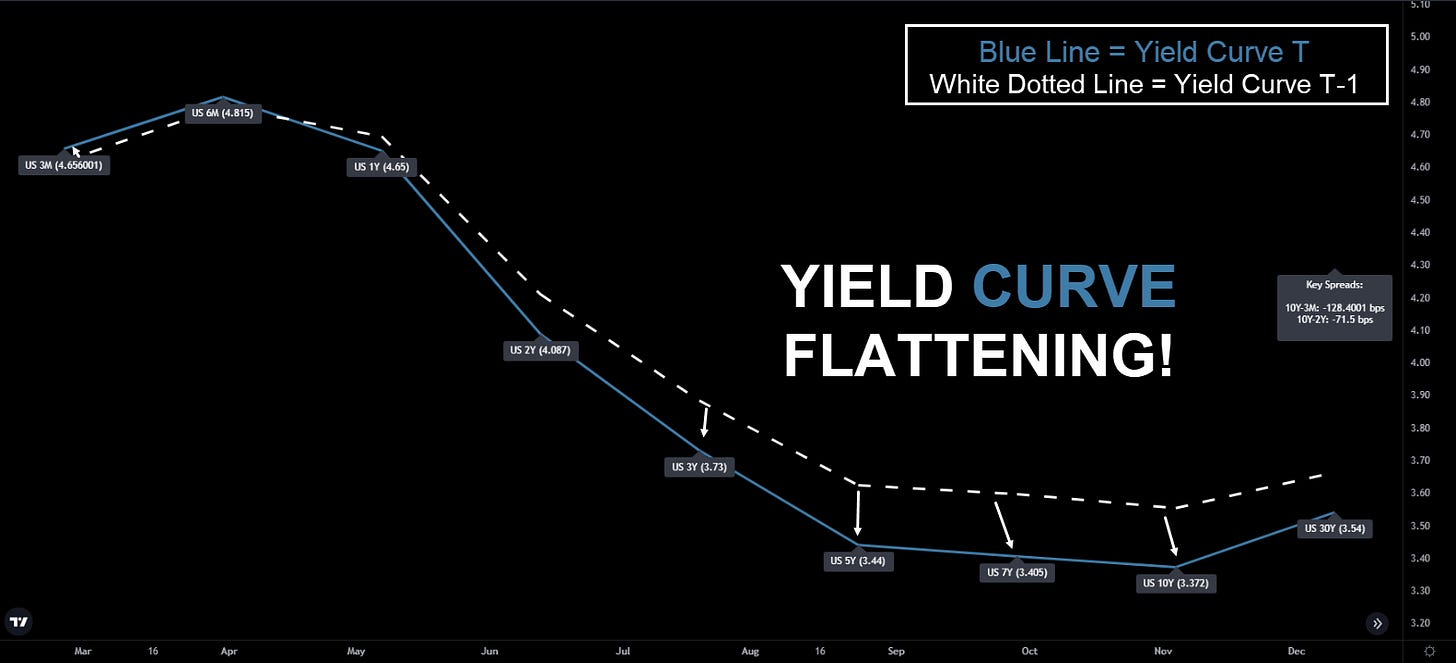

US Yield Curve

Despite the light PPI, yields at the front end of the curve moved higher, pricing in more fed rate hikes! The long end of the curve was a completely different story. The 10yr treasury yield got crushed and ended the session at 3.37%.

Is the fed tightening into a recession? Absolutely. And the bond market knows it:

Equity Dashboard

Most of the selloffs in 22’ occurred on the back of rising bond yields, but today’s selloff occurred while the TLT long duration treasury ETF ripped higher! It is tough to tell if this is a new paradigm where bad economic news is actually bad for the equity markets, or if this is actually a positive divergence:

15% UVOL - Washout Breadth 🤮

Finviz Heatmap

Megacap tech names AAPL GOOGL AMZN showed relative strength in an otherwise weak heatmap. Context is key though. Most of these stocks had huge runs in the first two weeks of 23’:

S&P 500 ES_F Price Analysis

The S&P 500 finished the session -1.58%, and below the teal downward trendline!

Next downside support level is the yearly POC ~3,921.5

S&P 500 ES_F Falling Back Into Value?

I find myself wondering…if after three days of attempting to breakout, we failed after getting a light inflation report, what else is there that could possibly break us out into the upcoming Fed meeting in two weeks? Earnings? Maybe. But I doubt it. Let’s see if buyers show up at the 50-day SMA:

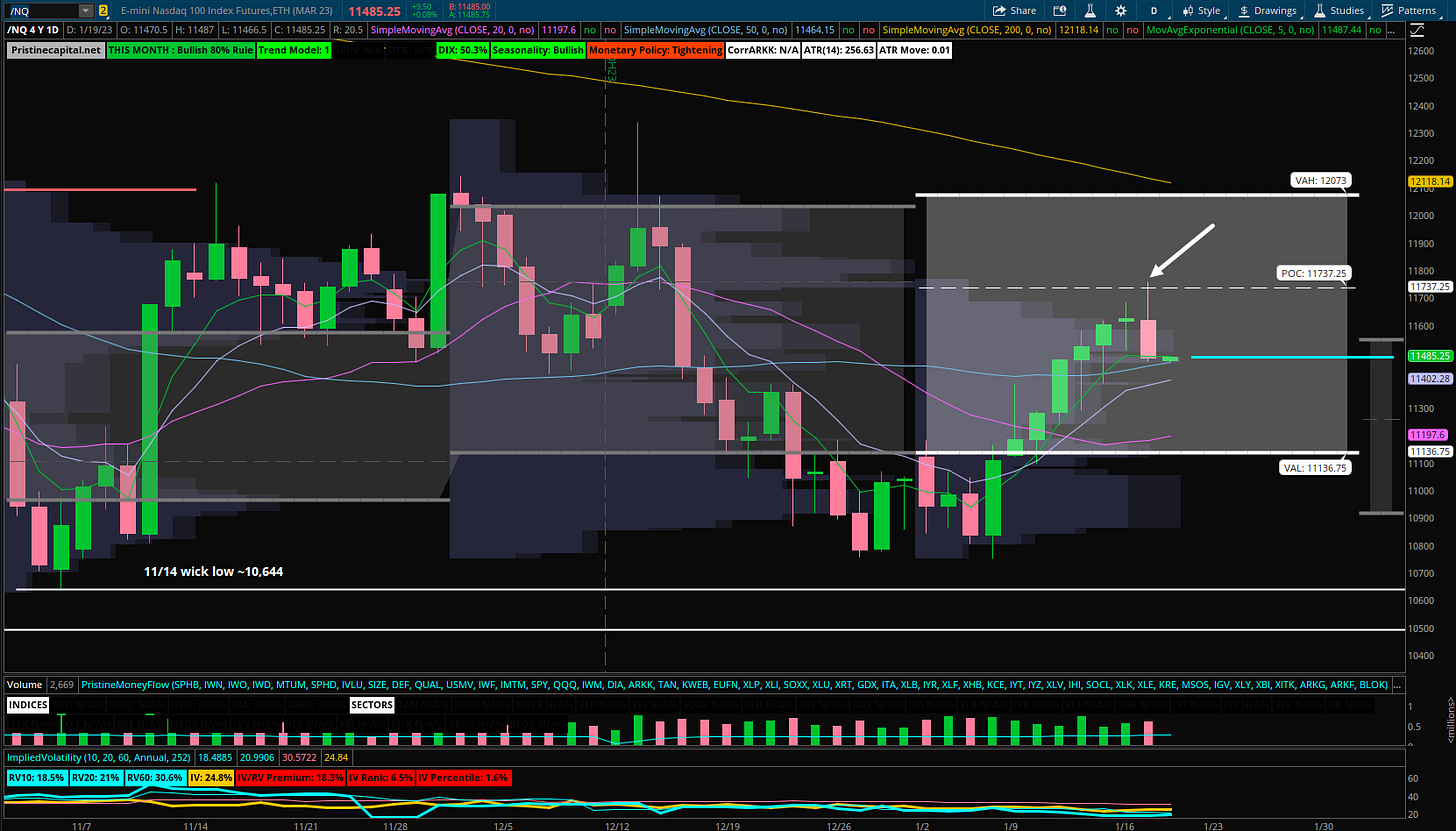

Nasdaq NQ_F Price Action Analysis

The Nasdaq reached up to the monthly POC ~11,737.25 before reversing lower and finishing today’s session -1.30%:

With earnings season kicking off, most of the megacap tech stocks that comprise the Nasdaq will be reporting earnings in the next few weeks, so it is tough to get too opinionated on them at this moment. NFLX reports tomorrow after the bell!

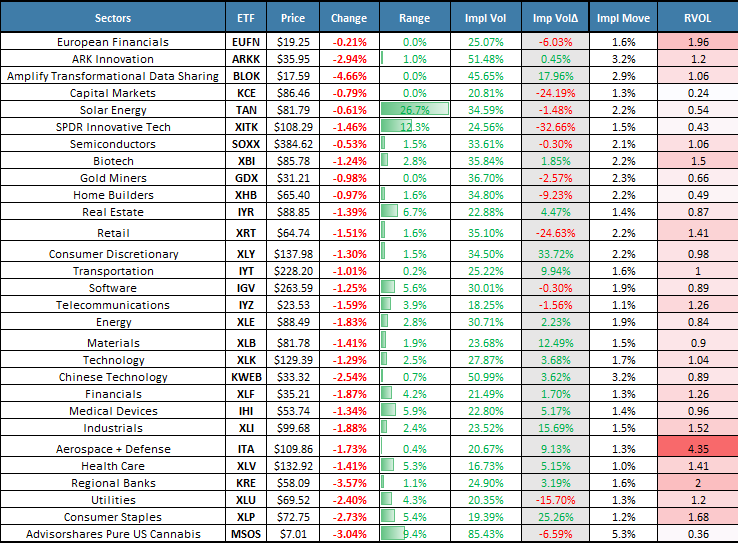

Sectors - Ranked by Momentum

EUFN European financials ETF is now in our top momentum slot

BLOK Blockchain ETF was today’s biggest loser, but it still remains in our #3 momentum slot

Earnings on Tap

Netflix reports after the bell tomorrow!

I will be covering all of these reports and reactions in Discord

Key Takeaways

US inflation is decelerating

The bond market is increasingly pricing in a recession

The S&P 500 breakout failed at resistance

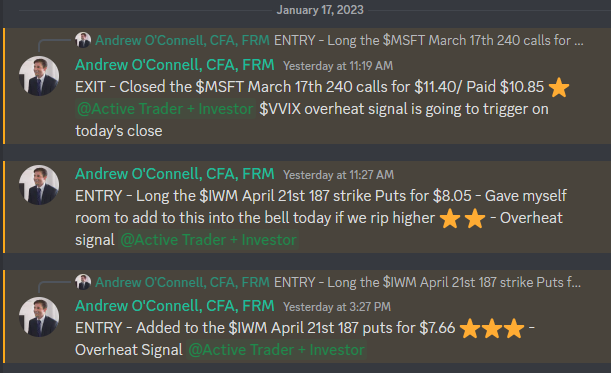

🏆Spotlight Trade 🏆

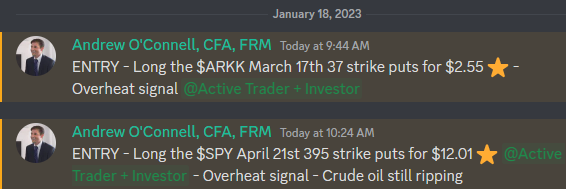

One of our proprietary risk models triggered a sell signal yesterday and alerted paid subscribers and myself to book gains and/or add short positions!

We came into the session net short as a result, and added more shorts into the green morning action, resulting in a fantastic trading day despite the market weakness:

This is one of many reasons why it is worth considering upgrading your membership if you haven’t already. We are not just bullish on green days and bearish on red days. Using real edges is paramount.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities