Pristine Market Analysis & Watchlist - 1/24

Buy Bonds, Wear Diamonds

Good evening everyone,

One week out from the Fed meeting. Let’s finish this market sequence strong!

-Andrew

Coming into the year, every fund manager said that the markets would crater, that inflation was still too high, and that the fed would overtighten the US economy into a recession.

But with those same fund managers being caught underexposed, short, and forced to cover into higher and higher equity prices, the narrative has changed to goldilocks! Inflation will return quickly to the Fed’s 2% objective, the economy will avoid recession, AND the fed will begin to cut rates by year end. Talk about having your cake and eating it too!

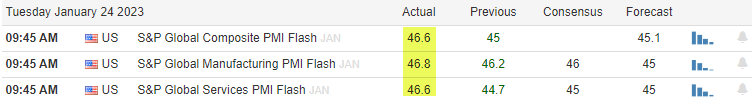

Today’s trading session kicked off with economic data that flew in the face of this narrative, and ended with company earnings that did the same:

Flash PMI’s all below a 50 reading, which signals contraction!

Buy Bonds, Wear Diamonds

I added a position in the TLT long-term treasury ETF after seeing the PMI data hit the wire, knowing it would catch goldilocks players off-guard and force them to add duration:

And pyramided into more TLT exposure as price action confirmed:

The long duration trade can work in two scenarios:

The fed raises rates way more than market participants expect. This will inevitably destroy future economic growth → TLT advances

The economy promptly enters recession because growth deteriorates faster than expected → TLT advances

S&P 500 ES_F Price Analysis

The S&P 500 held above the 5-Day EMA and monthly VAH 4010.75.

The market has effectively been range-bound between 3800 and 4100 for the last three months of trading, and at this point, the bears are heading for the hills

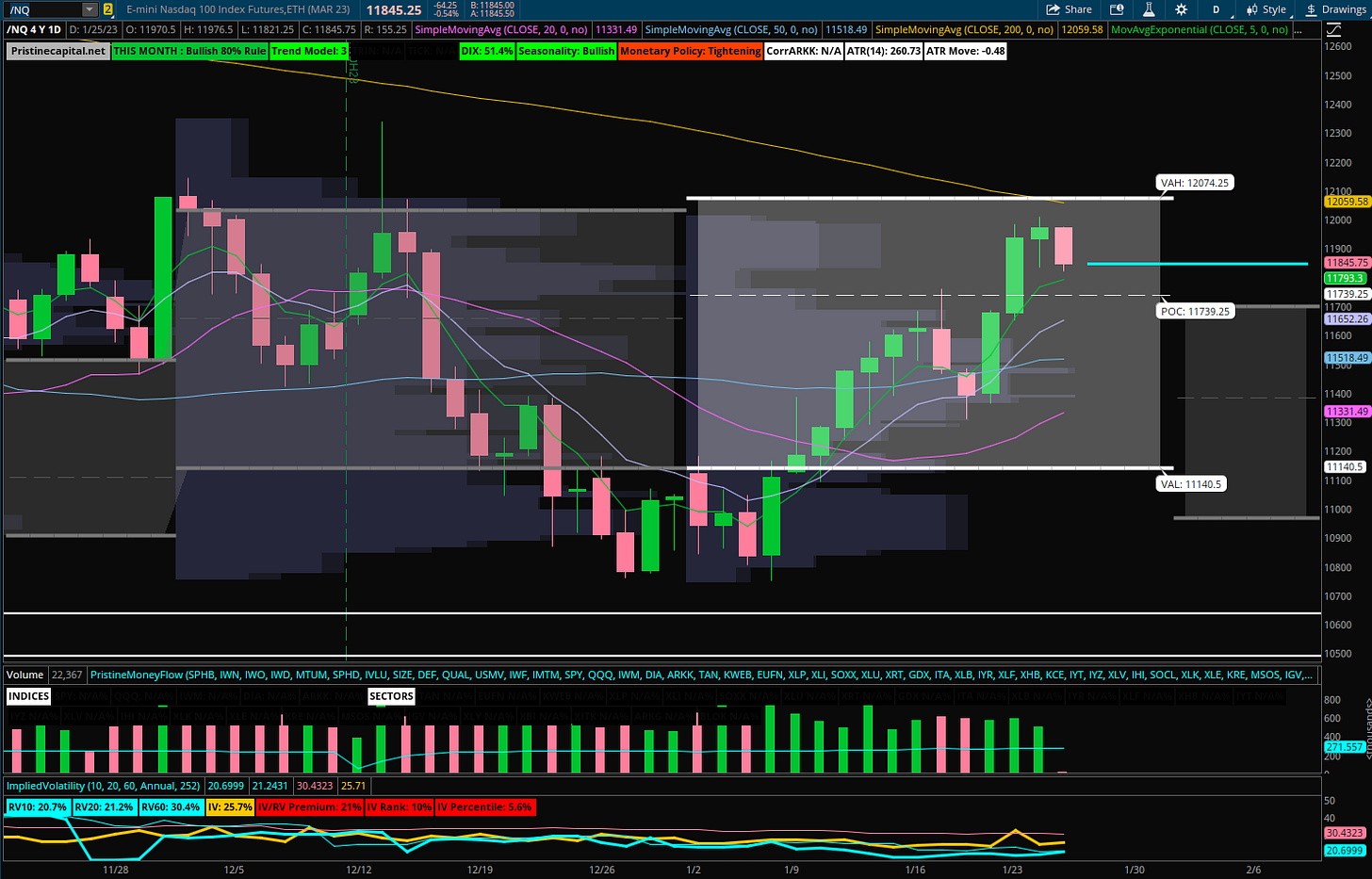

Nasdaq NQ_F Price Analysis

The Nasdaq continues to squeeze investors that were underweight into ‘23

The One Squeeze to Rule Them All

But how many more tech bears are there left to squeeze? We just experienced 99th percentile short covering…

Let’s find out together 👊

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Sector Rotation Dashboard

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities