Pristine Market Analysis & Watchlist - 1/23

The One Trendline to Rule Them All

Good evening everyone,

We said 2023 was going to be our year, and we meant it! We are at the tail end of the first inning, and I’m proud of the discipline everyone is demonstrating throughout the dips and rips of the last few weeks. Keep it up!

-Andrew

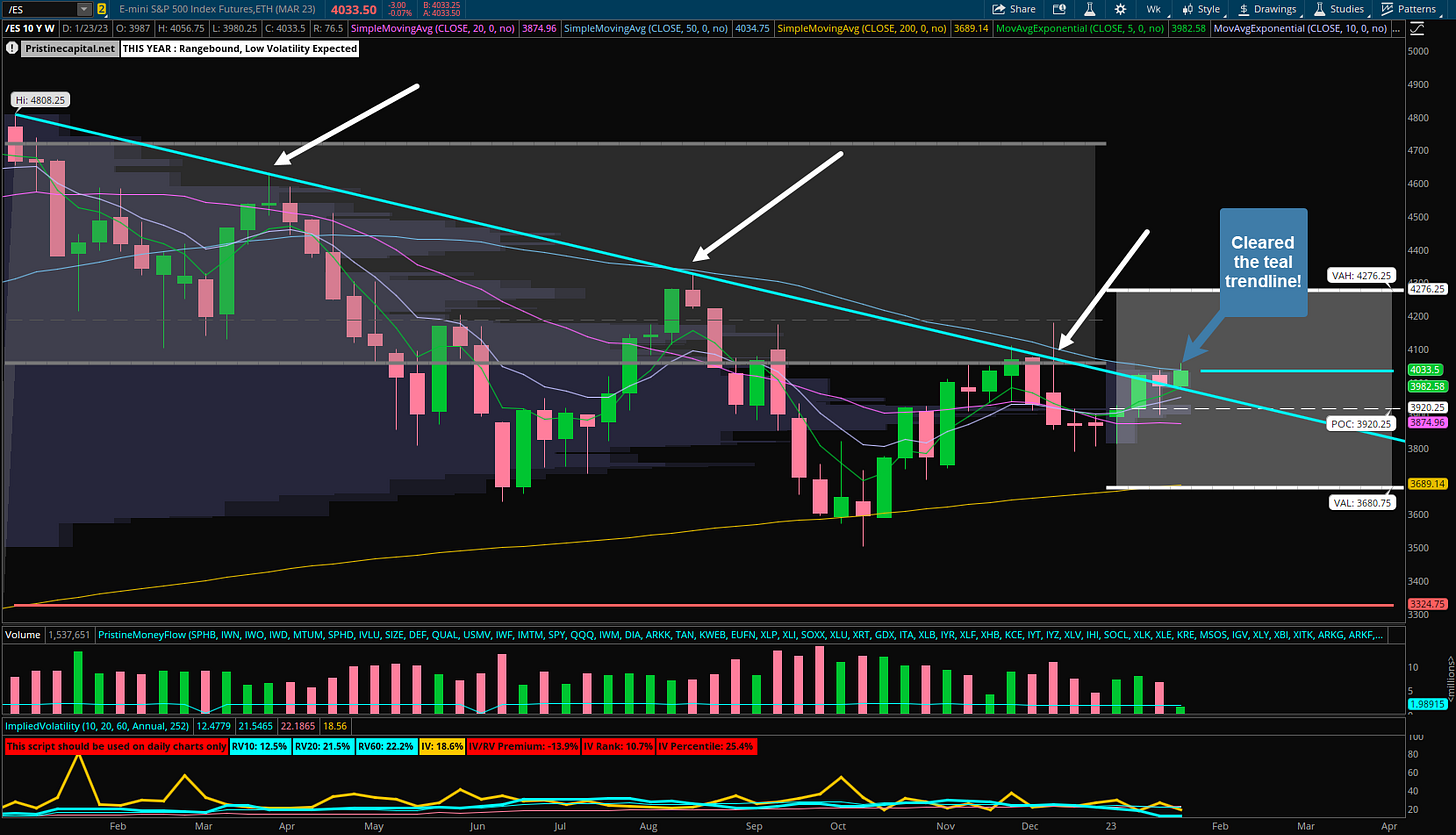

S&P 500 ES_F Price Analysis

Today’s big story is that the S&P 500 broke out above the teal downward trendline! We covered the squeeze logic behind this trendline break in our weekend analysis, and it played out in explosive fashion as anticipated:

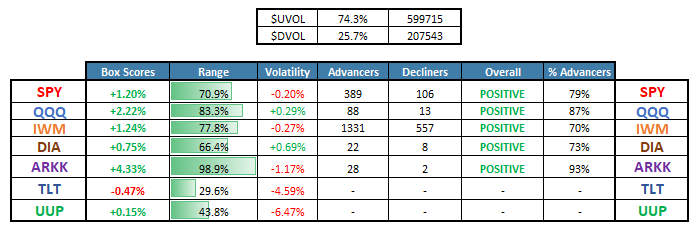

Equity Dashboard

While the trendline break is certainly a bullish event, we can’t ignore the bearish divergences that presented themselves throughout the session:

QQQ Nasdaq volatility increased alongside the ETF price 🚩

UUP dollar index ETF finished the session higher

TLT Treasuries sold off

ZN_F 10yr Treasury Futures

We must remember that the bond market leads the stock market, not the other way around! The most recent leg higher in risk assets, and tech specifically, occurred as 10yr treasury futures trended higher. Today we broke the trendline to the downside:

Finviz Heatmap

Despite the treasury weakness, megacap tech, which is highly correlated with treasuries, was today’s big leader. We outlined the case for a catchup in megacap tech earlier in the month, but with earnings for these names looming, the risk reward appears much more balanced after this rally:

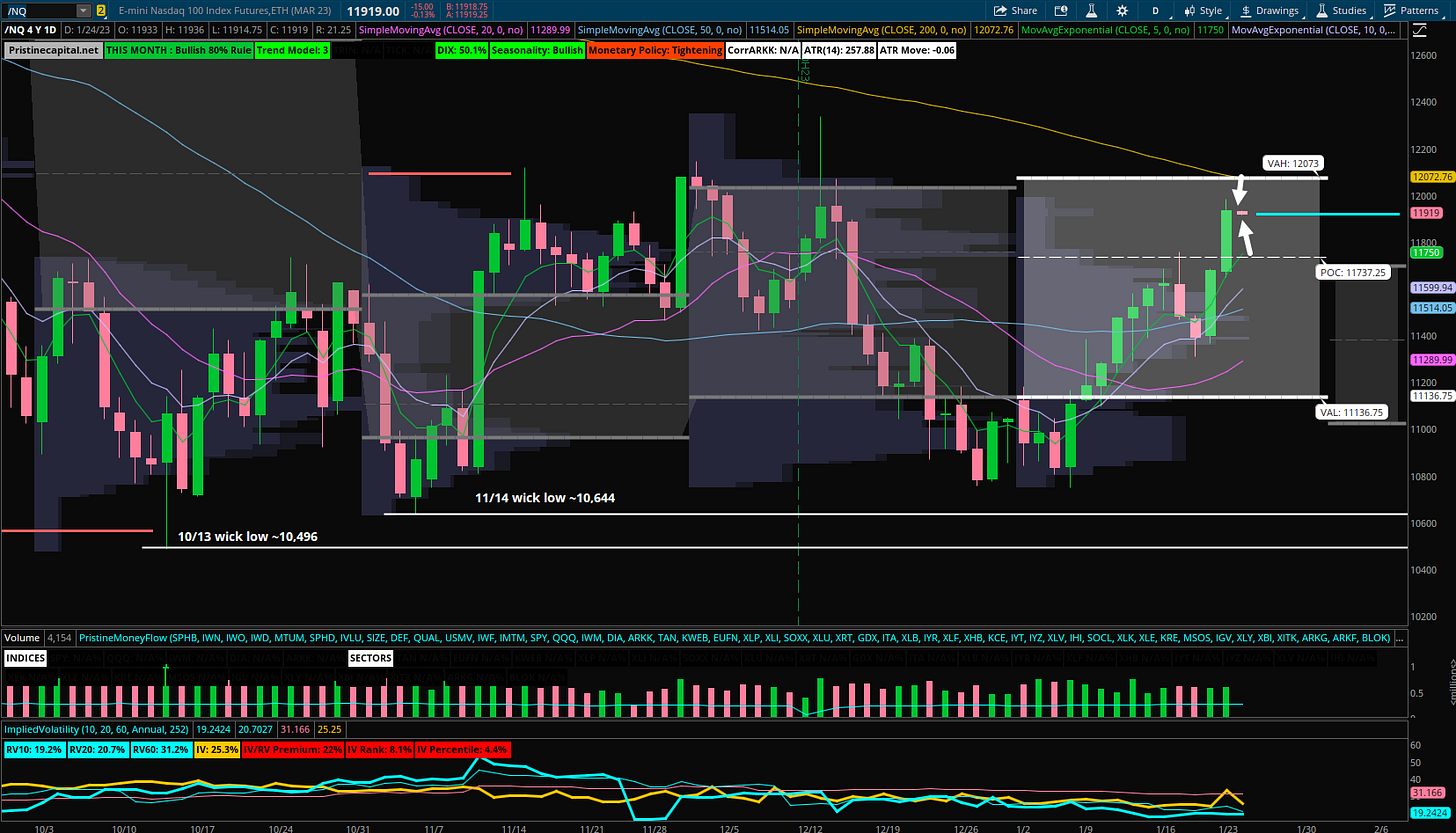

Nasdaq NQ_F Price Action Analysis

The Nasdaq is now trading about equidistant from the 5-day EMA and the 200-day SMA. Much will depend on megacap tech earnings in the coming weeks, with MSFT kicking us off tomorrow after the bell. Heading into the print, do you feel lucky? We all know these earnings reports can be hit or miss:

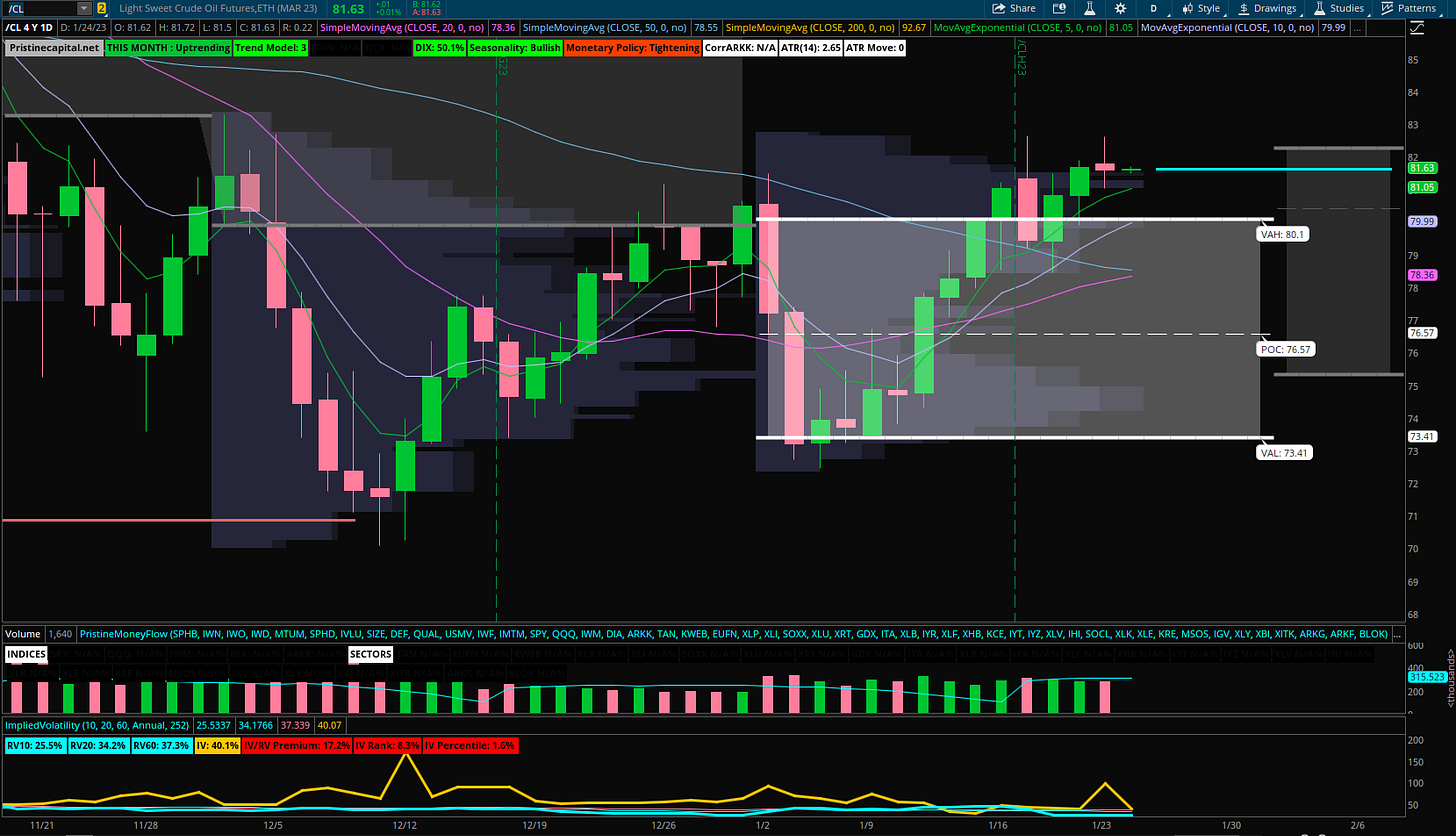

Crude Oil - The Canary in the Coal Mine

Everyone is celebrating the end of inflation, meanwhile Crude oil is breaking out above the monthly VAH ~80.1 in the background! A big reason for the light December CPI print was lower energy prices, but as of this writing, crude oil is in positive territory for the month of January. How dovish can the fed really be at the Feb 1st fed meeting if energy prices are bid into the meeting?

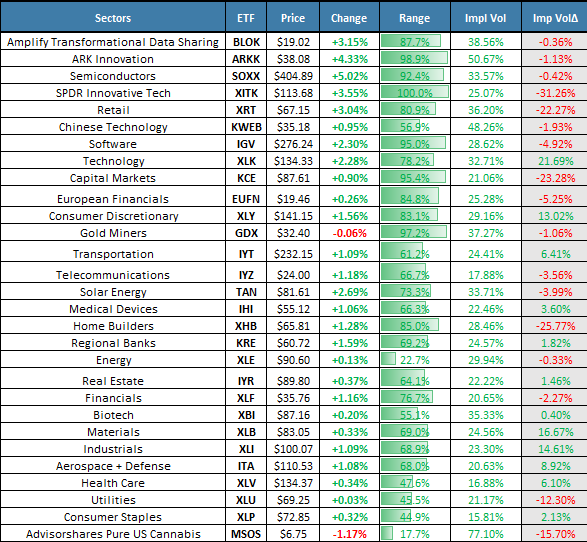

Sectors - Ranked by Momentum

The BLOK blockchain ETF remains in our top momentum slot.

SOXX semiconductors moved into our #3 momentum slot

Earnings on Tap

I am covering all of these reports and reactions in Discord

Key Takeaways

S&P 500 trendline breakout!

Divergences are appearing

Tomorrow is the first jam packed day of earnings this season! Buckle up!

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities