Pristine Market Analysis & Watchlist 5/30

Distribution in Semiconductors Stocks

Team,

Today’s session was the market’s first chance to react to the debt ceiling agreement! We have a lot to unpack. Let’s dive in!

-Andrew

Economic Data

Today’s session kicked off with consumer confidence data that came in above expectations and Dallas Fed Manufacturing data that came in lighter than expected:

But the real story was the blowoff in AI, the change of character in the bond market, and the overall reaction to the news that the US government will not default on its debt!

10Yr Treasury

ZN_F 10yr treasury futures bullish engulfing candle and first close above the 5-day EMA in weeks. With a lower risk of government default, US treasuries can now trade off long-term growth and inflation expectations as is the norm.

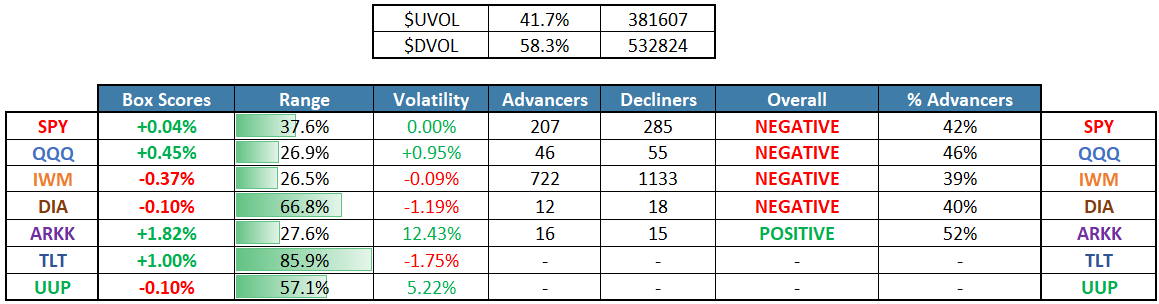

Equity Dashboard

The Nasdaq QQQ and S&P 500 SPY opened the session with substantial gaps higher, but both were distributed throughout the session and closed toward the low end of their day’s ranges. ARKK innovation was the relative outperformer, but even this index had a weak closing range. Not much enthusiasm to buy stocks in reaction to the debt ceiling agreement.

May Index Performance

The Nasdaq QQQ is trading +8.50% for the month of May. This is a year’s worth of returns compressed into a single month! Sharp acceleration for US tech, but not much exuberance elsewhere:

Index Price Action

ES S&P 500 +0.00% after hours (Inside monthly value area+ Sitting on 20-day SMA)

NQ Nasdaq +.11% after hours (Above monthly value area - Overbot)

RTY Russell 2000 -.06% after hours (Above monthly value area)

YM Dow Jones -.09% after hours (Below monthly value area)

ZN_F +.07% after hours (Below monthly value area)

Bitcoin -.39% after hours (Inside monthly value area)

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities