Pristine Market Analysis & Watchlist 4/12

Earnings Season!

Team,

Earnings season is upon us!

-Andrew

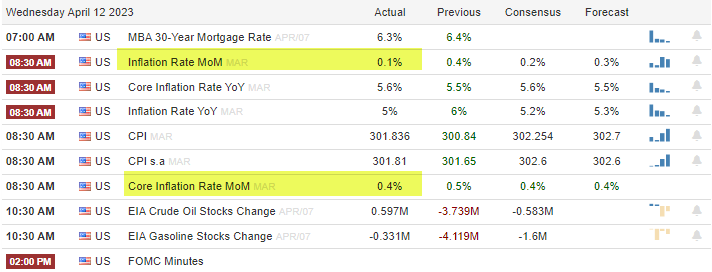

Today’s session kicked off with the CPI report at 8:30 AM. Non-core CPI came out lighter than expected at +.1% MoM, and core CPI came out in-line with expectations at +.4% MoM.

Of course, everyone is going to have a differing opinion on what these numbers mean for the inflation outlook, but the most important opinion to keep track of is that of the bond market! Has anything changed from yesterday to today? Nope. The market is still pricing in a 70.4% probability that the fed will hike interest rates by 25 basis points at the May meeting.

And expectations zooming further out in time barely changed either. For all intents and purposes, today’s CPI report, was a nothing burger.

Equity Dashboard

Equities finished today’s session with only 36.2% advancers. The ARKK innovation ETF led today’s declines, followed by the Nasdaq QQQ, but volatility bled lower for most of our tracked benchmarks

NVDA and TSLA, two posterchild growth stocks, both finished today’s session weak. It would be tough for the S&P 500 to mount a continued advance if these two names lose their momentum here.

ES_F S&P 500 Price Action Analysis

The intraday action was all over the place! The market popped higher on the morning CPI print, before selling off violently throughout the first half of the session, before bouncing higher in the afternoon, before flipping negative and eventually closing on the lows!

Let’s talk though some of the key events the market must digest in the coming days.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities