Pristine Market Analysis & Watchlist 1-31

Fed Meeting Incoming

Good evening everyone,

Pencils down!!! The 1st of 12 innings in the 23’ trading year has officially come to a close.

I’ll be reporting my performance for the 2023 US Investing Championship once my broker statement is available. As of now it looks like I finished up about +37% for the month of January. With that said, one month does not a year make. In the words of the late, great, Kobe Bryant:

Whether January was your best month or your worst month, it’s time to leave that in the past and look ahead to February.

We said 2023 was going to be our year, and we meant it 👊

-Andrew

Let’s quickly run through today’s action, and then discuss tomorrow’s Fed meeting

Employment Cost Index

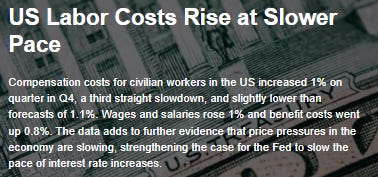

The employment cost index came out lighter than expected at 8:30 AM ET. This is the last inflation data point Powell has to mull over before tomorrow’s Fed meeting. Could this give him more of a green light for dovishness? Perhaps.

Equity Dashboard

Indices quickly flipped from red to green following the employment cost data, and sprinted higher into the Fed meeting!

S&P 500 ES_F Price Analysis

I have three words for all the equity punters out there. Thanks for playing! The S&P 500 rallied throughout the session and closed…right where it began the week!

Finviz Heatmap

Today’s heatmap looks like…a reversal of yesterday’s heatmap!

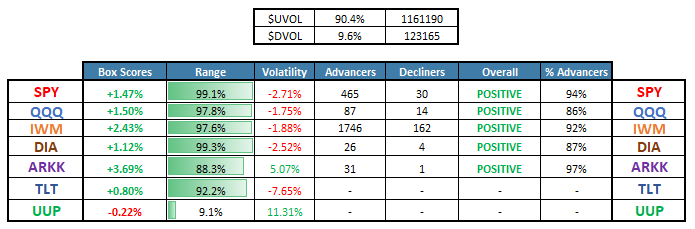

Sectors - Ranked by Momentum

XHB Homebuilders were today’s top performer, which signals that the market believes Powell will be incrementally dovish tomorrow

Earnings on Tap

I am covering all of these reports and reactions in Discord

Fed Meeting Incoming

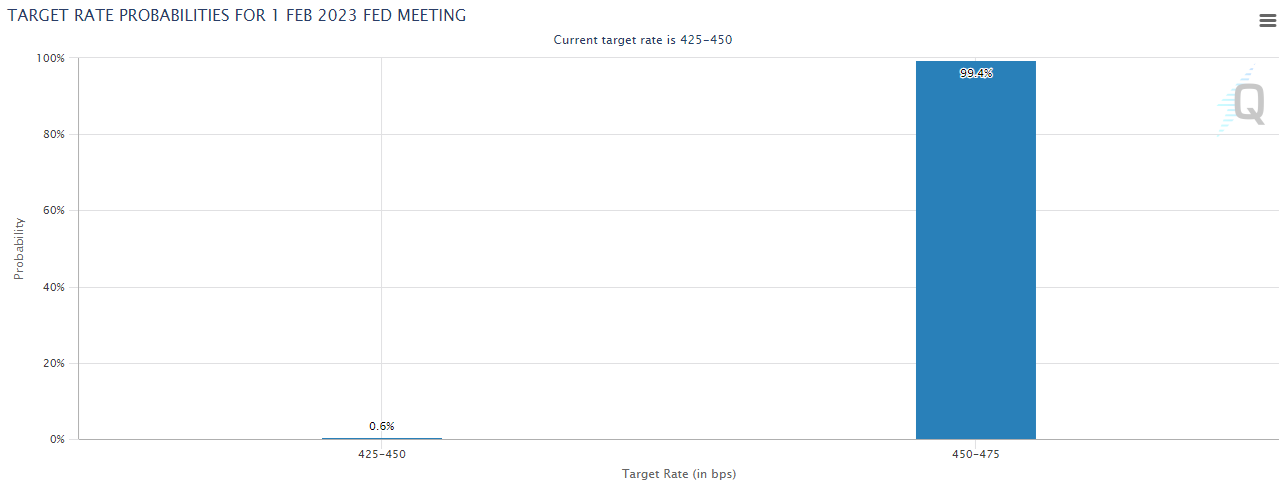

Fed fund futures are pricing in a 99.4% probability that we’ll get a 25 basis point rate hike, and the fed always delivers what is priced, so I am fully expecting a 25 bps hike!

The key to tomorrow’s meeting is what Powell signals for the future of monetary policy. As of now the Fed is pricing in an 85.1% probability of an additional 25 bps hike in March. Does Powell signal that this will be the last rate hike before a pause? This is what most investors will be looking for.

I would imagine that Powell will indeed discuss what it would take for the Fed to pause rate hikes, which is certainly a bullish development! With that said however, I also believe that smart money has completely front-run this. Investors are loaded up to their eyeballs with equity exposure into the Fed meeting. Check out today’s market- on-close imbalance

I can’t recall ever seeing such a large buy imbalance heading into a Fed meeting.

In the following sections of tonight’s update, I’ll cover my research in preparation for tomorrow’s trading session

✅ Trend Model Update - Our proprietary indicator that informs us on how aggressive/defensive to position in the market

✅Market Strategy - My trading plan

✅ Today’s Trade Blotter and Position Update

✅Daily Watchlist - We scan thousands of stocks and hand-pick the best reward/risk opportunities